From Tailwinds to Headwinds

time to increase focus on capital preservation

2022 is already showing itself to be difficult. A year where cyclical growth momentum, liquidity conditions, and US political risk (mid-term elections) are all shifting from tailwinds to headwinds. This follows a few strong years in markets with more signs of unwinding froth and elevated risky asset valuations leaving little room for disappointment.

Mr. Blonde’s base case remains the same (see past posts). Fed is hiking into fading cyclical growth momentum making for difficult markets, raising meaningfully the probability of a proper correction (>10%) and favors low beta, high quality, defensive growth over high beta, cyclicality. Bottom line, 2022 is about increasing focus on capital preservation.

Got Growth?

Core to the slowing growth view is Mr. Blonde’s earnings growth leading indicator. A multi-factor model including various well-known inputs like ISM New Orders, US Consumer Confidence, trade weighted US$, US BBB credit spreads, and oil prices.

Bottom line, profit growth momentum is peaking and set to slow through 2022 and is likely to be negative in 2023 — something markets will consider in late 2022.

Take note of prior peaks in the leading indicator and think about what transpired over the course of the subsequent year.

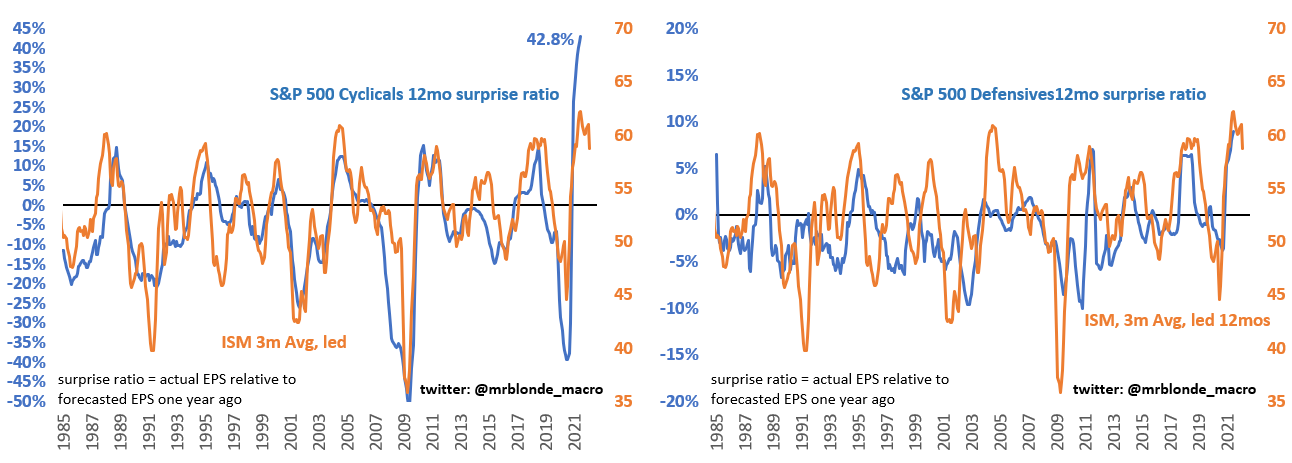

The earnings indicator offers a long +12mos lead time, but when PMIs start to fade it historically important to pay closer attention.

Mr. Blonde’s PMI indicator includes nine economic and market based leading indicators each normalized over a 5yr rolling period and various lead times ranging from 1-18mos. This is a guide and data-driven tool its not designed to predict with precision, but that is typically not necessary with PMIs as rising/falling is enough to change the character of markets.

The peak in manufacturing PMIs is just another sign of waning profit growth momentum and likely shift in earnings revision trends.

Keep It Simple Stupid: when PMI rising it suggests the probability of positive surprise is rising/high; when falling it suggests the probability of disappointment is rising/high.

So, the Fed is tightening policy into the above. How do you think that will feel? It makes Mr. Blond want to turn up the volume on K Billy’s super sounds of the 70s. See late 2015 and late 2018 as recent relevant comparisons.

Running to Stand Still

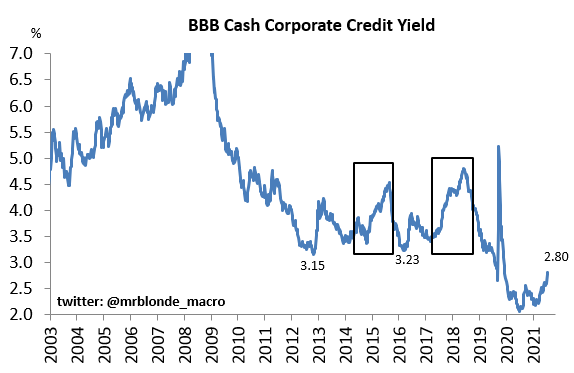

Anyone following Mr. Blonde on Twitter will have seen reference to credit valuation as the cause of equity valuation so many worry about. Fed tightening will weigh on credit markets with little room for spread compression to offset rising cost of capital. Boxed in the chart below are late 2015 and late 2018 periods when Fed tightened as global PMIs slowed.

A cost of capital valuation based framework for S&P 500 has done a stellar job guiding index value the last 20yrs. We can debate details, but if US rates head higher and credit spreads are not able to tighten then fair value of US equities falls without meaningful upward revisions to EPS. Current consensus expectations are for ~$223 in 2022 and $240 in 2023. As noted above, 2023 looks optimistic to Mr. Blonde.

The rise in rates will put downward pressure on market valuations and leave market searching for companies with secure profits in 2022 to mitigate valuation compression. This will be increasingly difficult if the above earnings growth forecast proves accurate.

Market Implications

Mr. Blonde keeps reading recommendations to buy various cyclicals because real rates are going up. Do people forget what happened in late 2015 and late 2018 as the Fed was slow to acknowledge recovery and was hiking rates into cyclical growth weakness. This time it might even be worse given they are primarily focused on hiking to stem inflation.

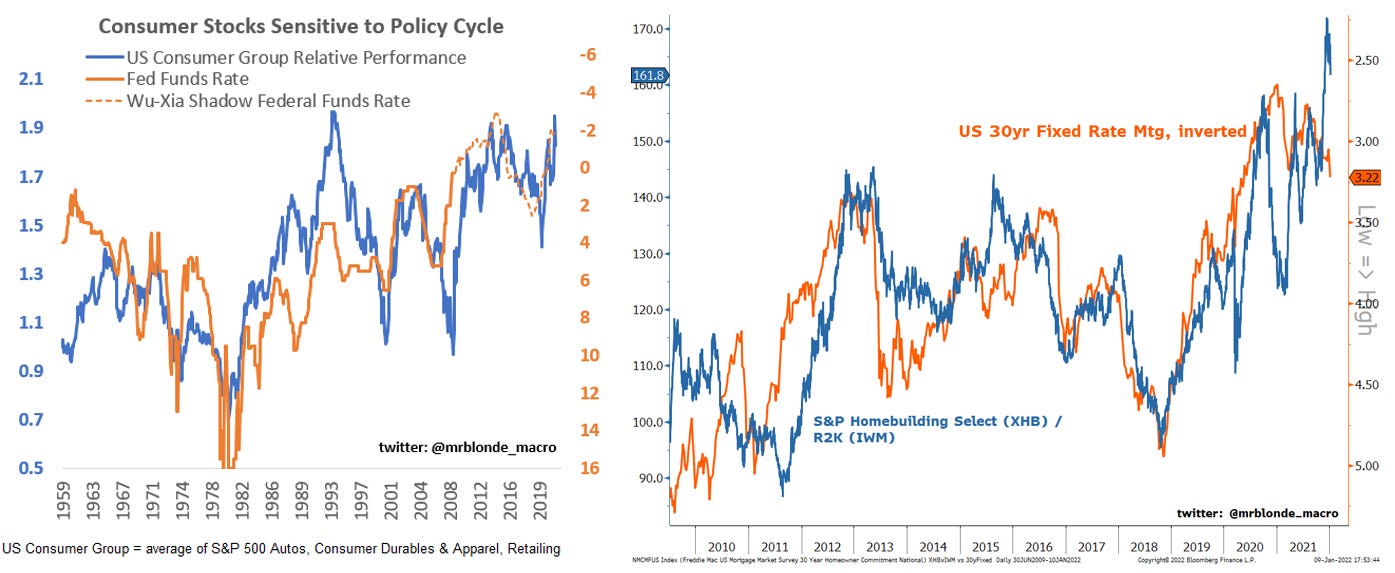

Either way, cyclicals/defensives ratio is not about real rates, it’s about cyclical growth momentum (i.e. PMIs). Notice the performance in 2013 when taper tantrum drove real rates up. Cyclicals outperformed because ISM was rising, not because real rates were higher.

Defense Keeps You in the Game

As a result, Mr. Blonde is playing defense this year with the Fed focused on tightening financial conditions we should expect more volatile market conditions. When broad market volatility starts rising, market participants seek ways to reduce PnL volatility. The first move is often to increase exposure to low risk, low beta market segments before ultimately reducing overall market exposure.

Its astonishing how many say “don’t fight the Fed” when they are easing, but when they start tightening shift the discussion to unimportant measures like GDP to justify staying long beta, or worse they tell you to buy cyclical risk. More outlined here, but when the Fed shifts towards tightening defense is the name of the game.

Is it really different this time?

Another misconception is NDX outperformance is only driven by real rates. Why do people only show the last couple years when making that claim? What happened in 2015? In 2018? See above, but Mr. Blonde expects as the year progresses and pace quickens on slowing cyclical growth momentum the market will value profitability and stability of profits more than “exposure to real rates.”

Mr. Blonde isn’t suggesting NDX doesn’t have issues, but let’s be careful to jump to conclusions based on a short window when there are clear recent examples of that relationship breaking down. People that think NDX is expensive should actually look at that crap making up RTY.

NDX is an index proxy for high quality growth, but its not Mr. Blonde’s instrument of choice. He prefers to select from this list of high quality growth compounders (HQGC) and diversify exposure across multiple sectors. This allows for similar style characteristics, but less sector and stock concentration risk.

Spring is for Selling

Economists talk about how great US consumer is, but Mr. Blonde has been short XRT for the last 9mos which has underperformed SPY by 18%. Next on the list is US homebuilders and housing related as Fed tightening enters a new, less friendly phase. Historically, the health of US consumer balance sheets doesn’t mean much to the performance of the stocks, but the Fed cycle does. Keep listening to economists if you want to be right, follow Mr. Blonde if you want to make money. ishares Home Construction (ITB) or S&P Homebuilding Select (XHB) are relevant ETFs here.

It’s possible the group gets some relief into late January given seasonal patterns, but Mr. Blonde sees this as an opportunity to go the other way. h/t: @NautilusCap for the useful seasonality chart toolkit.

Bonus Section

If you made it this far you’ve earned a little more. Its not just growth/liquidity that will weigh on markets in 2022.

Past Performance is Not Indicative of Future Results

All told after a strong 3yr run in broad equity markets the backdrop feels less favorable for taking above average directional risk and history would seem to agree. It started with correction last Sept, which coincided with hawkish shift at Fed.

S&P 500’s 3yr 90% price return is 94% percentile based on quarterly data from 1928. It’s extremely difficult to maintain such momentum and would require nearly 20% gains during 1H22 to do so.

That said, such extreme return periods do not clearly foreshadow an imminent collapse either. When 3yr returns are in top decile, the subsequent 12mos tends to deliver below average returns with near even odds of losing money. Bottom line, we should expect less from broad markets.

Seasonal Composite

“History Doesn't Repeat Itself, but It Often Rhymes” – Mark Twain.

Nothing captures the statement sentiment in markets more than seasonality. Far from perfect, but a useful tool to identify potential turning points and periods of above average volatility.

A composite of one year seasonal with US election cycle and decennial market cycle suggests a lengthy period of digestion in markets until we get to/through US mid-term elections in early Nov. This is particularly true if we focus on the election cycle seasonality (orange) which suggests flat/soft markets until early Nov. Year’s ending in 2 have a tendency to exhibit meaningful mid-year volatility which would presumably coincide with the Fed’s first hawkish move while growth indicators are showing clearer signs of lost momentum. Oh…and this all comes at a time when markets are long overdue for a ‘normal’ 10% correction.

Some more on the topic here with insight from Ed Clissold at Ned Davis:

Good luck trading and navigating 2022, it will be difficult, but its easier to know it will be difficult in advance than to realize it after the fact.

Ok, this is going to sound peak lazy. HQGC, no one stop shop etf or index to play this strategy? Or are we going to have to crunch some numbers? Great read as always.

Learned so much, thank you for sharing!