Growing but Slowing

Positioning for cyclical growth setback

Disclosure

The commentary and ideas here represent one person’s opinion and should not be considered investment advice. You need to evaluate your own risk tolerance, time horizon and skill level. Hopefully the commentary assists in your judgement and process, but you need to do your own due diligence and decide the best course of action.

Intro

Most know Mr. Blonde as the straight-talking psychopath from Reservoir Dogs. This commentary intends to be straight-talking with focus on macro equity markets that often require a psychopath mentality – don’t let the left side of your brain know what the right side is thinking. The objective is making money not pontificating on policy conspiracy theories or what the “right” policy prescription is for the world’s problems. Less bark more bite.

We will probe Mr. Blonde’s market framework (“the framework”) at a later date, too much to discuss in markets now:

Growing but Slowing

The current environment is best described as growing but slowing. Transitions in the macro growth cycle bring signals and uncertainty about pace and trajectory of the future. As a result the pace of equity price momentum slows, dispersion increases, and volatility rises.

The framework pays close attention to nominal growth rate of change. Profit growth is a commodity for markets — when abundant focus on cheap assets with operating leverage, when scarce pay up for idiosyncratic and/or stable growth. Growth rate of change is a critical variable for navigating macro equity markets and identifying leadership (i.e. alpha).

The Macro Growth Composite is a mix of long and short leading indicators each normalized to the 7yr rolling window in order to properly capture the volatility of the time. At a later date we can explore each input and its relevance, but for now recognize this as the growth guide.

Growth rate of change peaked in the April-May period and is now decelerating. As with any roadmap, it’s important to look around and evaluate the weight of evidence to suggest this shift is durable. Mr. Blonde thinks it is…at least for now.

Window of Weakness

For the past decade the primary driver of cyclical activity has been China credit cycle (i.e. rate of change in credit growth) and it suggests a more difficult environment over the next 6mos. I’m not smart to say it’s different this time. Equally important, the rate of change in US 10yr yields is a proxy for monetary impulse and cost of capital. Both measures operate with a lag.

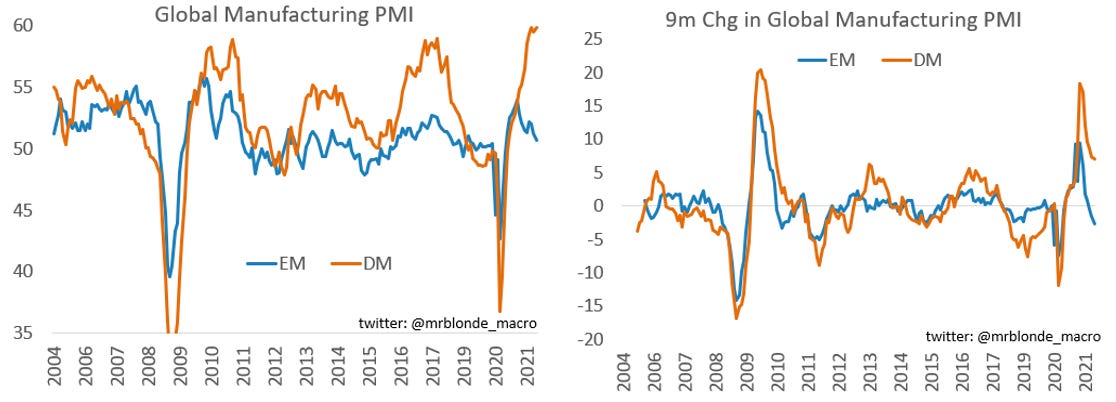

A closer look at global manufacturing PMIs identifies a concerning divergence. Emerging Markets (EM), the world’s manufacturing outsource center, is weak and weakening. The divergence in 9m change is not sustainable in my opinion and expect DM PMIs to decelerate. This quote from the Maestro comes to mind:

“Moreover, it is just not credible that the United States can remain an oasis of prosperity unaffected by a world that is experiencing greatly increased stress.” - Greenspan, 9/4/98

Look Inside

A common mistake among market observers is to think S&P 500 is representative of market “risk”. Of course it is, but it’s also a well-diversified, high quality, resilient portfolio that is often the last to correct. To understand equity risk you need to look inside.

“The best economist I know is the inside of the stock market.” – Stan Druckenmiller at 2:45min mark

The weakening of equity market breadth and increased dispersion within markets is consistent with past peaks in growth momentum and a validating signal. The market is speaking to us…we should listen.

The performance of Russell 2000 (RTY) vs. S&P 500 Consumer Staples is pretty telling…and historically consistent with falling ISM manufacturing.

A similar message emanates from relative price momentum in semiconductors.

The shift in momentum among high beta vs. low beta equities is also an important sign. High beta can mean different things, but typically associated with companies sensitive to cyclical growth and have high operating leverage.

South Korea is a key player in global manufacturing and trade. Weakness in KRW is a sign something is not quite right.

Commodity markets also lost some momentum. S&P/GSCI equal weight commodity index as % of its 200d moving average has been a decent gauge for pace of ISM activity. They both peaked earlier this year and have negative momentum.

Dr. Lumber has made it pretty clear.

US housing remains a bright spot within the US economy and should continue to be a support, but housing sentiment looks toppy as home prices appreciated rapidly. The sector likely needs to catch its breath as evidence of price shock leading to some demand destruction is growing (see right chart).

Markets are not ignorant, including US Treasuries. Inflation, tapering, fiscal deficits…none of it mattered to US rates market, but slowing momentum in global manufacturing PMI sure did. This is not new; it has been a feature of markets for a long time. Too much focus on the level of US 10yr yield and what it ‘should’ be.

What’s the big deal if PMIs slow from high levels to less high levels? Well historically there is a close relationship between PMI momentum and earnings revision trends. And earnings revision breadth is an important factor in driving equity price momentum. One domino at a time.

Market Implications

Bottom line, market leadership shifts as we move through growth regimes. As growth slows, the pace of market gains will slow and defensive, higher quality markets, sectors and styles take the lead. This is already happening with more to go.

For empirical context, the table below is a summary of average monthly returns and hit rates during different Macro Growth Composite regimes since 2005. Focus on skew of returns and think probabilistically.

Key observations:

during slowdown phase, pace of market gains slows with more dispersion

favor US over rest of world

profitability and current value (i.e. FCF yield) favored over risk (beta, small, leverage) and deep value (i.e. p/book)

cyclical sectors start to underperform with more consistency

treasury performance improves

reduce beta exposure, favor high quality markets, dial back overall risk exposure

A consideration for another note is how quickly we could move into “contraction” given the volatility associated with this cycle. The magnitude of stimulus and spending leaves us vulnerable to contraction in some areas, particularly goods sector, in 2022 if not sooner.

‘Tis the Season

All of the above comes at a time of year when markets are accident prone. With late Aug-early Oct period representing one of the worst times of year to be long equity risk. Even more so during first year of Presidential cycle as the honeymoon wears off (h/t: @edclissold at NDR).

Less Bark, More Bite

At this point you are probably asking “Are you gonna bark all day little doggie or you gonna bite?”

Mr. Blonde has dialed back risk by raising cash, reducing marginal positions (especially cyclical beta) and adding short exposure. This started back in late July. For context, a portfolio previously +80% net invested is now closer to 45% net, but with high beta shorts.

Focus should be to 1) reduce marginal positions, particularly low quality high beta cyclicals, 2) add shorts in said cyclicals, 3) upgrade quality of the long portfolio. Remember, profit growth is a commodity and we pay up for profitability in a slow down.

Persistent weakness (i.e. narrow breadth, high beta underperformance, etc.) increases market fragility and raises the odds of a broad correction sometime in the next couple months.

Mr. Blonde is long Sept put protection in SPY, IWM and HYG in case things get a little heated, but the higher quality “short risk” trade is to be long quality factor.

Various forms on display here:

Parting Shot

When we talk about growth weakness, or risk off, there is a tendency to jump directly to shorting S&P 500 (SPX). This is often a mistake. Corrections have cadence and often start with internal weakness/divergence before it reaches SPX.

Take the mid-late 2018 period as prime example. Russell 2000 (proxy for small, high beta, cyclical) peaked relative to SPX in Jun’18 and lagged SPX by 6% before SPX peaked. And on first move down in SPX, RTY sell off accelerated.

Omar Little said it best, “you come at the king, you best not miss.” Wouldn’t say no to an SPX short, but prefer low quality, high beta shorts. More to come.

Excellent content. Thanks alot.

Very well written. Enjoyed the charts - well done!