Tug of War

sentiment/positioning push while macro fundamentals pull

This commentary remains free for all, but come 10/31 will require a monthly subscription. See here for details and expectations. Hopefully after reviewing content provided over the last year you will find it well worth the price.

Brief market thoughts and very early earnings season observations. Bottom line, we’re in a tug of war between crowded thinking and still deteriorating macro conditions. This choppy, violently sideways price action can linger longer until we get new bad news to push us lower or enough time passes for fundamentals to deteriorate. The violence of upside moves suggests there’s value in holding shorted dated calls or call spreads, but as time passes the confidence for a meaningful bear bounce passes with it.

Violently Sideways

On 9/30, Mr. Blonde suggested the pre-conditions were in place for a bear market bounce (here, here). As suggested at the time, trading against one’s core view is mentally difficult and not for everyone. While markets shot higher initially, they have been violently sideways since. 5-6% rallies with 3-6% sell offs reflects a market that lacks conviction and doesn’t have new news to move it meaningfully in one direction or the other.

Mr. Blonde would give his Bear Bounce call a C+. The strong move in first few days of October suggests he was on to something, but the lack of follow through since has failed to impress. That said, it has not been a good strategy to press shorts either. The last few weeks have something for everyone but satisfied no one.

The Upside Down

One of the more interesting developments recently and felt in price action is the magnitude of up vs. down days. The average up day is exceeding the average down day over the last month and indicates a market with more urgency on the way up. This is reflects positioning and sentiment as well as trading dynamics (i.e. see options market).

All told, this escalator down, elevator up environment supports Mr. Blonde’s opinion to maintain a defensive, risk off, portfolio but tactically consider short term calls or call spreads to mitigate volatility from short, sharp upswings. More aggressive, active traders would consider the ranges and more aggressive dip buys…just don’t forget to sell.

Gravity is a Force

Working against bearish sentiment and positioning is a strong gravitational force. This issue is something Mr. Blonde has been highlighting for 10+ months and is the result of the Fed hiking into a cyclical growth slowdown (here). Periods when cost of capital is rising and EPS is falling are incredibly difficult and significantly increase the speed of financial conditions tightening.

First, consider the speed and magnitude of change in cost of capital is significant. The change is significant because it was the primary driver of asset price valuations for the last decade. Many times over the last 3yrs the equity market was called a “bubble”, but equity valuation (earnings yield) was just following cost of capital lower in the era of financial repression. Rising EPS and falling cost of capital is a powerful tailwind that is now a headwind.

Maybe we will enter some new valuation equilibrium and equities can live with higher yields? That is certainly a possibility as the above charts highlight, but a transition to that new backdrop has been and will be a painful process. With US BBB yields at 6.5% (yes you read that right) and consensus EPS for 2023 at $237 (and falling) the implied price for S&P 500 is ~20% lower and represents a strong gravitational pull on markets.

Bottom line, for there to be a durable up move in stocks we will need rate volatility to subside and need EPS revisions to turn positive. While the window for a bear bounce remains open, it would be wrong to lose sight of the trend.

Early Earnings Season

The bulk of earnings season (~65% of S&P 500 market cap) will report after 10/24, but through Thursday evening 101 S&P 500 companies reported, or guided, with 65% exceeding lowered forecasts and delivering a median surprise of 1-2% on sales and EPS—well below what’s been delivered in recent quarters. S&P 500 is tracking y/y quarterly net income growth of +0.1% and -6.5% ex energy on sales growth of +9% and +6.6%, respectively.

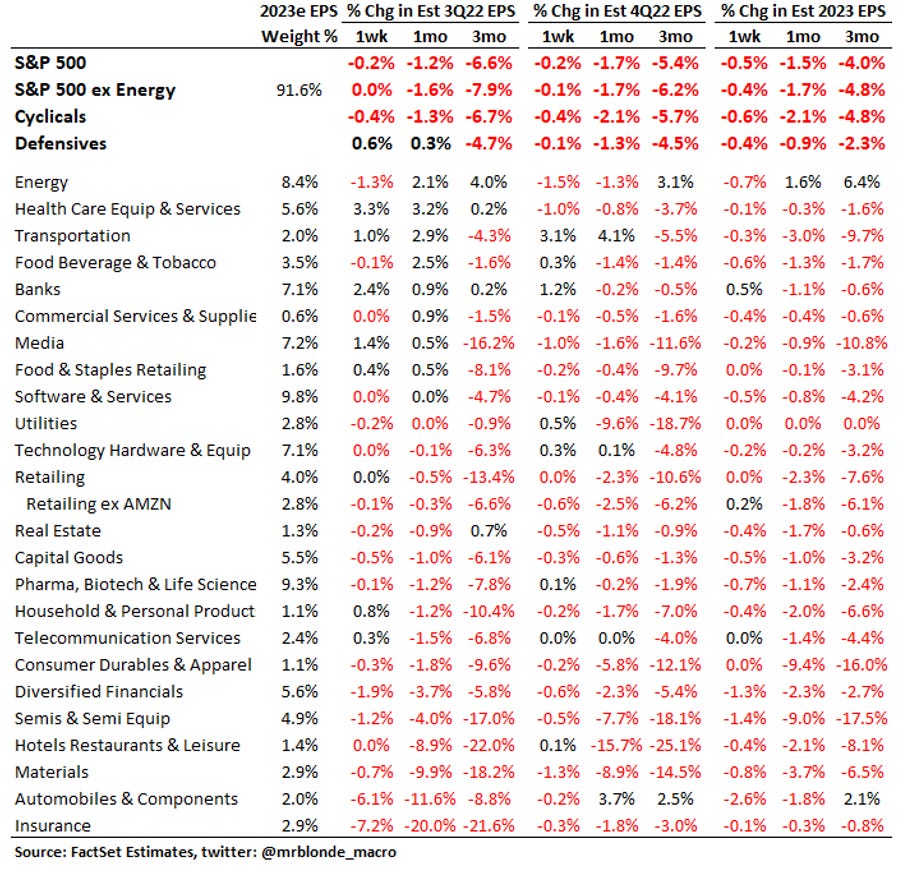

Of course 3Q reports will be an input for markets, particularly big surprises, but more important will be quality of report (i.e. pricing, margins, etc.), management update and characterization the environment into 2023. Mr. Blonde will use 2023 estimate revisions as a gauge for the health of the quarter as revisions typically encompass the current quarter, quality of the quarter and guidance. Notice how 2023 revisions trended during and after 2Q earnings season…a pretty good tell.

In addition to aggregate revisions, its useful to look beneath the surface. Only energy has positive EPS revisions and barely. Cuts are likely to continue, just a question of severity.

Price Doesn’t Lie

The other effective way to evaluate quality of earnings season is to cast a wide net (i.e. S&P 1500), adjust earnings surprises for dispersion of estimates, evaluate relative performance in the days around report date, study significant surprises and evaluate historically for context. Sounds like a lot…it is, but far more thoughtful than “70% companies beat” without any important qualifications.

While only 200 companies reported from this larger universe, the early results make clear misses are not tolerated. The market correctly recognizes the importance of robust, high-quality profits at this stage in the cycle.

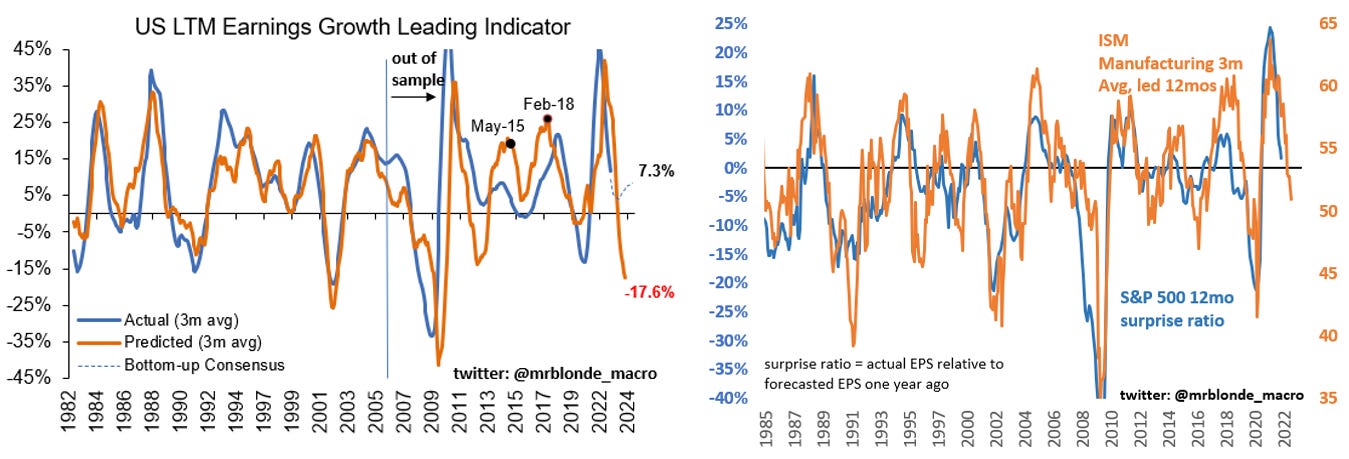

Following the Forecast

Mr. Blonde’s view on the earnings cycle is unchanged from very early this year (here). Growth deceleration and negative revisions this year that turn into negative growth rates in early 2023. Nothing from recent reporting seasons suggest that view is not on track. Before its all over, S&P 500 EPS will be closer to $200 or less from its current $220 and compared to 2023 expectations of $237 (down from $252 earlier this year).

Just a quick note to share some observations and thoughts in what has been a violently sideways couple of weeks. Pretty low sharp ratio environment in equities at the moment as we await new news. Maybe we’ll have some clarity before end of earnings season and the next FOMC meeting on 11/2. Good luck trading your view.

Have you considered some more longer term right tail hedge for the possible bear market rally? Maybe, just maybe a proper bear market rally could take some more time to develop? I mean, it did take from June 16th until July 19th for the previous downtrend resistance to be broken in ES1 Index.

Love and greatly appreciate your work.... thank you very much! One comment to consider: You have a very important table in this update... the table of S&P500 values based on EPS and BBB yields. To me this table represents floor valuations, meaning the value should be a minimum of $x based on the two inputs. Rationale is that at x value of the S&P500 I (the buyer) would earn the equivalent of the BBB yield plus an average dividend yield. However, over time the earnings component will grow, which is not captured in the table of S&P values, so the values are understated.... hence my comment about these being floor values. What got me thinking about this was - due to the range of input values of the table - I couldn't see whether the table reasonably approximated the actual S&P500 values of the past or if it was low (conservative) compared to past valuations of the market. If low, then that would be consistent with my point. The ultimate point, though, is to be cautious about waiting for the values implied by the current table to materialize because they may be too conservative.

Will