Mr. Blonde has been warning about the Fed hiking into a growth slowdown from Sept last year (here). Most were in denial through 4Q21 and focused on buying dips and talking about how good stock market returns are during Fed rate hike cycles. At this point, and 15-25% lower in major indices, far fewer disagree which has shifted risk/reward a bit.

Markets ‘feel’ ripe for some relief. It’s a trading view rather than a change in fundamental outlook and the ‘feeling’ is based on judgement supported by data-driven observations. It’s an opinion that markets may have moved to far too fast and are bracing for bad news that may take longer to develop than currently priced.

For Mr. Blonde this means trading against his core view so its a small change to exposure and maintaining defensive posture just a little less so. The US CPI report is a clear catalyst and swing factor that will either make this judgment look stupid or genius, but Mr. Blonde’s inflation indicators suggest slowing momentum. It may not be evident in tomorrow’s report, but think its worth risking a little in case it is.

1 step forward, 2 steps back

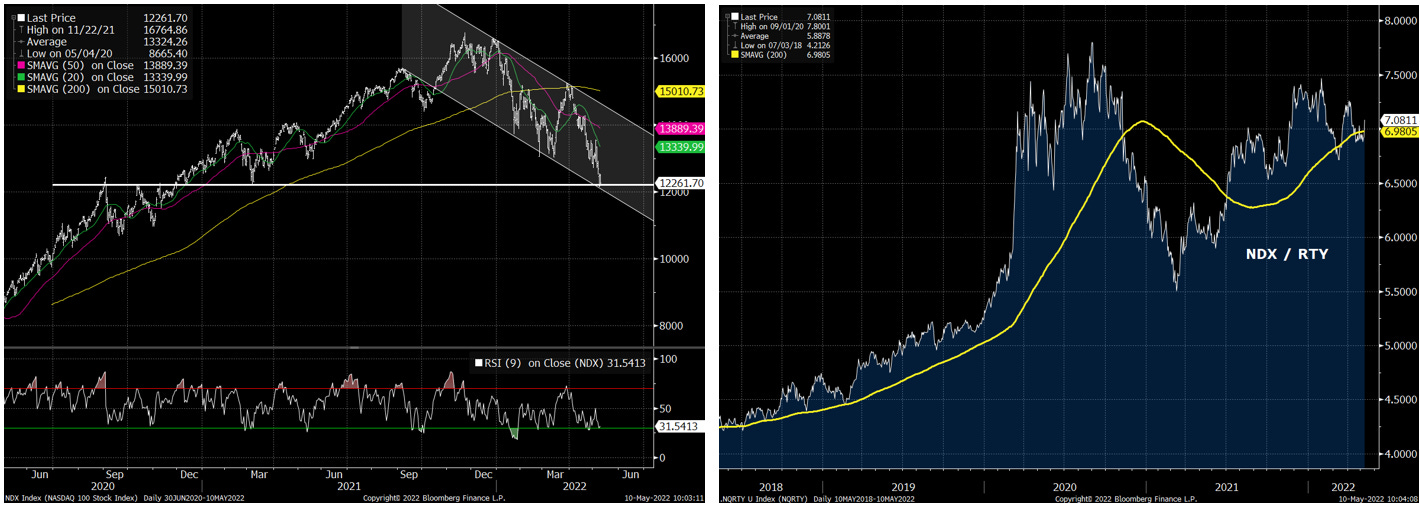

First, Mr. Blonde is no technician, but the NDX price chart looks to be a natural spot for some relief even in the context of a downtrend. Also interesting and despite all of the focus on NDX as a giant bubble is the relative performance of NDX to Russell 2000 which is hanging onto a still rising 200d avg.

Sour Sentiment

Bearish sentiment is a necessary but not necessarily sufficient factor for buying risk. Mr. Blonde uses a combination of AAII and Investor’s Intelligence (II) sentiment surveys to study the efficacy of bull/bear sentiment readings historically. It’s true over short time horizons (i.e. 1mo) that bearish sentiment is generally a good contra-indicator. This is primarily because sentiment follows price and it indicates oversold conditions. As always, judgement is required but the starting conditions present some margin of safety.

Its the Economy Stupid

Further evidence of sour sentiment as well as realization of Mr. Blonde’s view is the weakness in cyclical/defensive ratio. For all the talk of great nominal GDP growth, strong household balance sheets, and commodity super cycle the outperformance of low beta defensive sectors has been significant and is anticipating a difficult growth environment.

Capitulation?

More signs of capitulation recently, particularly the shift in equity fund flows. Is it enough? Maybe enough for the time being until we start to see the growth impact from tighter financial conditions and more material markdown of profit growth expectations. Certainly the market has entertained that view over the last month, but the confirmation could be what drives capitulation to its completion.

Historically, as presented in the table more durable, capitulatory bottoms are typically found with first readings <= -3. For the time being a reading of -2.3 coupled with bearish sentiment and oversold conditions is enticing enough to dial back shorts and tactically increase exposure. If you have been holding heavy cash position this seems like a good place to add some risk.

Inflated Expectations?

The most obvious catalyst to lean against the bearish sentiment is evidence that we are passing the worst of upward inflation pressure. Inflation is kryptonite for expensive markets as it forces the central bank’s hand irrespective of growth conditions. Inflation will continue to be an issue, but if it’s perceived to be less of an issue it can bring some relief.

Final Word

Trading against one’s core view is not easy and not for everyone. Mr. Blonde’s fundamental view for profit growth momentum to slow meaningfully as the year progresses and turn negative remains. This is a tactical view and recognition Mr. Blonde’s view is no longer in the minority. He still expects market narrative to shift “from Fed hikes to growth cuts” as the year progresses and will continue to cap upside in risk markets, but doesn’t preclude them from going up for periods of time.

To put the view into context, on a risk scale of 1-10 (10 is max risk) this is a move from 2 to 4 for Mr. Blonde but major equity indices can rally 10-12% and still be in a clear downtrend so the risk/reward has shifted somewhat.

Good luck trading your view.

Always excellent coherent well written thanks man

Thanks for the update Mr B....interestingly yesterday I covered my Nasdaq puts and bought some QQQ’s so I’m you’re wingman.