It’s increasingly difficult to have a differentiated view as many now see Fed hiking into cyclical growth slowdown warned about here many months ago. Bearish sentiment is a necessary but not sufficient metric for adding risk — the mood has darkened for good reason. Mr. Blonde’s profit growth leading indicator has yet to tick higher, PMI momentum is negative and inflation prints will keep Fed driving through the rearview mirror.

No new broad market view here, just updating the next phase which is focused on EPS cuts and the realization of significant growth slowdown. The “R” word is being used more frequently which reflexively makes it more likely as corporate and household behavior shifts defensive. S&P 500 profit and price Recession downside risk was outlined here.

Posting a data driven, unemotional, index from @NancyRLazar1 to make the point that recession odds are way up and historically don’t reach this level without delivering one.

Risk markets have certainly contemplated recession, especially in the last couple months, but are not fully priced for one. Consider the average peak-to-trough decline in S&P 500 during the ’70, ’74, ’87, ’01 recessions was -39%. At face value, the current -24% drawdown suggests the market assigns 61% probability to such an outcome—coincidentally similar to Nancy’s way more data intensive indicator.

Bottom line, it can and will likely get worse before it gets better…which brings us to 2Q earnings season.

Summertime Blues

2Q earnings season is unlikely to deliver many good headlines. Mr. Blonde’s broad assumption is the season carries mild asymmetry. Expect more meets than beats, but even the beats are likely to face downbeat commentary into 2H. Companies that miss will be punished.

This pattern was already evident from recent earnings seasons but given the macro backdrop and time of year (summer trading volumes) it’s a challenging setup.

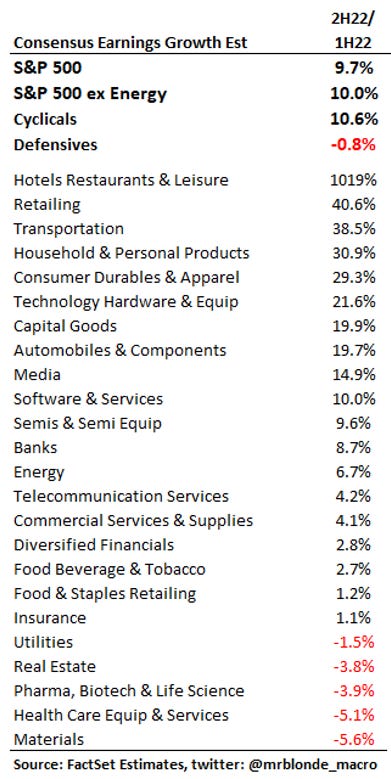

2H growth expectations have come off a touch since first highlighted here, but are still way too high given deteriorating growth momentum and the consequence of higher input costs and tighter financial conditions.

Analysts seem to be getting the message with estimates coming down across the board. In fact, 2023 consensus EPS has now fallen from $250.2 to $247.7, which doesn’t sound like much but its rare for out year estimates to be lowered. And excluding the energy sector the cuts have been sharper.

Table with a lot of numbers maybe too much for some, but it highlights the sea of red that is numbers cuts. Very few groups are spared with the exception of energy, but the 27% fall in oil prices isn’t likely to drive many to take numbers up there either.

For the macro, fixed income followers EPS growth and revisions are what make equities ‘positive carry.’ You want to buy upward sloping EPS curves (i.e. roll up the EPS curve), but as revisions turn negative you are left with little/no carry and reliant on p/e expansion to drive returns, which is unlikely if numbers aren’t going up. Side note: the lack of ‘positive carry’ is why non-US markets have stunk for the last decade despite perennial calls to buy ‘cheap’ non-US markets.

We started 2022 with peak liquidity, peak valuations, and peak earnings. We’ve made progress on liquidity reduction and valuation compression, next up is meaningful reset in earnings expectations. Mr. Blonde expects this to be the finishing move taking S&P 500 toward 3000 level (i.e. ~15x $200) at which point it will be easier to say the market is priced for a profit growth recession. The pace of earnings correction will happen more slowly over time (i.e. death by paper cuts), but as previously documented S&P 500 price consistently bottoms 9-12mos ahead of the EPS bottom.

Wen Moon SPX?

Mr. Blonde was recently asked what signs/events to watch for a low in equity risk. This is a unique cycle and its dangerous to be dogmatic, so consider this a pre-mortem exercise rather than an explicit forecast.

The Sept-Nov time period represents an interesting window of time for the low to be set for a few reasons:

calendar seasonality into mid-term election year,

would expect ISM <50 completing 18mo down cycle,

expect visible signs of growth slowdown and labor market deterioration which could bring tone change from Fed,

2023 outlooks slashed as corporates (and analysts) throw in the towel,

we know S&P 500 price bottoms 9-12mos before EPS bottom (3Q23?).

Don’t get too excited its just a thought experiment in an effort to stay aware and forward looking. As you can see from the list more bad things need to happen.

That’s all for now, not major change in defensive market view. The relief called for in early June is passing its expiration date as we achieved the 6-8% average bear market rally over 15 trading days…more like 6.7% in 5 trading days actually. Will follow up with some trade ideas and stock screens. Good luck trading out there it’s a war zone.

Thanks for reading, please provide feedback by liking, sharing, commenting.

Thorough and terrific analysis. I completely agree it is all about earnings, and while some active managers will try to anticipate the capitulation in the earnings outlook, the vast majority of investors will wait for this news to be front and center.

Always rather elegantly written and most importantly, based around rational analysis that frequently convinces in its determination to be evidenced based but not dogmatic. Refreshing. I often have to read it twice as am no expert, that’s not a bad thing but wherever possible keep explaining technical terms that you deploy, for some of us not from trading backgrounds.