Passing Peak Profit Momentum

Earnings season(s) take on added importance when growth rate of change is falling

Short note, high level thoughts and charts as we enter earnings season.

Markets and market pundits significantly increased their focus on inflation and Fed policy response, but Mr. Blonde thinks that was last year’s trade and in 2022 the focus should be on the risk to growth deceleration. As the year progresses the market will face less growth and higher cost of capital – a difficult mix for markets.

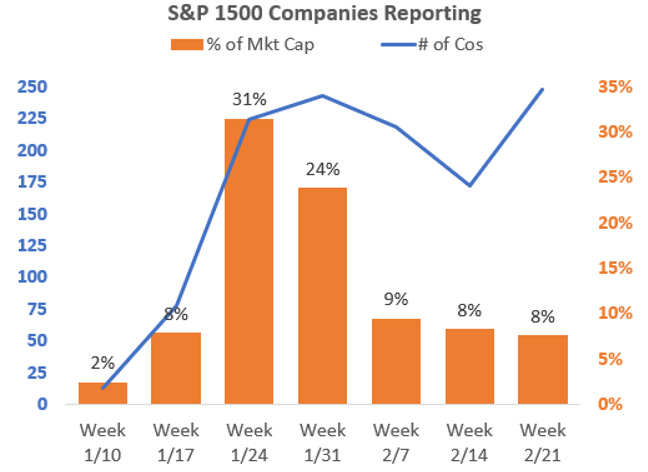

As a result, expect earnings seasons to have added importance this year. 4Q21 earnings season started last week with US banks reporting, but the pace picks up and broadens in the coming weeks with bulk of reports late Jan (post option expiration).

Growth momentum is slowing from breakneck pace of 2021, but as this slowing momentum continues market behavior and risk tolerance shifts with it. Mr. Blonde already outlined his view on growth going forward and the rising probability for disappointment in “From Tailwinds to Headwinds.”

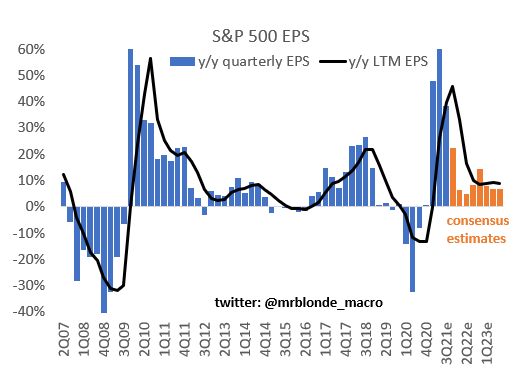

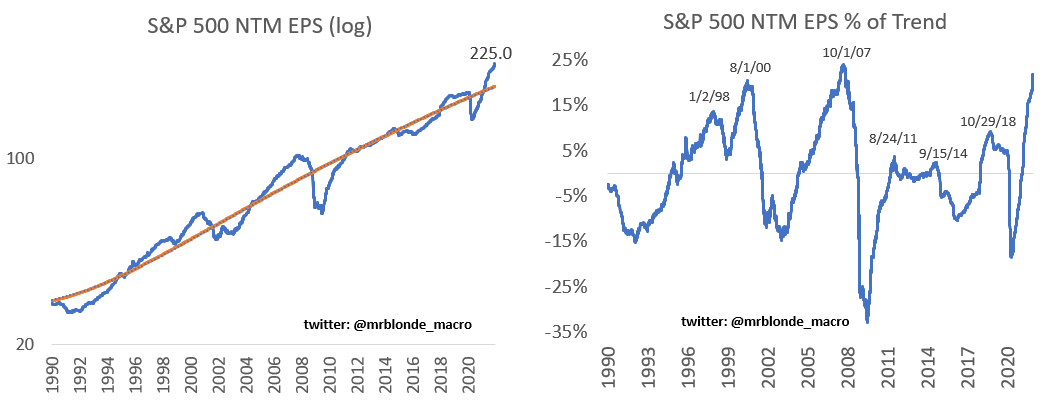

Plotting next 12mo (NTM) EPS vs. its trend historically puts the last 18mos into appropriate context. Massive fiscal and monetary stimulus resulted in a big shift from public to private markets. While the stimulus will linger, we are passed the peak and the pace of earnings expansion will slow meaningfully this year with rising probability of negative growth in 2023.

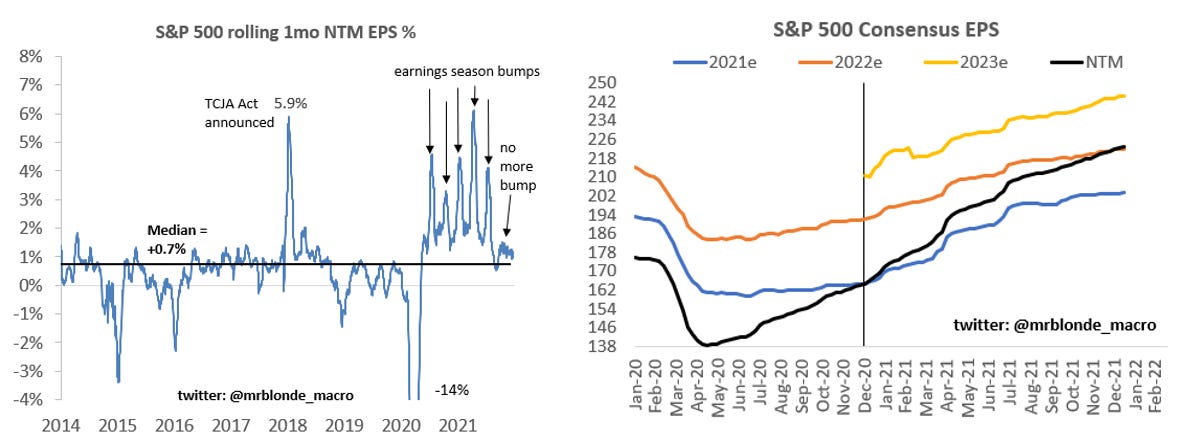

Fading momentum is already evident and started during 3Q21 earnings season when NTM EPS revisions failed to bump higher during reporting season. NTM EPS is still rising at a healthy ~1%/mo pace, but majority of that rise is just a function of passing time and “rolling up the EPS curve.” The stall in revision momentum is a factor in last year’s multiple compression along with hawkish shift among central banks.

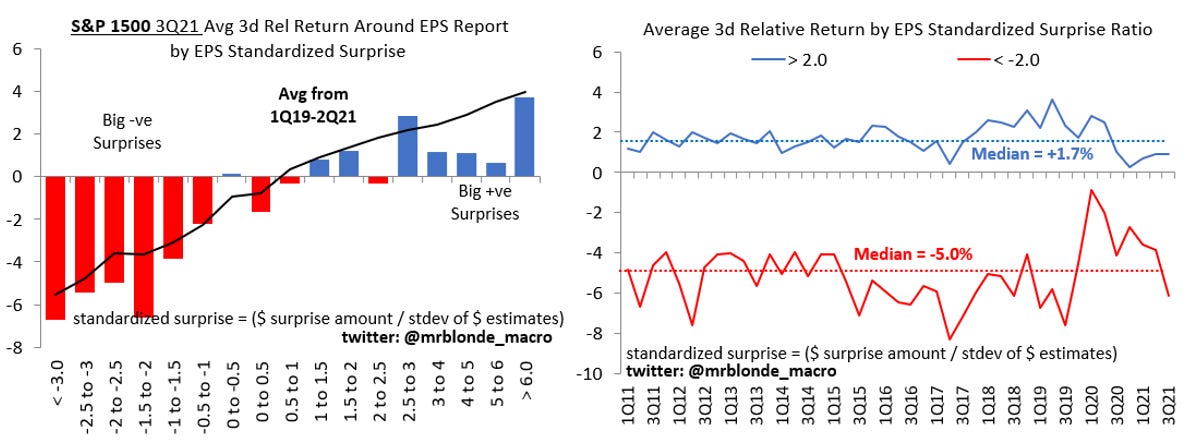

Importantly, the market’s reaction during 3Q earnings season reverted to “normal” with misses punished and beats only modestly rewarded. With Fed talking up the tightening cycle markets will recognize growth momentum will be harder to come by and we should expect misses (or weak guidance) to respond similarly.

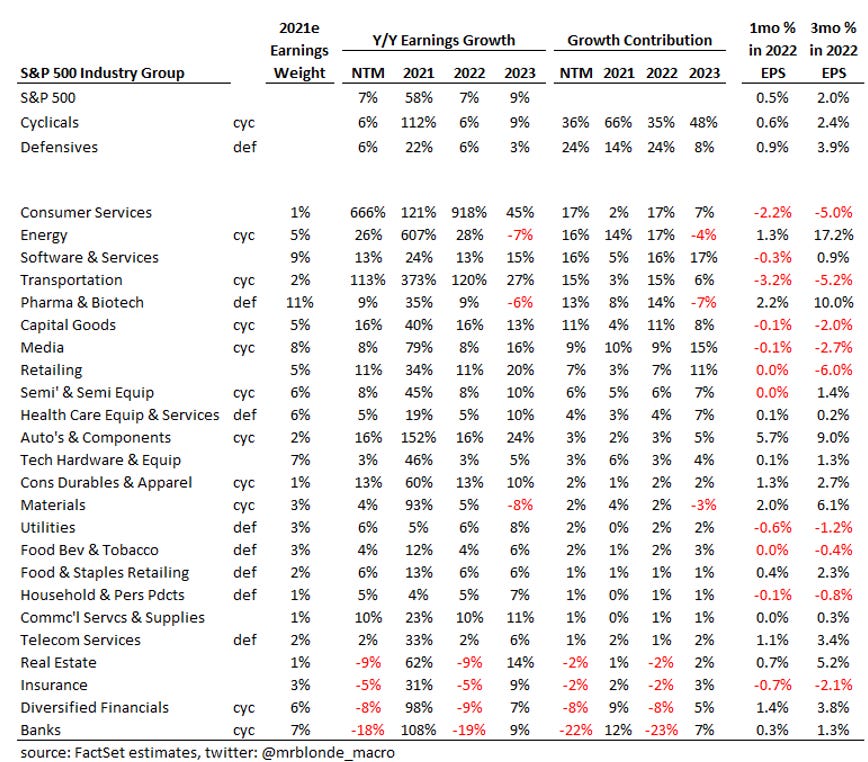

The most important groups for achieving 2022 consensus earnings growth are consumer services, energy, software & services, transportation, pharma & biotech and capital goods. Each are expected to contribute >10% to 2022 growth. Financials on the other hand have negative earnings growth expectations as reserve releases lapse, capital markets cool and trading desks quiet down.

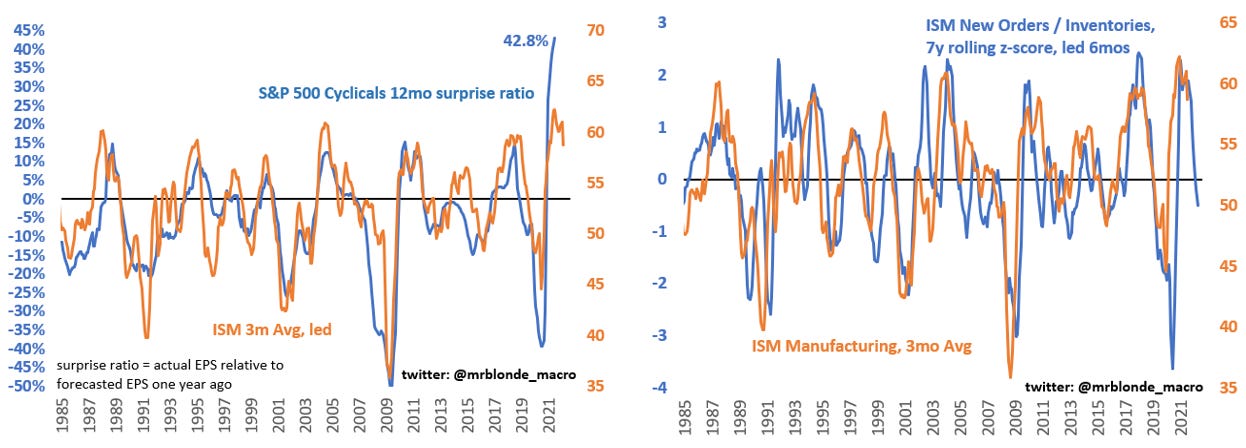

Cyclicals are the most vulnerable to changes in growth momentum and this is something Mr. Blonde will be watching closely over the coming earnings seasons. Shifts in incremental margin and pace of growth can be important tell on future growth and revisions. The new orders/inventory ratio suggests ISM falls this year.

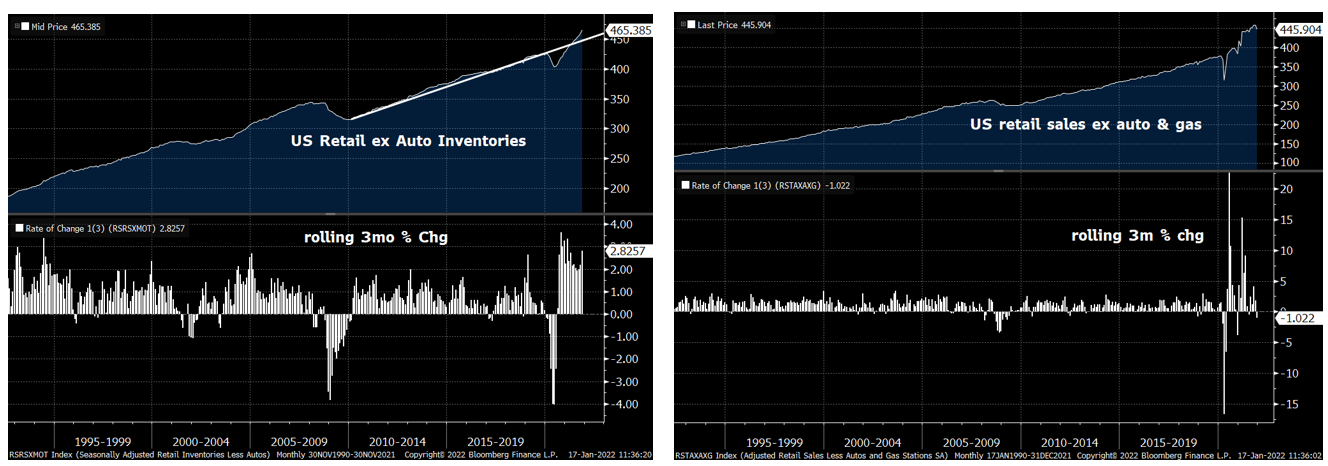

Last week’s December retail sales report only increased Mr. Blonde’s conviction on slowing growth momentum. It is historically rare outside of recessions for the 3mo % change in retail sales to be negative.

Lack of inventory or Omicron fear don’t explain the weakness: 1) Nov inventories had one of their largest jumps on record, 2) weakness in non-store retail (i.e. online sales) was a black eye in the report.

Maybe there is some seasonal adjustment oddity that will partially correct itself in January, but rising inventory growth with falling sales growth is a bad combo.

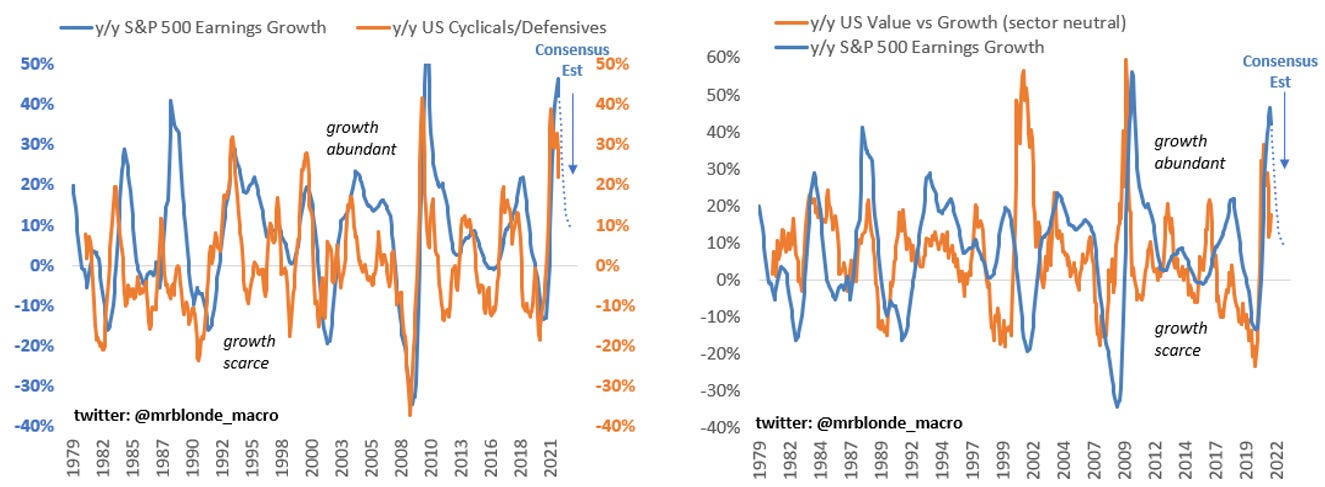

There will be more to report as earnings season progress, but this year is setting up to be one of disappointment for profit growth momentum. And historically when growth is becoming less abundant there is a shift towards the pockets with low beta, less cyclical sources of growth.

Just a few high level thoughts as we enter 4Q earnings season. Good luck trading, keep a defensive mindset.

Keep writing clearly, appreciated. One of best and most doennto earth commentaries I’ve read

Excellent and succinct...will recommend!