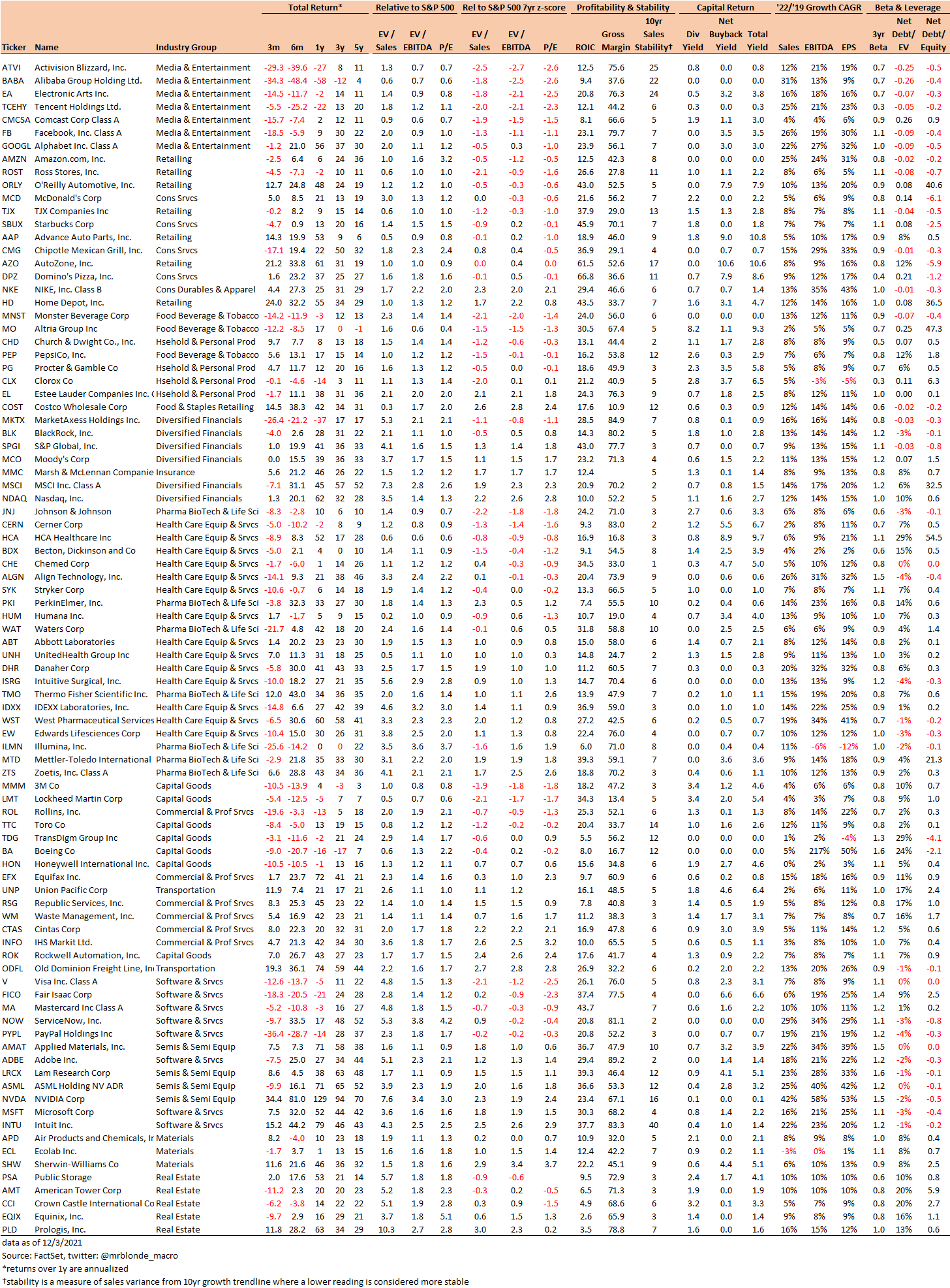

High Quality Growth Compounders (HQGC)

This list is not designed to be exhaustive and it is certainly possible some companies no longer deserve the title of high quality. But Mr. Blonde’s is macro equity focused and doesn’t get bogged down in micro details. When screening for a fundamental characteristic one needs to accept imperfections.

For example, Chinese tech has long been considered high quality growth despite the risk of regulation. The stocks are still on the list here despite recent events and horrific performance.

A good stock picker will use the list to find undervalued opportunities. A macro minded trader might use this list as an index to trade high quality growth. A quant will find this approach disgusting.