Compounding Quality

Quality returns from quality stocks

Please read the disclaimer here.

Long high quality companies is akin to carry trade in fixed income markets. Rather than a coupon payment, high quality companies re-invest at high rates of return some of which is distributed to shareholders but majority of which gets retained and reinvested.

In this commentary, Mr. Blonde outlines the performance of quality over the last few decades and offers a list of stocks he uses to implement this viewpoint.

Bottom line, quality stocks should be core long exposure and as Mr. Blonde outlined in previous commentaries here and here the group performs better during periods of slowing cyclical growth momentum.

Quality Acts Like Carry

If you ask 5 people you get 3 different descriptions of quality. For Mr. Blonde, quality is a combination of profitability (margins and/or ROIC), stability of profitability, and low/modest balance sheet leverage (i.e. self-funding). The MSCI US Quality index is a good proxy for the style with enough history to study through macro regimes.

The MSCI US Quality index (M2USQU Index) has been a reasonably consistent outperformer of S&P 500 over the last 30yrs. Performance vs. a traditionally lower quality, higher beta index like Russell 2000 is more episodic and reflects sensitivity to macro.

Quality Returns From Quality Stocks

This is a story where slow and steady ultimately wins the race. For investors not benchmark obsessed and instead focused on absolute risk adjusted returns it’s hard to do better than a hedged long quality position. Assuming 40% net long vs. S&P 500 (high hurdle rate benchmark), its delivered ~7% annual return on 9% volatility and positive returns 75% of years for the last 30yrs and similarly good over last decade.

The return stream is competitive to top quartile equity long short hedge fund returns…without the fees of course.

Sorry for the big data table, but valuable to see the persistence of returns vs. multiple markets over a long period.

Macro Drivers of Quality

The last decade, in particular, offered a powerful backdrop for quality investing. Falling potential growth drives growth scarcity resulting in central banks driving down the cost of capital in attempt to change the trajectory. Lower cost of capital is to the benefit of the most profitable companies. Corporate inequality is a thing too.

The growth scarce macro backdrop of the last 10yrs has only further supported this segment of the market. h/t: @MichaelKantro who recognized this dynamic early. 21 million bitcoin is not the only scarce asset ;)

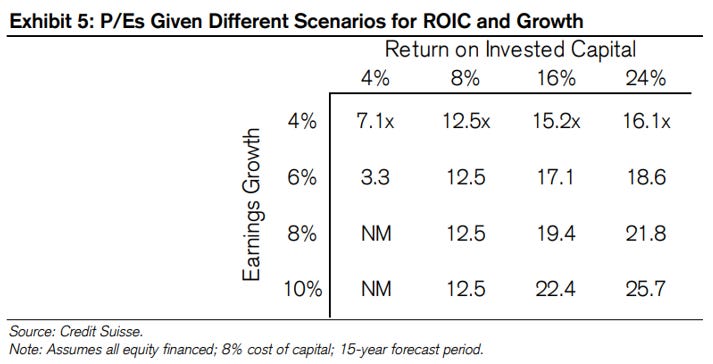

If you are not familiar with Mike Mauboussin’s work its highly recommended. A collection of articles found here. This table from a 2015 note on valuation summarizes the interaction of ROIC, growth and valuation well. Mr. Blonde is generalizing, but as the ROIC-WACC spread widens the higher the justified valuation. Sure higher rates would be a headwind for this group, but it would be more challenging for highly leveraged companies with low ROIC and lacking pricing power. Pick your poison.

You Get What You Pay For

Many fear quality stocks because they appear expensive when making naïve P/E or P/Book comparisons. These simplistic measures don’t account for stability of business model and ability to re-invest at high rates of return.

Some parts of the market are cheap for a reason and for them to be less cheap you need a durable shift in business model, or more likely, a cyclical growth tailwind. The message here is simple: you get what you pay for.

Finally, in a world where “everything is expensive” it is sensible to expect markets to differentiate by other qualities like profitability, growth, and strength of balance sheet.

The Quality of Mr. Blonde

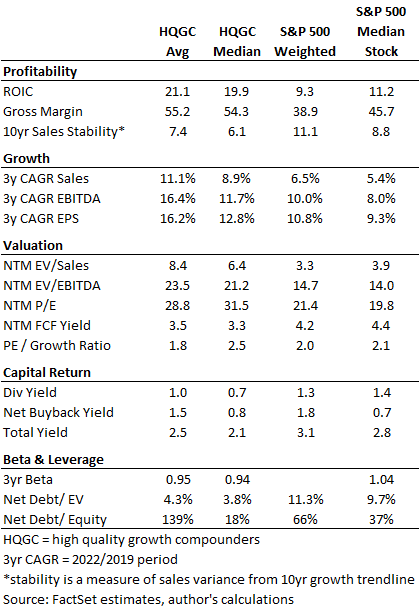

The few people who know Mr. Blonde will know he’s a “compounder bro” and the style has been a core equity position for most of last decade. The list of 90 high-quality growth compounders (HQGC) is diverse across sectors and can be found here:

The list is not exhaustive and many won’t agree with every stock. More will say names are missing. For Mr. Blonde a focus list of equities is not only about the fundamental characteristics but also about familiarity and deliverability.

See full list for details, but stocks range from GOOGL to CHD to SHW and HD. The fundamental composition of this group offers superior profitability with lower sales volatility, double digit growth, market level capital returns and less volatility and leverage. Yes one year forward valuations are higher, but comparable when adjusted for growth, profitability and volatility.

The equal-weight average return of this fixed basket of high-quality growth compounders has performed well over the last 7yrs and has done so with far less tech exposure than the market. Debunking the widely held belief that markets are only about tech stocks.

The standard disclosure applies here: past performance is not indicative of future results. The objective here is not to offer a black box model, but to highlight the benefit of selecting good stocks with good fundamental characteristics and extending investment horizon.

Historically, the group performs best vs. Russell 2000 market hedge, but you do need to stomach more significant style reversals from time to time. High beta, low quality rallies are the main source of volatility in may style strategies which is what makes focus on macro regime conditions an important overlay.

The group is resilient, but not without risk. Regulatory risk that taxes profitability and competition that attacks pricing power are a couple obvious ones at the stock level. At the style level, quality underperformance is most likely in the early stages of a recovery when high beta cyclicals and companies with economically sensitive business models outperform.

This note is already too long. There will be more to discuss and highlight in future notes. Bottom line, high quality growth represents a core portfolio holding for Mr. Blonde. The macro regime influences the amount of exposure vs. opportunistic, cyclical trades and the most appropriate market hedge.

Great post as always, thanks Mr. Blonde. One stupid question about 40% net exposure. You have a note about it saying "100$ long index vs. 60$ short in respective index." I have a hard time fully understanding it. Does it mean that I buy 100$ of the index, at the same time, short the same index 60$? If so, why not hold only 40$ long position? Or does it mean that I long a put option (or short a call option) on the same index as a hedge?