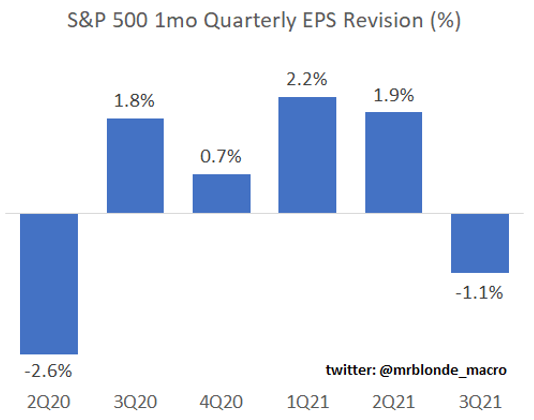

The pieces are coming together. PMIs keep falling, cyclical earnings revision breadth is rolling over, equity market technical weaken and the Fed is now hawkish. We’ve seen this movie before and it has similarities with volatile environments of late 2015 and late 2018.

Mr. Blonde is unsure if this risk scenario will make front page news tomorrow, but sees a deteriorating backdrop and thinks 3Q earnings season (early Oct) may serve as a reminder of the challenges. Recent reports and stock price reaction from FDX, NKE and ADBE raise an eyebrow. The tone heading into 3Q earnings season is already quite different from the previous four.

Tapering is Tightening

The Fed announced a commitment to tapering and winding down quickly. It is common for equity valuations to compress during periods of Fed tapering/tightening. Chart here of S&P 500 forward p/e with Fed funds and the Wu Xia shadow Fed Funds rate (per Atlanta Fed). If you are not familiar, the shadow rate attempts to account for both the level of Fed Funds but also the theoretical impact of QE.

In late 2015, S&P 500 P/E contracted 9% and in late 2018 it contracted 18%. Given elevated absolute valuation and level of positioning (discussed here), Mr. Blonde is taking a cautious approach to risk.

An uncomfortable similarity during each of those Fed tightening periods was a declining manufacturing PMI. In both cases, the weakness in manufacturing emanated from China/EM in response to China’s credit cycle.

Flash PMIs in Europe fell in fairly dramatic fashion. Germany -4.1pts, UK -4.0pts, France -2.3pts, and EU -2.7pts. This marks the 3rd straight month of declines and is now happening at an accelerating rate.

Falling PMI environments are important because they indicate high probability of earnings revision trends shifting from a tailwind to a headwind, particularly for cyclical groups.

This already appears to be underway with 1mo earnings revision breadth rolling over for cyclicals vs defensives. Mr. Blonde often hears the level of PMI indicates good growth and the slowing rate of change is expected given the sharp acceleration. Ok, so if slowing is expected and not a concern, why are analysts’ revisions rolling over?

Historically such a sharp turn in cyclical group revision breadth is a sign of caution for cyclical/defensive ratio. From Mr. Blonde’s perspective the risk/reward to being long cyclicals is not attractive given this backdrop.

Only need to see the price action in FDX this week to respect something might be changing. By the way, FDX is historically a pretty good tell on the direction of ISM. Coincidence? Probably not.

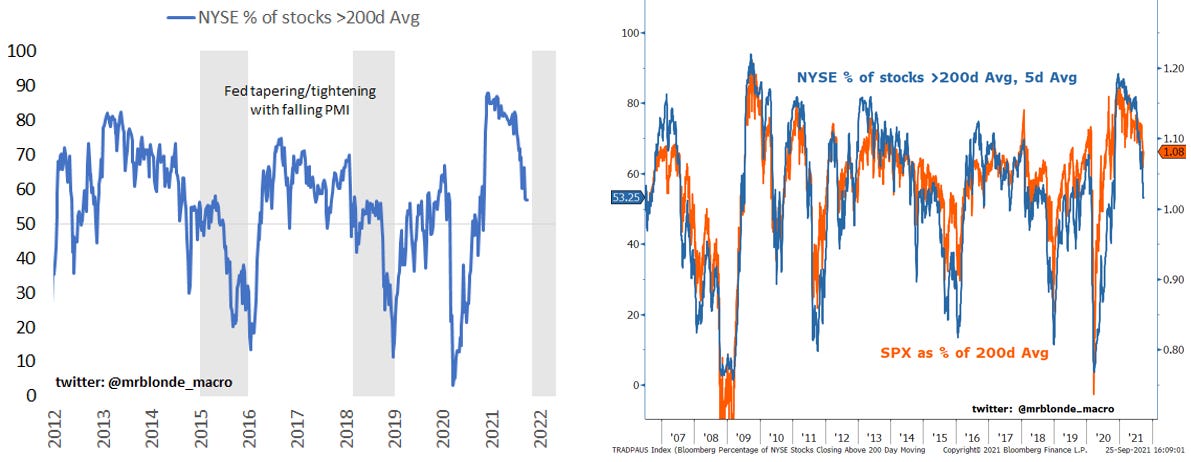

Bad Breadth

Breadth continues to narrow, which was a similar feature of markets during both 2015 and 2018 periods. Narrowing breadth is a reflection of a weakness within markets. Identifying that weakness is key to risk managing against it. Risk manage by avoiding the problem areas, but also recognize the vulnerability it brings at the market level.

Narrow breadth leads to weak price momentum at the index level. It suggests a higher probability of SPX trading to its 200d average (-8% from here) and potentially below it.

Are you gonna bark all day, little doggy, or are you gonna bite?

A few trades Mr. Blonde sees as relevant to macro minded equity portfolios and consistent with views outlined above. A long quality and short low quality, high beta cyclical profile remains a core view as outlined here.

Short gold to lean long US$

As anticipated, Fed meeting was hawkish. Short gold looks like the right trade. Everything outlined here still applies:

USA, USA, USA!

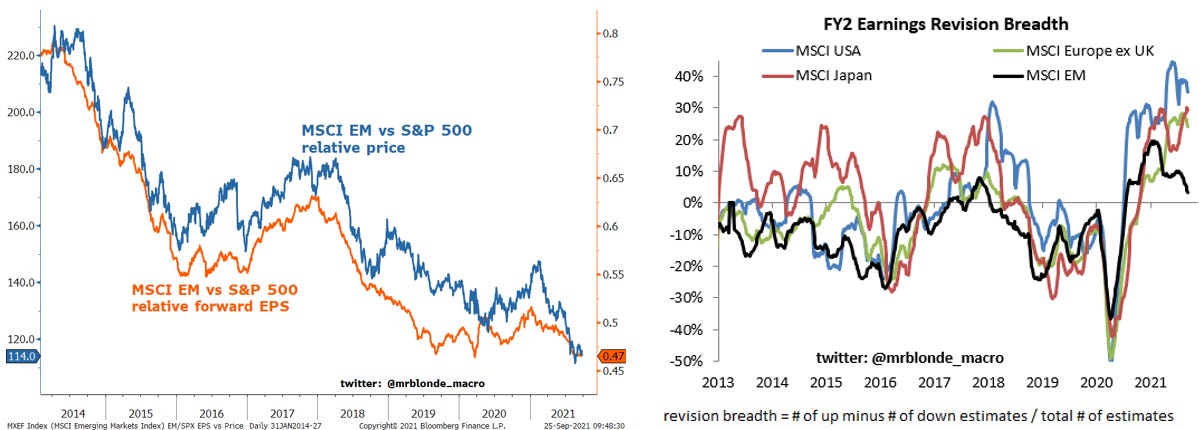

The calls for EM equity outperformance are deafening. Talk of “cheap” valuation and “so bad its good” environment, but the real story is the continued underperformance of EM EPS trends. At some point EM equities will outperform, but its not likely until US equity markets breakdown first.

For those on Mr. Blonde’s twitter feed, this table will look familiar. Remember, a country/region is really just a reflection of sector bets. In the case of ex-US (ACWX) or EM (EEM) the bet is long cyclicals and short defensives, particularly when compared to US which is neutral/underweight cyclicals. This is especially true if you consider Software as a new economy defensive group as Mr. Blonde does.

Mr. Blonde’s continues to use non-US markets as the preferred portfolio hedge and source of funds. The trend (and lack of cyclicality) is your friend.

Take Metals to the Bank

Long XLF / Short XME. An environment of Fed tapering and US led economic activity, while China (and china property sector) are deleveraging favors US banks over metals & mining. This is a trade with an upward sloping trend and performed especially well during 2015 and 2018 periods referenced above.

China is responsible for majority of commodity purchases, especially metals. The Fed is responsible for driving global rates.

The cyclical pair has spent most of 2021 bottoming and now appears to be making an upside breakout. FYI, the pair has 30d realized volatility of 27 vs. 11 for SPX, so size accordingly.

Services Over Goods

Mr. Blonde previously outlined his concern with the significantly above trend consumer goods purchases in No Pain No Gain. This sector is vulnerable to decelerating sales growth just as inventory growth rises, ouch. Its not realistic to expect consumers to buy goods at the same pace of the last 12mos.

If you are bullish on the economy, then services would seem to be the better bet given depressed state, fade in COVID cases and consumer that is willing to experience again (just look at packed college football stadiums).

This equity basket pair is long hotels, restaurants, leisure, health care services, airlines, and REITs while short household durables, specialty retail, leisure products, household products. The long/short pairing here is consistent with an environment of falling manufacturing PMI and weaker cyclical growth environment.

If you are an institution this trade is straight forward to execute. If you are not, you will need to do some stock/ETF selection to make this work for you. JETS/XHB (or XRT) or Hotels/XHB (or XRT) has a profile very similar to the pair trade above. S5HOTL Index (S&P 500 Hotels group)= 37% BKNG, 18% MAR, 14% HLT, 9% EXPE, 21% cruise stocks (CCL, RCL, NCLH)…Mr. Blonde wouldn’t bother with cruise lines.

Hopefully you have found the data driven content and ideas insightful. Mr. Blonde welcomes constructive criticism, feedback, and comments. Don’t be bashful, share your thoughts.

Interesting read! I do agree that even though we have had plenty of reasons for inflationary concerns in the US, the balance of probabilities remains in the stagflation camp

Really interesting and data-backed insight as usual. Big fan of your work/process. Thanks for sharing!