Fast markets resulted in this comment hitting a few days later than hoped, but the data rich content is relevant for what’s ahead.

A hawkish Fed pivot and the latest COVID variant created a toxic mix of growth uncertainty and policy tightening — a bit like late 2015 and late 2018 analogs discussed here. Exacerbated by a time of year when appetite for risk taking is low.

Don’t fight the Fed.

We've had a top shelf open bar for 2 years and bartender now saying last call...people will start moving towards the exit door. The bar has gotten pretty crowded in the last year. How big is that door? Some are already shuffling to the exit, others will rush to the bar for one more drink, but none of us will want to be here when the lights turn on.

Let Mr. Blonde say up front each cycle is unique and so its challenging to be too precise on what exactly to do other than shift toward a more defensive mindset, whatever that means for you (i.e. less leverage, more shorts, more cash, lower beta longs, more nimble trading, etc.).

History Rhymes

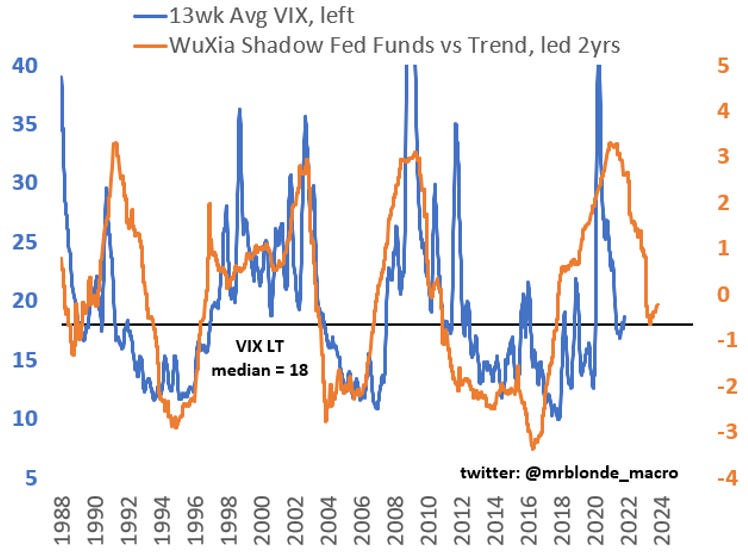

The early stages of hawkish Fed policy shifts are challenging. This doesn’t necessarily mean ‘massive’ correction or bear market, but it often means more volatility and anxiety. A straight-line correction would probably be easier actually.

Recent tightening episodes to set the stage. These are just pictures and purposely ignore some of the finer points of each cycle. Note: yellow line in each chart = 200d avg for trend context

1994. Fairly aggressive, “surprise” hike that resulted in a meaningful 9% S&P 500 peak/trough correction, but more significant volatility across fixed income (not shown). But it ultimately took S&P 500 almost a year to digest the Fed tightening before resuming an uptrend in 1995.

1999. Following rate cuts in late 1998, Fed started hiking in mid-1999 resulting in 12% S&P 500 peak/trough correction. At the time, Nasdaq (not shown) was on a different planet but also digested some initial volatility before its explosive run into 1Q00. Ultimately, and said in hindsight, the mid-1999 rate hikes started the topping process.

2004. In the months leading up to the first-rate hike, S&P 500 stopped rising and had a series of 5-7% corrections/rallies into the first few hikes. From that point, earnings growth led the market higher, but retracements to a rising 200d moving average were frequent. We all recall how this slow steady pace of hikes ended.

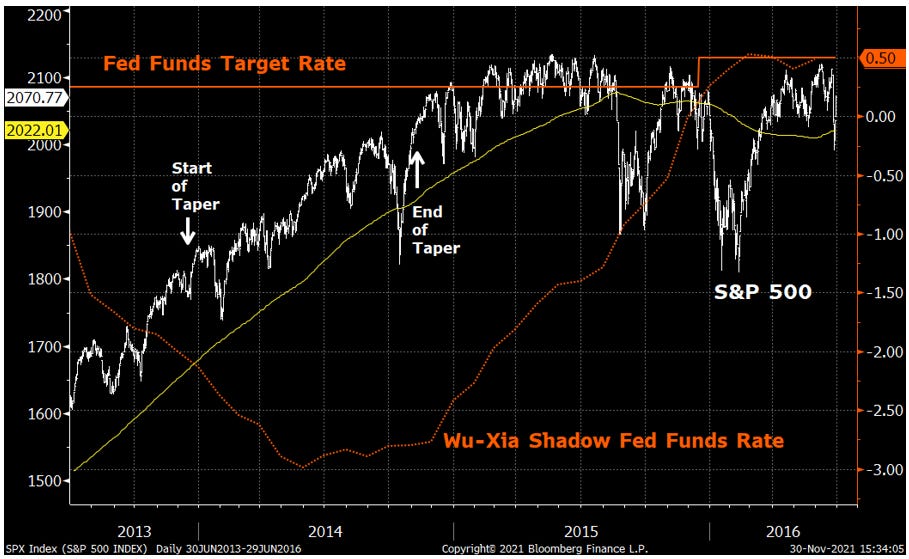

2014-2016. Fed policy requires more interpretation today given all their fancy tools to stimulate the economy. Some insist that “tapering isn’t tightening” but I’d suggest various measures of market risk are less convinced of that. Start of tapering is akin to the bartender yelling last call. Not sure about you, but that was typically Mr. Blonde’s que to find the exit…she’s never as pretty with the lights on.

The above only scratches the surface when considering equity markets and Fed cycles. The index price chart hides the bifurcation between rising EPS and falling P/E multiples and it tells us little about market internals as the tightening cycle progresses. Dispersion (alpha) becomes increasingly important when expected market returns (beta) are mid-single digits with higher volatility.

Easing Off the Gas vs. Slamming the Breaks

Mr. Blonde made some minor modifications to their original and included tapering periods, but chart credit to Ed Clissold (twitter: @edclissold) and Ned Davis Research.

On average, equity markets do ok during Fed tightening cycles, but a few important caveats are necessary. First, the speed of Fed cycles is an important determinant of equity market performance.

Second, multiple contraction is a common feature of Fed tightening cycles and we’re starting this one with record valuations across most risky assets. Fortunately, rising EPS is also common because the Fed is typically tightening into a good growth environment. Notice 10-15% earnings growth in the year after Fed tightening begins. Note: This is one reason Mr. Blonde favors S&P 500 dividend futures — long the growth without the valuation risk — discussed here.

Such environments favor growth security and deliverability, which are more common features found among high quality growth stocks. And if market valuation is to compress, its most likely to come from the most egregiously valued segments. More on both below.

Cycle Details

For the detail hungry the table below summarizes each categorized tightening cycle.

Cycles are categorized according to Mr. Blonde’s subjective opinion, but driven by magnitude of the first hike and pace of hikes in year one. Non cycles are ‘adjustments’ and tapers. Summary stats suggest cycles are well defined, but if you disagree, all the data is there to summarize your opinion.

The Market Message

The start of Fed tightening is the “last call” to get your shit together. As the cycle progresses market volatility rises which calls for increase in risk premium compensation. Its not hard to imagine this cycle making it more challenging given duration and magnitude of the easing cycle and valuation starting points.

Sector Skew

Sector performance prior to Fed tightening cycles favors a mix of tech, cyclicals, and defensives. Despite banks being viewed as rate sensitive, tightening cycles are historically unfriendly to the group. Autos, transports, semis also do poorly as tightening ensues.

Mr. Blonde was already fading cyclical stock outperformance with opinion PMIs peaked and start of Fed tightening cycle only reinforces that view. To policy wonks, tapering might not be tightening, but try explaining that to markets.

Risk/reward in high beta cyclicals is not attractive at this stage. If more reflation then Fed rate hike expectations accelerate which is likely to slow growth, if growth disappoints then not good for cyclicals. Bottom line, the group has a narrow path to travel.

Style Skew

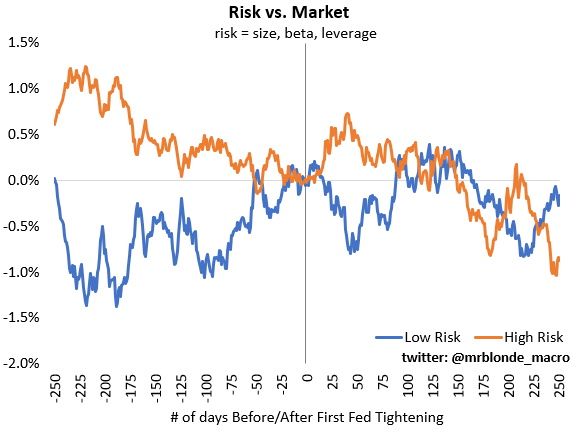

The below charts represent US sector neutral style factors based on Fed cycles from 1987 to present (sorry only have daily factor data from 1984). In the charts, direction is more important than magnitude here and keep in mind the lines represent the average of all cycles.

Bottom line, favor cheap stocks with high profitability and good growth momentum while reducing risk (i.e. beta). Take note of the factor volatility as the ‘first’ tightening date approaches — expensive, momentum stocks hit hard. As tightening progresses, notice stocks considered cheap, profitable and with good growth/momentum will likely perform best.

Easy Come Easy Go

What is happening at the moment to expensive stocks should not be a surprise to anyone that understands what they own. The most expensive stocks (i.e. for example >10x ev/sales) require confidence in the future growth outlook to justify the valuation and healthy liquidity environment (i.e. willingness to lend). The confidence in that outlook is shaken when the Fed drains the punchbowl.

Mr. Blonde has advocated a short position here for months, but feels a bit long in the tooth at this stage. That is not a recommendation to buy, but inclined to use weakness to reduce.

Quality is King

Periods of rising volatility favor higher quality, lower beta stocks. The market has been telling us this story for a few months as talk of taper turned into the act of taper. For some reason people like to chase breakouts in Russell 2000 and want to be long “cheap” markets like EM. Wish them luck.

Stay Short Consumer

An ETF of low quality, small cap consumer stocks remains one of Mr. Blonde’s biggest shorts. We can debate the health and wealth of the US household balance sheets, but historically when inflation is high and Fed starts a policy tightening cycle it is time to avoid consumer stocks.

The early November short squeeze was gut wrenching, but this ETF also provides exposure to low quality, high beta, and small cap…all things Mr. Blonde wants in his short book. Signs of fatigue at peaking 200d moving average increase confidence.

Good luck trading. Will follow up soon with relevant stock screens for the environment described above. If you appreciate the note share it. If you have questions or want clarification post a comment. Don’t be shy.

Excellent. Well done

1st class update Mr Blonde. Will let the others ask all the tough questions &, would simply add, I too, found myself once or twice too late at the bar with the wrong company but, was always thankfully rescued by the lights going back in before the closing 😂.