Soft Landing Squeeze

now what?

In mid-June (here), Mr. Blonde identified equity markets as oversold, showing signs of capitulation and ripe for relief. The buy/cover timing was great, but walking away from markets a couple weeks ago (here) in front of earnings season and after 8% up move was ill timed. It happens, can’t win ‘em all.

Positioning Pain

At the end of March in “From Fed Hikes to Growth Cuts” Mr. Blonde outlined his view that growth concerns would overcome inflation and pace of Fed rate hikes. Much of this seems to have developed and certainly played a role in growth sensitive commodity sell off, rally in duration with power flattening and momentum factor unwind in equities as the macro narrative shifted.

What Mr. Blonde failed to appreciate is equity investors interpretation of inflation risk to growth risk transition as ‘soft landing’ and reason to re-risk portfolios despite various activity measures accelerating to the downside. Of course, nothing excites equity investors like a good story and inflation momentum falling to remove sideline threatening Fed fits the bill.

Of course, it’s important to monitor sentiment and positioning from a trading perspective, but growth leading indicators and fundamentals (EPS) define the trend. Bottom line, if growth leading indicators are still falling then Fed hiking at a slightly slower pace is not something that is likely to drive a durable rally.

A few observations, thoughts and ideas:

No Straight Line

Even in the worst of bear markets there are double digit rallies — markets don’t move in a straight line. The factors driving such relief are some combination of bearish sentiment, under/short positioning and often a shift in macro narrative that brings hope. Sentiment conditions were in place and something identified here in mid-June. Did Mr. Blonde think we’d go 13% to 4150 on SPX? No, but its not inconsistent with past bear rallies.

This bear rally now looking a little long in the tooth with several controversies building that could challenge the relaxed narrative. Namely inflation proves slow to fall, China reacts to US Taiwan visit, the pace of decline in growth activity increases.

WTF did he say?!!?!

Certainly, no shortage of wordsmiths trying to decipher wtf Jerome Powell said or meant to say. Risk taking market participants didn’t think too hard about it and reverted back to the low terminal rate mindset to boost equity valuation without much question to why the rate is lower.

Mr. Blonde is simplifying here so while likely to be precisely wrong this rationalization of recent price action is still directionally correct. In mid-June (previous FOMC), S&P 500 traded at 16x p/e (or 6.25% earnings yield) with terminal rate expectations in the 3.5-4% range. This put earnings yield 250-275bps above estimate of terminal rates. Following July FOMC, terminal rate expectations fell ~100bps and S&P 500 p/e rose to 17.4x or 5.75% which is 50bps reduction in earnings yield and a small widening in the yield gap.

Plotting S&P 500 forward P/E alongside a policy proxy highlights the stimulative effect the FOMC shift (did they shift?) had on markets. The policy proxy rises when inflation expectations are rising faster than real yields or real yields are falling faster than breakevens. So the conclusion, right or wrong, among fixed income markets was a reasonably dovish shift in Fed policy prescription. We’ll see if they stick to that script or dial it back more forcefully.

Time to ‘Pivot’?

Mr. Blonde shared this picture of NDX yesterday after posting the same chart in mid-June. Now seems like a decent time to pivot…yea, “pivot.” No reason to try to be a hero in late August as there’s a good chance markets meander until people kick the sand from their toes, but this seems like an area to add shorts (or sell trading longs).

Now Negative Carry

S&P 500 usually goes up over time. In fact, 3mo rolling returns are positive 70% of the time since 1998. However, if you were to choose a period of time to be defensive, under risked or short the odds suggest to do it when next twelve month (NTM) EPS rate of change and momentum are negative. Historically, S&P 500 averages -3.7% and is down 62% of the time during periods when 3mo % change in NTM EPS is negative and falling.

For my fixed income followers, rising NTM EPS is akin to “rolling up” the EPS curve and its what gives equities positive carry. So, when it goes negative the carry profile evaporates and equities will require rising valuation to drive performance.

Not presented here, but can review past posts for earnings view where Mr. Blonde sees high probability of negative growth into 1H23…a view held from the start of 2022.

Seasonally Soft

Coincidentally, NTM EPS is about to move into negative territory just as we enter the seasonally worst time of year to carry long equity risk. Seasonality is far from perfect, but the Aug-Oct period is notorious for above average volatility and below average returns.

Are you gonna bark all day little doggie or are you gonna bite?

Enough pontificating about markets below are some trades on Mr. Blonde’s radar.

US Exceptionalism…and Dominance

For over a year Mr. Blonde has advocated for a heavy US overweight and this continues to be the case. Don’t listen to the obsessive calls for “cheap” non-US markets. You get what you pay for in equities. US growth will weaken, but Europe and China already in a recession and won’t benefit from weakness in world’s largest economy. Remember, non-US markets are highly cyclical and far more sensitive to GDP volatility. For big boys/girls, this trade is easily replicated via long ES futures and short a mix of VG, NK and MES futures.

Still Short, but Shorter Leash

Another long recommended short is consumer cyclicals. This view has largely been expressed via XRT (S&P Retail ETF) as well as short homebuilders at the start of the year. The basis for this view was primarily over consumption of consumer goods post covid, rising cost of essentials squeezing discretionary income, and a 50yr pattern of consumer sector underperforming during Fed tightening cycles. This remains a short, but with Fed tightening cycle reaching its later stages this trade will be on a shorter leash into 2H22.

Stay Defensive in Style

Still see tailwinds for the low risk factor, which Mr. Blonde first started recommending in late 2021. The long/short factor trades with positive correlation to financial conditions indices and typically performs best during periods of falling ISM. This is a defensive risk position without taking a directional view on the market. Expect market participants to favor defensive, low risk assets as long as Fed is inflation fighting and activity indicators are falling. Institutional players can reconstruct this trade via equity swap, while retail traders can consider AGFIQ Market Neutral Anti-Beta Fund (BTAL).

Got Gold?

Gold is something Mr. Blonde has largely avoided and certainly stayed out of the religious belief debates. Needless to say, this has been an extremely frustrating asset for most, but now seems to have frustrated many out of a view. For context, CFTC data shows gold positioning at -1 sigma vs. 20yr avg. Gold implied volatility is low enough (~16%) to make Sept gold calls an attractive portfolio position.

Think they work in one of a few outcomes…1) NFP and/or CPI data is on the soft/cool side which further fans the Fed pivot excitement, 2) China counter jabs Nancy’s visit to Taiwan which further raises the specter of geopolitical risk. Again, all in the context of unloved asset entering a historically favorable seasonal period.

SPY Hedge for the Range

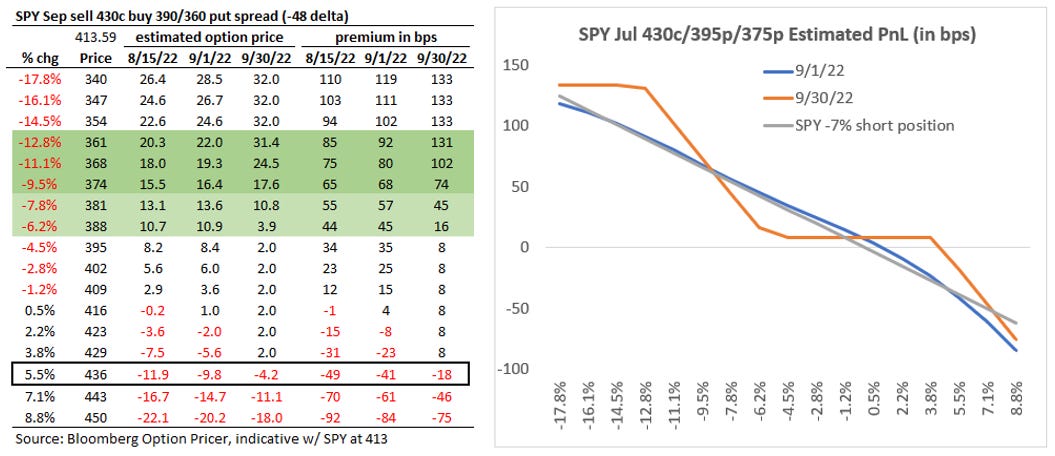

A repeat idea following a bear market rally. One way Mr. Blonde is dialing back exposure and walking away from markets is to add an SPY put spread collar, which is short 430c and long 390/360 put spread. Importantly this structure has unlimited loss potential in the event equity markets rally significantly above SPY 430 level by late Sept, so this is not for everyone and you need to assess your own risk tolerance. But this is a hedge offers a small upfront credit and fits the view equity markets have limited upside and are vulnerable to taking ‘two steps back’ as we enter seasonally weak 3Q period.

For sizing, Mr. Blonde is willing to lose 20-40bps in the event SPY trades to 430 in Sept. At this position sizing, the structure is the delta-adjusted equivalent to -7% SPY short.

More aggressive traders may consider legging into this trade. Buy put today, sell the call on up moves and sell the lower strike put after first meaningful move lower (i.e. >-5%).

Compounder Comeback?

And one more for those who made it this far. Early readers of Stuck in the Middle might recall the post titled “Compounding Quality” where Mr. Blonde outlined the benefits of being long high quality growth compounders vs. higher beta lower quality parts of the market. Of course this group was under attack for much of early 2022 as valuation concerns were a primary concern and portfolios were being deleveraged. In recent weeks as the market’s concern about runaway Fed hikes has relaxed and growth concerns increased, this group is starting to perform again. Worth reviewing and watching.

Get some rest and enjoy what’s left of the summer! That’s what Mr. B is gonna do.

Great post. One question. How is the 5-y, 5-y breakeven minus the 10-y real rate a policy proxy? I can't wrap my head around that

Thanks mr B, lovely summary of the state of play 👏