January’s tightening tantrum is a correction in magnitude similar to past periods preceding the start of Fed tightening. What happens next will be determined by cyclical growth and inflation momentum, but risk/reward is asymmetric. Good growth will bring talk of more, faster rate hikes while weak growth ignites fear of policy mistake.

Tactically the correction and sentiment shift opens a window for some reprieve and two-way risk. Don’t get carried away though, these bounces are likely to be met with risk reducing supply and shouldn’t be viewed as an all clear signal.

Mr. Blonde tactically dialed back short exposure last week, but this is a risky short term trading decision not a change in view (here, here, here, here). Cash exposure remains firmly above average and overall risk position light and heavily defensive.

A few market thoughts followed by trades Mr. Blonde is doing.

Unfriendly Fed

In “Don’t Fight the Fed” Mr. Blonde outlined market behavior during past Fed tightening cycles. We can learn a lot by observing market history and what often happens even if each episode is a little different. It’s called being mentally prepared. The first section of that note studies in more detail behavior of equity markets in advance of the first Fed rate hike.

Bottom line, what we’ve seen to date is 100% consistent with past first Fed rate hikes. The SPX 10% correction (and more elsewhere) reflects a “tightening tantrum” and recognition the Fed is no longer a friend—breaking up is hard to do.

Ripe for Reprieve?

Early last week Mr. Blonde tweeted the SPX analog vs. the late 2018 correction. Analogs are tricky and imperfect, but they can be a useful indication of trading sentiment and investor behavior. Mr. Blonde gives them more credence when they were considered in advance and when the macro conditions between periods are similar.

This correction pattern suggests a volatile two-way risk period as we digest hawkish Fed and wait for growth/inflation conditions to make our next move.

Some tactical observations to support the view for reprieve, which started last week:

First, following Monday’s 6% flash crash in NDX futures we retested that zone 3 times during the week and held. For all of the carnage and anxiety, we ended the week flat. NDX is firmly below 200d which is hardly comforting but price action last week was better than terrible.

Note: highlighting the alpha-dog NDX here but SPX futures look similar.

Second, no shortage of equity stress signals and first time since ____ observations. Equity vol can always go higher, but SPX 3m 25d put implied volatility in low 30s earlier this week put it above tightening events in 2015 and 2018.

Is that a close your eyes and buy signal? Hell no. It simply indicates hedging flows and market expectation for changed environment. Important step.

Third, one way to measure complacency in equity markets is PE/VIX ratio. All else equal high P/E markets should carry more volatility. Other than 10%, what’s the difference between 22x and 20x? S&P 500 PE/VIX ratio reached 0.54x early last week and suggests less complacency about risk.

Also notable S&P 500 p/e retraced 100% of post covid expansion. This represents ‘a’ level, but not necessarily ‘the’ level. Either way it’s one signpost along the way of unwinding speculation and normalizing market conditions.

A more durable line in the sand would be -2 sigma level of 17.75x or SPX 4000 level based on $225 consensus NTM EPS…assuming EPS doesn’t change of course.

Fourth, measures of sentiment shifted which can bring some temporary relief. Using sentiment is tricky and generally works best when not at major turning points or shift in macro landscape, but it does indicate more balance than at the turn of the year.

Investor’s Intelligence survey has three categories bullish, bearish and correction. The % that are bearish (currently 26.7%) remains a bit low vs. past peaks, but the % that are bearish or expect correction is 65% and indicates negativity. The bullish % at 35 is also tactically washed out.

Finally, one dissipating headwind is corporate buy flows post earnings season. Good chart here from UBS which aggregates buybacks and dividend payments (majority get reinvested) to show nearly $45b of weekly buying power by mid-Feb.

That’s the end of the ‘good’ news. If you’re a perma-bull or don’t want to be realistic you should stop reading at this point.

Cyclical is Critical

Mr. Blonde won’t overanalyze what Powell said or didn’t say. The Fed is hawkish after ignoring improving growth and inflation conditions all of last year. This is what happens when your policy framework is hyper focused on lagging indicators like the labor market amongst other issues.

First a plug and preamble, this visual and framework post by @EPBResearch who has an excellent grasp on growth cycle dynamics and shared his framework in a must read post and follow. Mr. Blonde couldn’t have written it better himself.

People question the relevance of PMIs when the level of growth is good, but what they seemingly miss is the secular/cyclical growth dynamic. With low and declining secular growth trends the cyclical growth forces become MORE important. Falling cyclical growth in declining secular growth trend means you are falling faster. Hopefully this simplifies things for skeptics.

The challenge now is cyclical growth momentum is slowing and typically once it starts it keeps slowing with very few cases of reacceleration from a starting high level. Mr. Blonde’s Macro Growth Composite focuses on profit growth rather than GDP and therefore is more relevant to market risk. Last I checked there is no market in GDP futures.

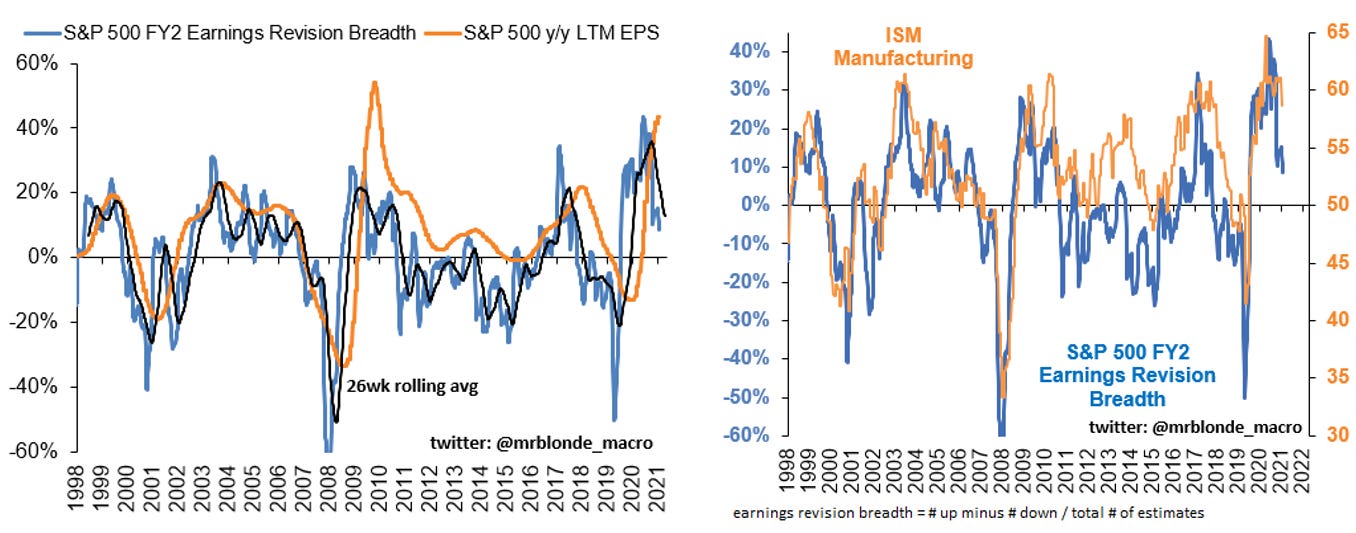

The Macro Growth Composite normalizes Mr. Blonde’s earnings growth leading indicator, global manufacturing PMI, and US earnings revision breadth as measures of long, medium, and short term leading indicators, respectively. No data restatements here and highly relevant for markets over time. The right chart dovetails from twitter: @EPBResearch post to highlight increased sensitivity to cyclical growth momentum in the last decade. Ignore at your own risk.

Earnings revision trends are a good gauge of real time cyclical growth sentiment. When revision trends are in a declining trend the probability of declining earnings growth momentum is very high. This isn’t rocket science. Also notable is the relationship between earnings revision breadth and ISM manufacturing. Pretty clear where that is headed over the next 3mos.

Earnings Season

We are about mid-way through earnings season and while realized results are ‘ok’, the real message comes from analyst evaluation of the quarter and how it influences their outlook. Mr. Blonde outlined the downside risk to earnings in Passing Peak Profit Momentum and 4Q results so far don’t indicate any reason to change that opinion.

Companies are still beating EPS expectations which is no surprise, but the magnitude of beats is slowing confirming cyclical growth deceleration.

Perhaps more telling are revision trends in response to quarterly reports (hat tip: JT). The cumulative change in next quarter’s consensus EPS estimate for S&P 500 (i.e. so 4Q21 reflects 1Q22 EPS revisions) is reflective of business momentum and corporate guidance. Bottom line, no follow through on those EPS ‘beats’ leaving forward looking markets wanting for more.

The biggest tell is price action. EPS ‘beats’ are not being rewarded like they used to and misses punished. This started with 3Q reporting season and something Mr. Blonde flagged at the time. Corporate earnings sentiment has shifted in negative direction, take note.

Are you gonna bark all day little doggie or you gonna bite?

Enough talking about the crappy market environment, lets highlight some trades Mr. Blonde is doing.

Software > Semis. This first Mr. Blonde’s view to favor defensive high quality growth over cyclical growth. The software group has also been trashed and de-leveraged in the last 3mos as valuation compression took hold and fear set in on the pack of ‘soft’ reports from CRM, DOCU, and ADBE late last year. But software is now 3 sigma oversold vs. semis and recent reports struck a better tone (i.e. MSFT, NOW).

Semis are a group historically sensitive to the PMI cycle and carry greater relative risk to a fade in goods consumption. Long IGV / Short SMH for a trade with view this pair can retrace at least to its 200d average, but potentially go further.

Don’t Fight the Fed. If the objective is to tighten financial conditions, then its likely low beta low volatility assets will perform better than high volatility assets. If market volatility is high (likely) then equity investors will seek low volatility positions to avoid adding to portfolio volatility.

Mr. Blonde has and continues to favor long low beta, short high beta expressions. This includes BTAL, an ETF that mimics DJ anti-beta sector neutral factor, USMV/IWM and expressions of sector neutral long/short quality. In all these expressions, the short side is a key component.

Short Cyclicals. The next big risk for markets, as outlined above, is weakening cyclical growth momentum that causes a significant shift in growth expectations. Other than short (or underweighting) specific stocks the cleanest way to implement this view is to short a high beta ETF, like SPHB. The correlation and beta of this ETF to Mr. Blonde’s definition of cyclicals is high and reasonably persistent.

Plenty to read from past posts on why Mr. Blonde expects cyclicals to lag, but in short cyclicals lag defensives with PMIs fall…every time.

cyclicals = autos, consumer durables, media, banks, diversified financials, capital goods, transportation, energy, materials, semis

Good luck trading, stay defensive in your approach whatever that means for you. There are likely to be several opportunities to buy risk this year at better prices.

It's clear that buy on dip doesn't work as well as it has over the past couple of years. Perfectly agree that you can buy risk from levels further down: staying liquid, defensive and downsizing is the best you can do now. This liquidity is great for traders if you are patient and light on exposures!

Another good piece, thank you!