Brief note and observations on 4Q earnings season to date, no change in market view for slowing growth alongside policy tightening to deliver volatile and well below average equity market returns.

The Cycle

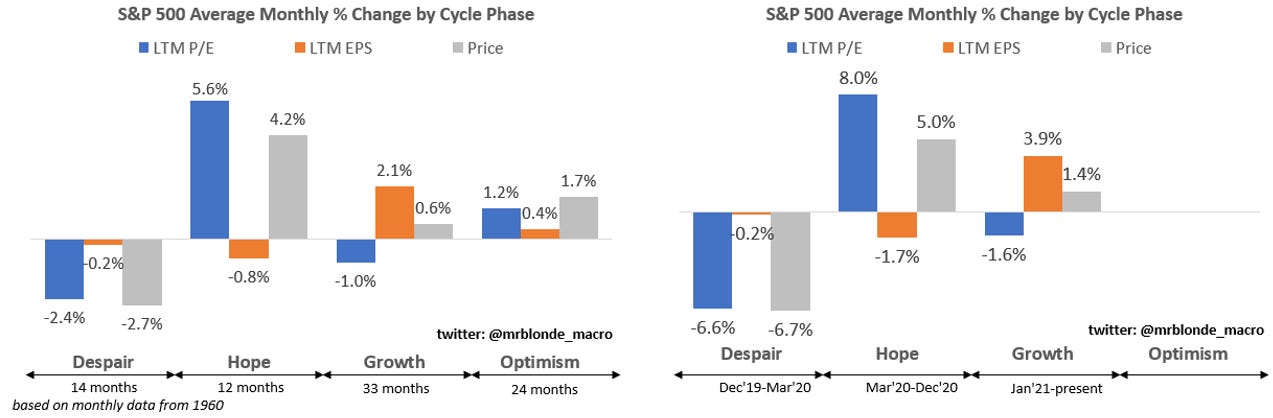

Before sharing some 4Q21 earnings season stats, Mr. Blonde taking a step back to evaluate market performance characteristics through various cycle phases. This is an extension of work done by GS to define market regimes into despair, hope, growth, and optimism.

Despair is period of nasty correction when multiples and EPS are falling together.

Hope is the period of recovery when valuation expands in anticipation of EPS recovery.

Growth is the period of EPS realization but contracting multiples.

Optimism is late cycle period when EPS still rising and valuation gets ahead of itself.

There are obviously many mini, trading cycles within each big cycle, but the point remains this period has so far behaved in similar fashion to past cycle periods. Bottom line, don’t be too emotional about daily market volatility and be skeptical of people that talk in extremes the truth is often somewhere in the middle of the distribution.

4Q Earnings Season Stats

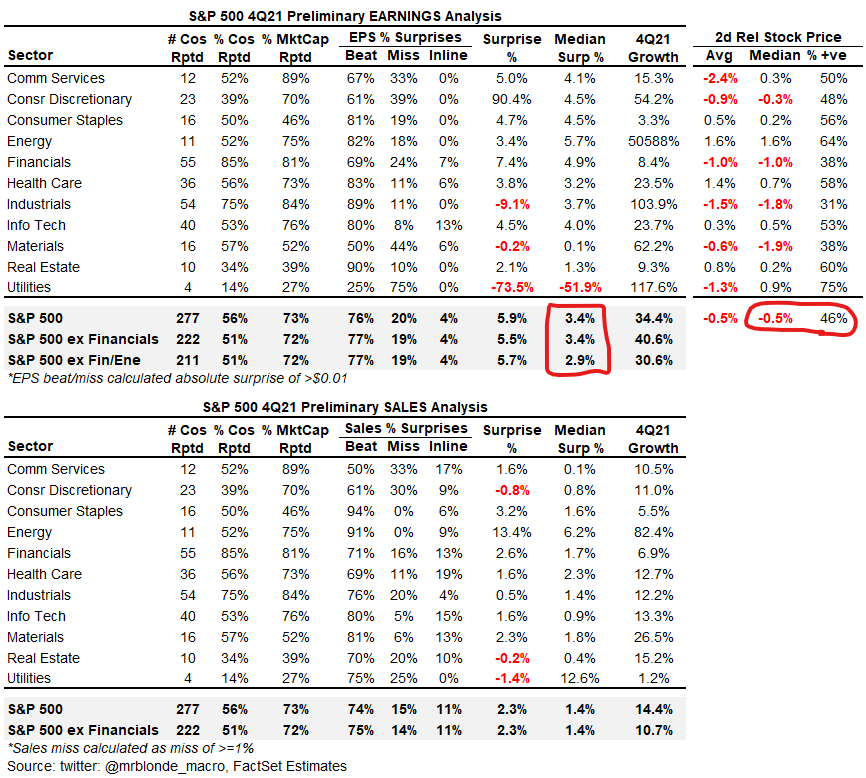

56% of S&P 500 companies representing 73% of market cap have reported 4Q21 earnings. The results are good and broad across sectors as widely anticipated. 34.4% earnings growth is strong, but down from ~42% in 3Q21 as growth rate of change slows. Also notable was the lack of stock price follow through in response to reports with less than half the companies outperforming the market in the days around their report. Price doesn’t lie.

Growing but Slowing

Consistent with the “Growing but Slowing” and “Passing Peak Profit Momentum” viewpoint(s), the pace of positive surprise has slowed meaningfully in 4Q21. The two big areas contributing to EPS beats and upward revisions to S&P 500 EPS over the last 18mos are FAAMG and bank stocks. No more reserve releases from the banks and while FAAMG are still putting up eye-popping growth figures given their size, market forecasts seem to have caught up.

The slower pace of positive surprises has also resulted in fewer positive revisions to subsequent quarter forecasts and corporate guidance has returned to its mildly negative average. Generally speaking, Mr. Blonde finds earnings revisions more reliable than guidance ratios as fewer companies provide guidance and analyst revisions are more likely to take in complete information including what corporate management said.

Measures of corporate sentiment from BofA that use natural language processing (NLP) to skim through earnings transcripts also suggest less positive vibe. The slowing rate of change is how weakness starts…every time.

Price Doesn’t Lie

As suggested above, one of the best ways to judge the quality of earnings season is to evaluate the stock price reactions in aggregate. Its important to study a broad universe of companies when judging earnings season rather than the typical talking head approach to extrapolate 1-2 reports as being representative of the whole.

So far, reactions to 4Q21 earnings reports are asymmetric with big beats barely rewarded while modest misses have been punished. Some of this asymmetry is normal as you can see by judging average relative returns for +/- 2 sigma surprises.

Note: using S&P 1500 universe here to cast a wider net on reactions, but for aggregate earnings S&P 500 is dominant weight

Running to Stand Still

With lack of upward EPS momentum and Fed dialing up rate hikes, this leaves broad markets in a difficult position and one that is likely to yield flat, choppy return profile at best.

Mr. Blonde’s S&P 500 valuation framework considers cost of capital along side earnings power in order to approximate “fair value”. US BBB corporate yields have risen to 3.2% (part duration and recently spread widening) alongside 5yr avg dividend yield of 1.8% suggest ~5% cost of capital. S&P 500 next twelve month (NTM) EPS of $225 suggests fair value SPX price of ~4500 – go figure.

So, you can use the table below to think about where SPX price is headed over the coming months and what price levels should be considered ‘cheap’ or ‘expensive.’ Mr. Blonde has a below consensus EPS forecast into 2023 outlined here and thinks credit spread widening is more likely than tightening while Fed is leaning on financial conditions. All told, the backdrop for taking directional risk isn’t great.

Good luck trading, keep a defensive mindset.

Thanks! This is fantastic article. Most folks are tunnel visioned on macro and overlooking this aspect. I would love to see an update once all the 4Q results are in. Thanks again.

Very good piece - good content well presented. Thank you.