Mr. Blonde won’t waste time recapping all of the issues, but they piled fast during seasonally weak time of year proving the cautious view from late July and throwing shade at buy the dip calls appropriate.

Did it go exactly as planned? No, markets are hard and humbling. But risk management is about assessing risk/reward and willingness to give up small gains to avoid larger losses.

For investors, is the latest move in markets a trick or a treat?

For Mr. Blonde it’s a treat. The first meaningful correction in a year after significantly reducing risk and raising cash presents an opportunity, but the macro backdrop is challenging with several tricks to overcome before re-risking in any material way.

Still Analogous with Tough Times

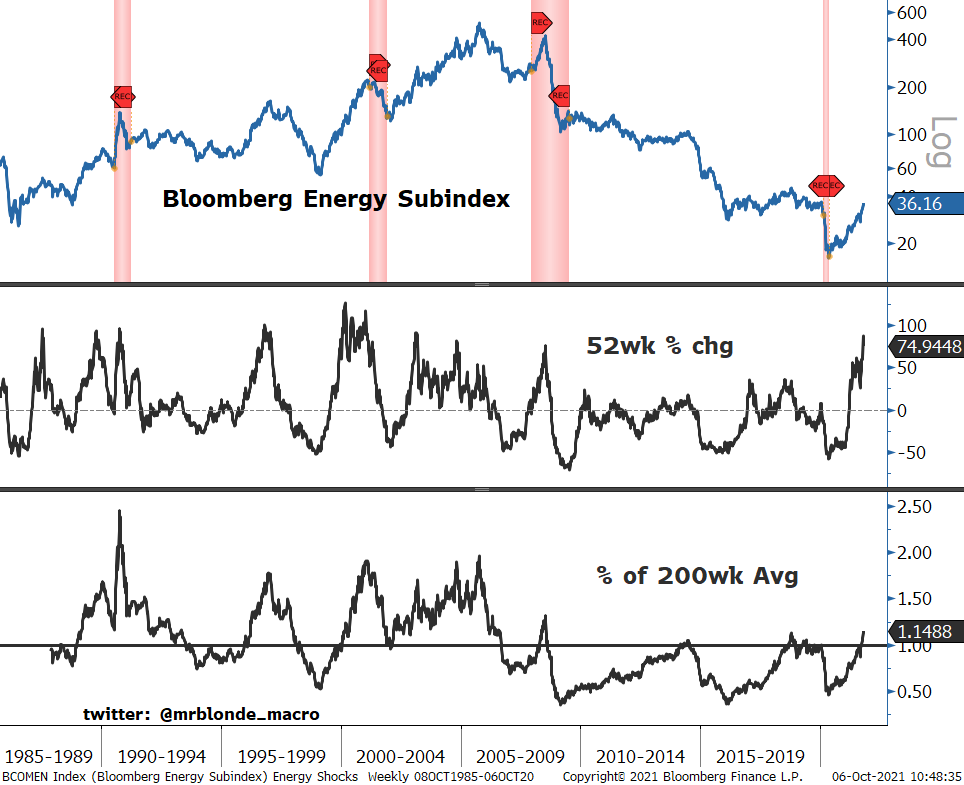

Supply chain concerns, labor supply issues and now major energy price spike drive an inflation impulse and significantly challenge central bank’s ability to exit extreme policy accommodation smoothly. As a result, this raises the odds of a policy misstep (i.e. tightening into weaker growth).

In Stay Skeptical, we discussed the backdrop of decelerating growth and policy tightening and similarities with current backdrop. This view is unchanged and makes for an even more difficult backdrop.

Uncertainty is Kryptonite for Expensive Markets

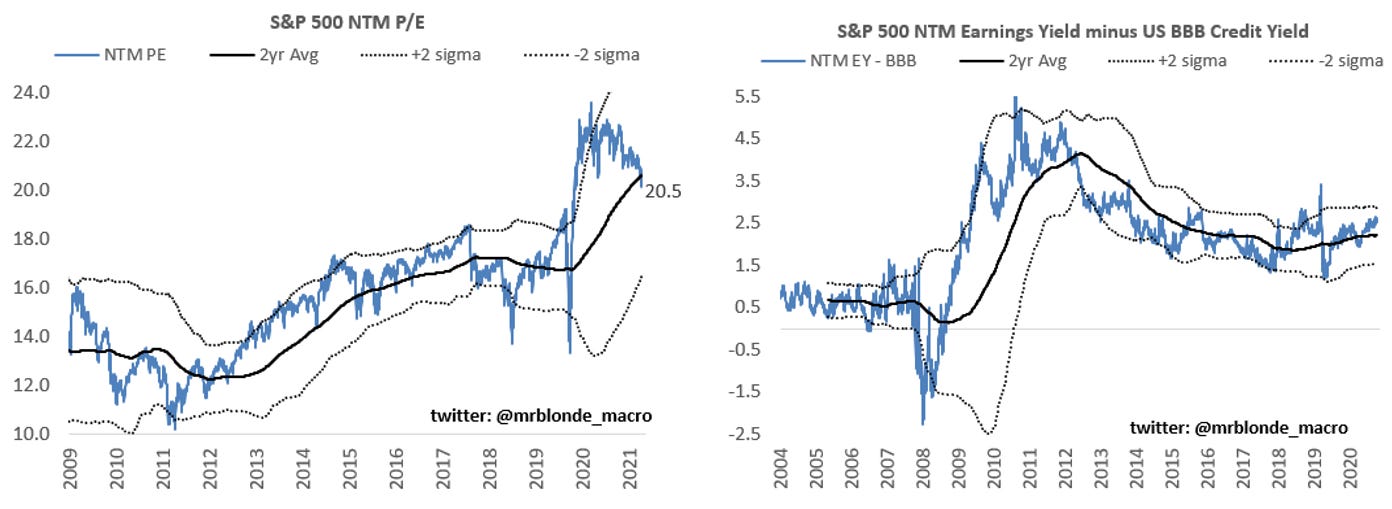

Unfortunately, everything is expensive with US 10yr at 1.5%, US BBB corporate yield is 2.25%, S&P 500 forward p/e is 20x and the “cheap” pockets are typically low quality and vulnerable to external shocks, like a spike in energy costs or cost of capital.

At this stage of the cycle, multiple compression is common. What is challenging is how expensive markets are in absolute terms which makes it difficult to calibrate downside. What is the difference between 21x and 19x? Other than 10%...both are pretty lofty market valuation multiple.

The good news, so far, is credit markets are largely unfazed by recent volatility with spreads a little wider but all in yields near lows which can soften the blow. Cost of credit capital has been a key support for equity valuation over the last decade.

The Pressure is On

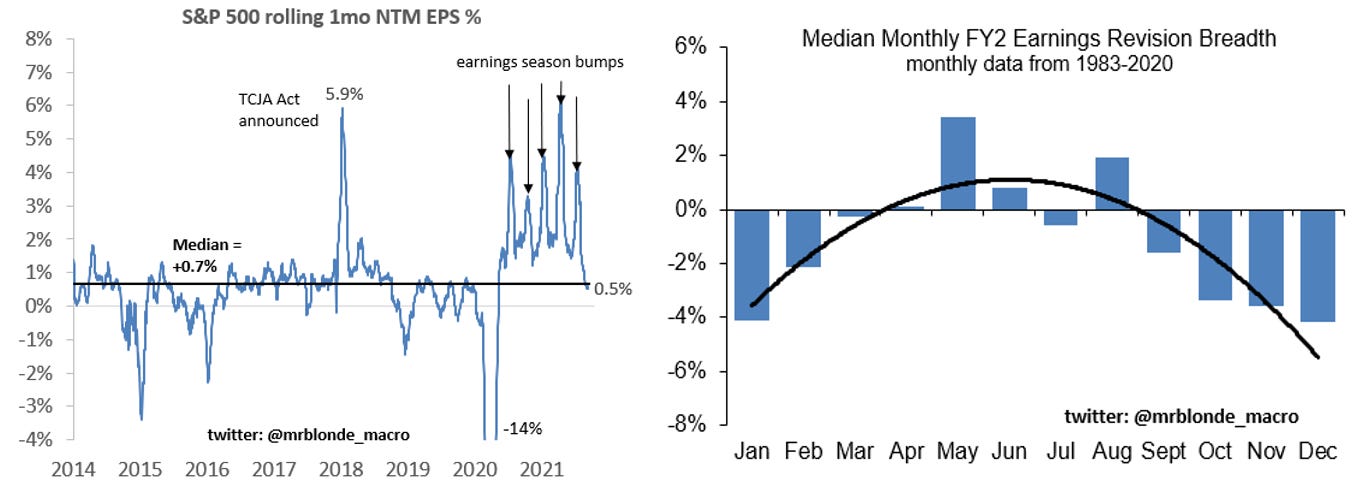

3Q reporting season will be an important fundamental signpost and help us differentiate good from bad. The rate of change in NTM EPS has fallen dramatically as the outlook dimmed, but the bump during the last few earnings seasons gives hope.

It’s hard to be excited about 3Q given the environment and read from early reporters so far (FDX, ADBE, NKE, MU, COST), but the corporates have proven to be quite resilient to a multitude of challenges the last decade.

But what will they say about outlook? 3Q reporting season also tends to be the period when corporates confess they can’t meet full year target or manage next year expectations (i.e. guidance). Given the tailwind earnings provided the last 12mos and in the face of difficult macro this gives Mr. Blonde pause.

Death of NDX

Death of NDX calls reminds me a bit of “death of value” calls around this time last year. 10yr yields rose 20bps in late Sept and people came out of hiding to call for peak NDX again. Mr. Blonde appreciates the positioning argument and agrees, but its critically important to ask WHY rates are going up today. The backdrop is quite different from this time last year when growth acceleration was a tailwind.

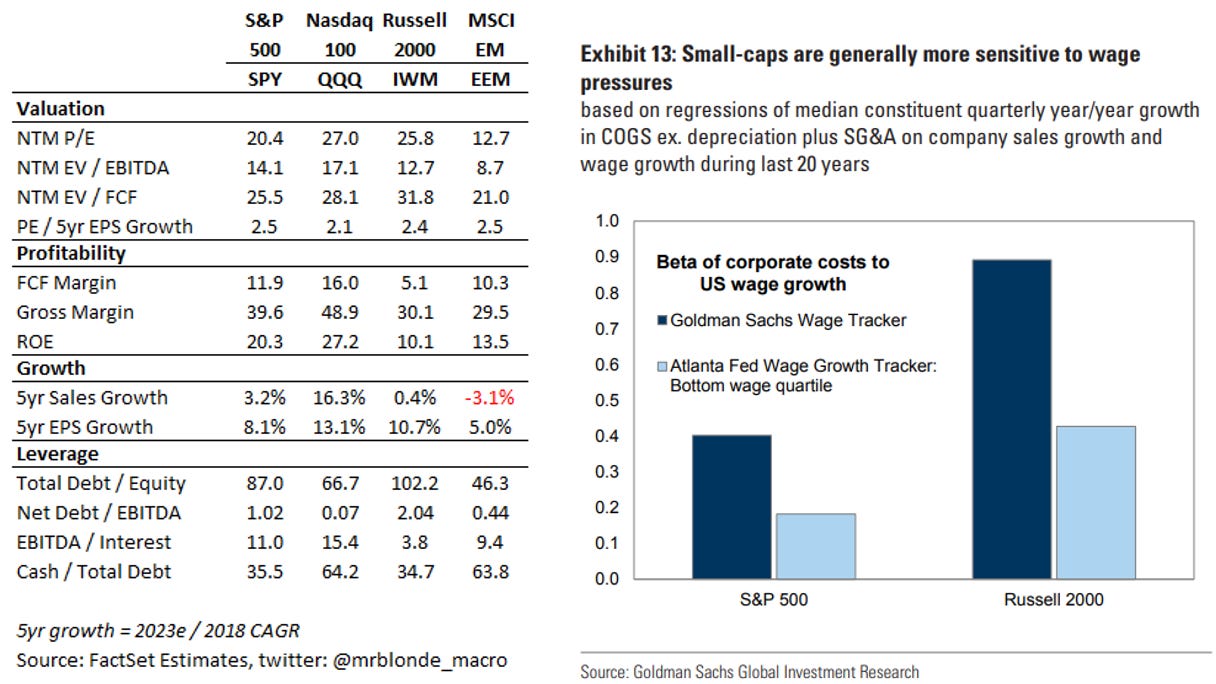

Outlined in Stay Skeptical, the late 2015 and late 2018 periods are analogous to today with hawkish Fed at a time of slowing growth momentum. It proved to be a difficult period for markets. When times are tough you don’t reach to buy low quality small “craps”.

Choose Your Fighter

If you want to trade duration within equities the focus should be on unprofitable tech (and other sectors). At this point we all know what ETF carries this exposure…it rhymes with BARK. Bottom line, a naïve P/E view of markets misses a lot of important facts and more often than not you get what you pay for.

In the environment described, Mr. Blonde has no interest in long Russell 2000 positions. Small companies will lack the flexibility and pricing power to adjust to rising prices and rising cost of capital in a softer growth environment. Choose your fighter wisely.

Tax Man Cometh

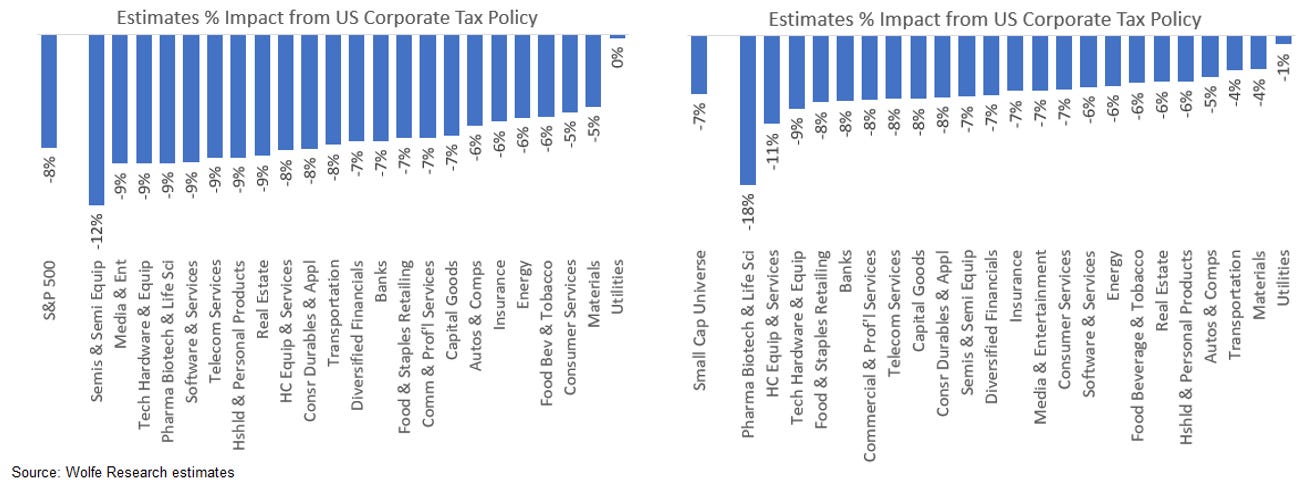

One major issue in need of clarity is the outlook for corporate taxes in 2022. The Fed’s tapering schedule is set and will upward pressure on cost of capital, but we need clarity on EPS trajectory.

Sensible estimates, based on what we do know suggest it will shave as much as 8% off of 2022 EPS forecast all else equal. This could take S&P 500 2022 EPS forecast from 218 to 200 quickly…and would suggest 0% earnings growth in 2022. Such a backdrop will make earnings durability and deliverability MORE important.

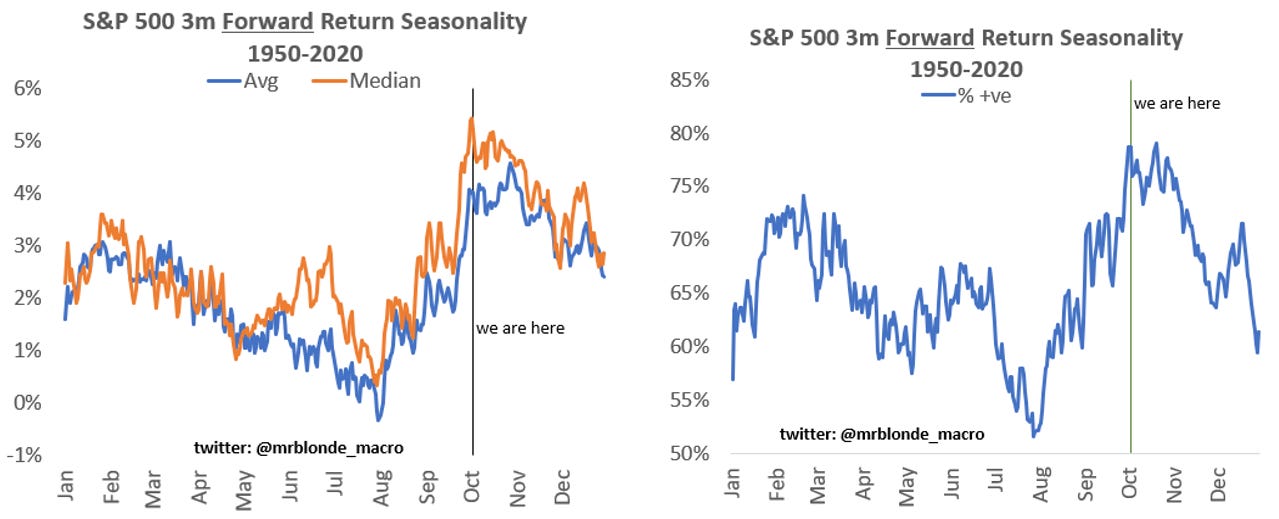

A Bull Point

Seasonality shifts from significant headwind to a tailwind. Seasonality has its flaws, but ~80% hit rates and 3mo forward expected return during the year is a noteworthy change. If we can get some clarity on the issues above, this is an important psychological factor to keep in mind.

Are you gonna bark all day, little doggy, or are you gonna bite?

Mr. Blonde’s minimum correction criteria was been met in the window of time he expected. Is it all clear? Far from it and expect choppy, challenging markets to persist. Trading mentality shifts to covering on big down days to reduce short exposure and move towards neutral risk position (whatever that is for you).

A few quick points regarding previous trades:

Services / Goods

No change in opinion. This pair remains a nice way to trade re-opening view while avoiding some pockets susceptible to disappointment.

Short Gold

Still short, but reduced position by ~30%. Mr. Blonde has no clue what is going on at the Fed, doesn’t seem like they know either. Expect hawkish leanings, but new appointments to vacant seats and increased potential for punting Powell reduce clarity.

XLF / XME

No change in view, slight change in trade construction. Using big banks (KBWB) along side XLF in order to get a bit more rate beta in the trade (see right chart). XLF has big weights in BRK (12%) and capital markets (26%). View remains the same, the pair benefits from hawkish Fed policy, long $ bias, and in the context of China led slowing PMI environment.

New ideas:

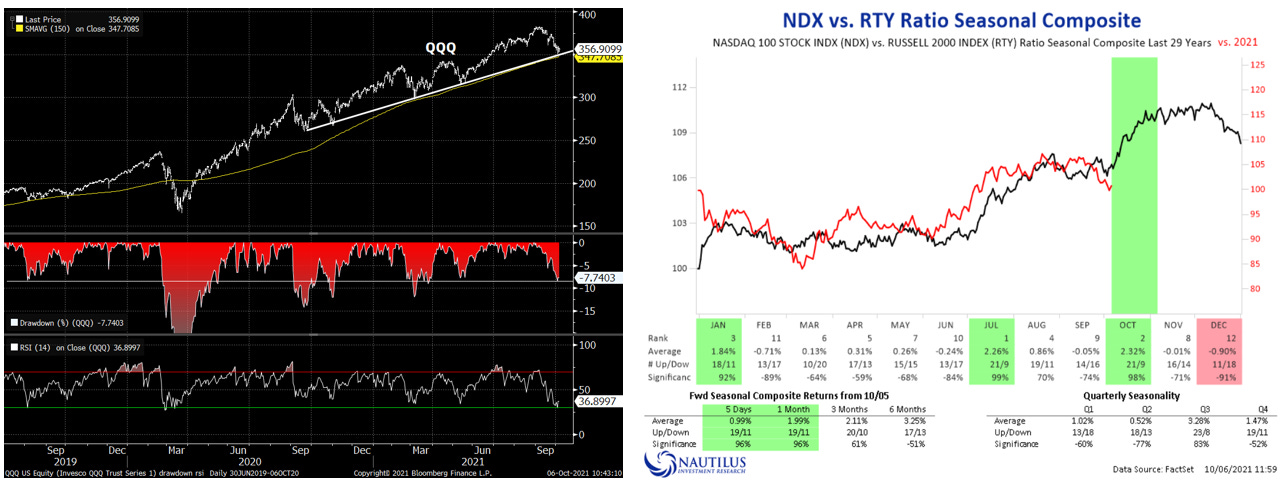

BTD in QQQ

Oversold, 8% drawdown, finding support at upward trend line and near 150d moving average support

h/t: @NautilusCap NDX up 15 of the last 20 October’s and 21 of last 30 vs. RTY

footprints of hedge fund deleveraging in the last 10 days suggest forced selling and likely NDX hedging

guess who has no exposure to commodity input inflation…tech

not married to this one, but seems like decent entry point for a trade into strong seasonal period

For stock pickers, Mr. Blonde recommends re-vising the High Quality Growth Compounders list for stuff to buy.

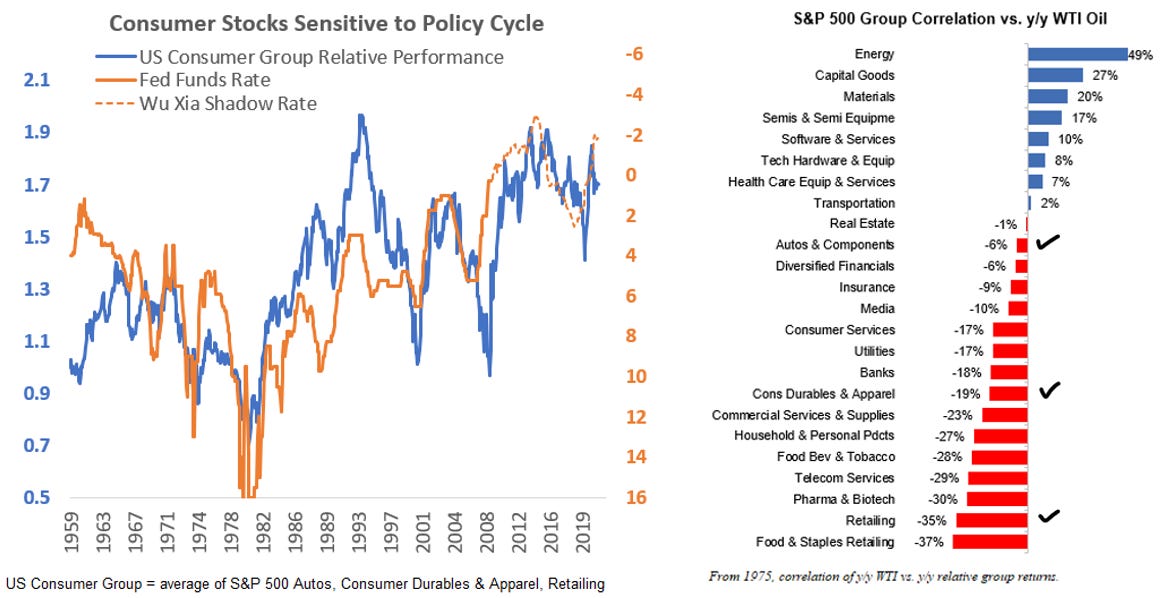

Short Consumer Discretionary

Short XRT. Let’s not over think this one. The group lack’s pricing power and is feeling cost pressure from higher transportation and higher wages. Now along comes higher energy prices to suck up some of that “excess savings” everyone is expecting to be spent. The time to buy retail was in the darkest moments last April, not now.

The cleanest, broadly available, way to participate here is short XRT (SPDR S&P Retail ETF).

Marginal Utility

Long XLU. Utilities offer something other sectors don’t…they are boring. But boring might be just what we need in the next few months as there are likely to be many cross currents.

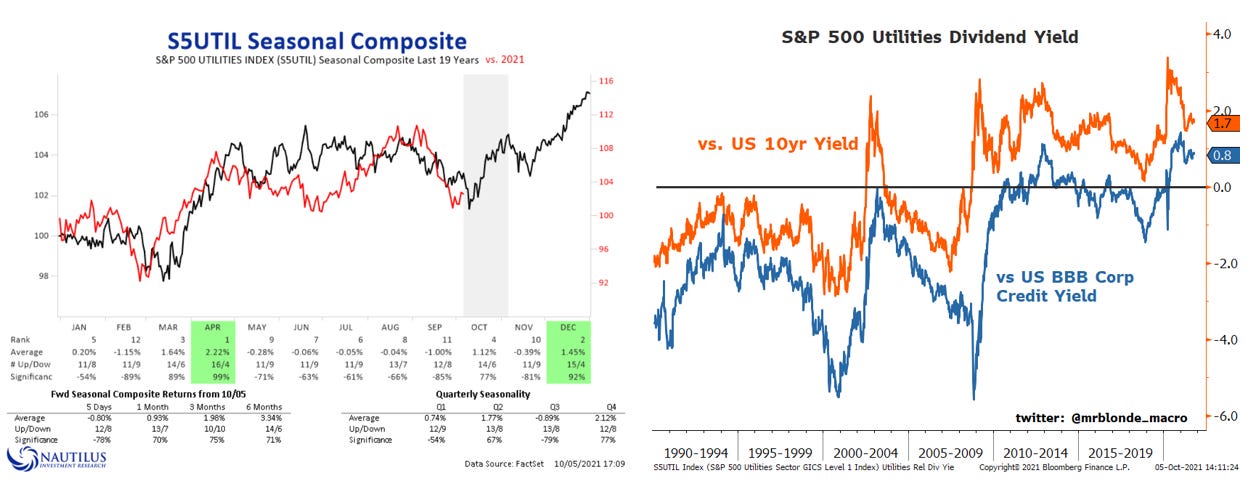

In past decades, active managers might go to cash to wait out the volatility storm, but central banks have removed that option for most with cash offering 0%. Utilities dividend yield is +80bps vs. US BBB corporate credit and +170bps over US 10yr yields. Mr. Blonde considers utilities as a cash instrument in multi-asset portfolio, particularly after the group sold off (down 14 straight days in Sept).

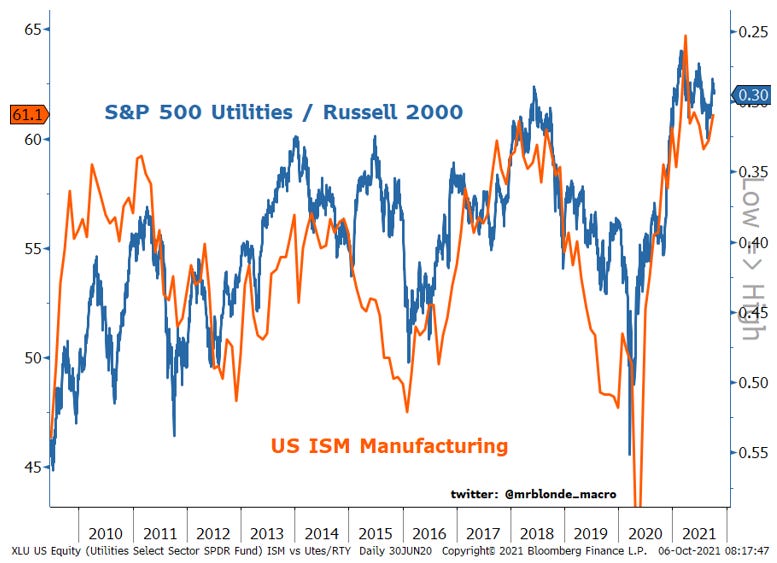

A long utilities position after the latest sell off fits with Mr. Blonde’s view that PMIs are more likely to fall than rise from here. Historically utilities outperform other, more cyclical, parts of the market during this phase.

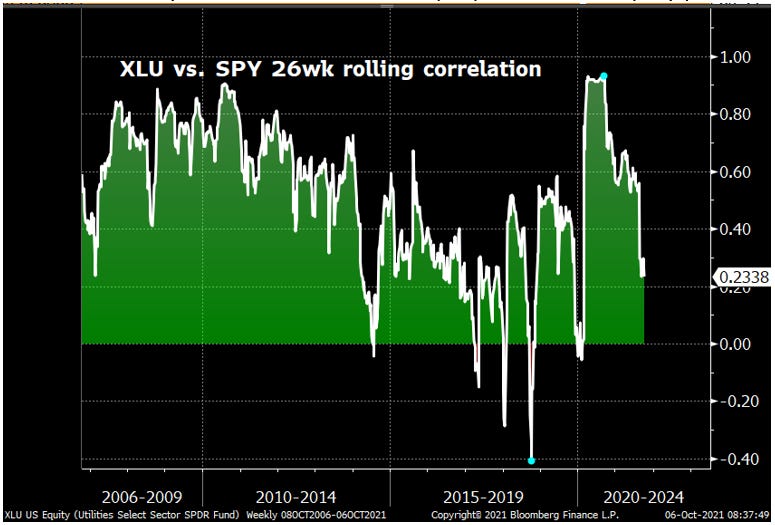

Also noteworthy, is XLU’s diversification properties in an equity portfolio with relatively low correlation vs. S&P 500.

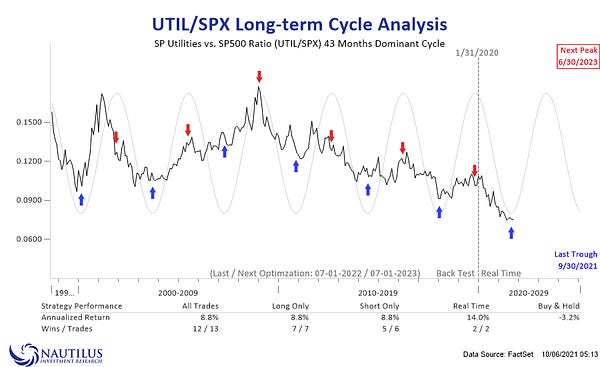

Our friends at Nautilus Research made an astute observation which fits with the oversold view as well as the natural timing cycle of ISM upswings/downswings.

There is a tremendous amount of material here and several trades Mr. Blonde is engaged in. If anything is not clear or a question is raised its best to use the comment section which will allow the answer to be read by all. It also creates good dialogue and keeps thoughts organized in one place.

Are not utilities a bit of a bond proxy? With a potential sticky inflation issue and hawkish Fed, is it really the time to go long XLU? Is your argument mostly based on outperformance vs SPY? If you look at a long term chart of XLU-SPY, you certainly have to get your timing right and not overstay your welcome.