Mr. Blonde spent the majority of August away from markets. Probably a good time to be away as little changed in the macro backdrop despite commentators suggesting otherwise. As usual price has a way of changing sentiment whether justified or not. But the Fed (and other central banks) is still in tightening mode and growth is still slowing with signs its broadening and picking up pace. This is an environment for short risk.

Shock Signs are There

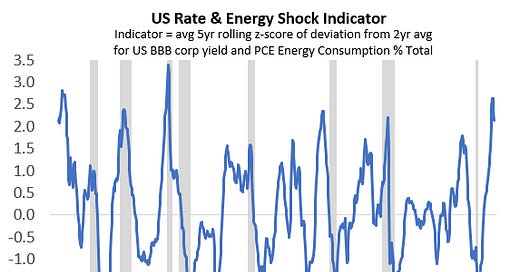

We are in the middle of one of the largest rate & energy shocks of the last 60yrs and people are tripping over themselves to call the bottom. Calling the bottom in risk assets seems misguided while Fed (and other central banks) maintain a tightening bias and energy prices are still rising at a rapid clip (see Europe which is rekt). As suggested for months, Mr. Blonde doesn’t know if we will actually have a “recession” but you don’t need that explicit forecast for a bearish view when the risks of a significant growth slowdown are high and rising.

Stiff Headwind

Growth risk is to the downside and accelerating. Powell just told us, pretty clearly, that negative growth and “pain for households” is an unfortunate cost in battling inflation. There is no Fed put that isn’t preceded by sharp, negative growth first.

The growth risk to corporate profits has been flagged here for some time. Recent data points, events and 2Q earnings season have done nothing to disprove this forecast. If anything, the confidence in the forecast has increased. We can debate the precise outcome, but if 2023 earnings growth is more like -10% than +8% that is a significant negative surprise for the market to digest in coming quarters.

If you think its priced in, then you assume 2023 EPS of ~$200 and S&P 500 currently trading at 20x forward p/e. Is that a market to buy while central banks fight inflation with rate hikes? Value is in the eyes of the beholder, but that valuation is too rich for Mr. Blonde.

Corroborating the message above is the sharp fall in purchasing manager indices, particularly parts of the survey that lead (i.e. new orders/inventories). As shown many times, the analyst community is not good at forecasting turning points in cyclical growth and operating leverage catches forecasters offsides in both directions. It was an important revision tailwind into 3Q21, but is now moving in the other direction and when ISM falls into the mid-high 40s will indicate NTM EPS is 10-15% too high — repeating the message from the model above.

The pace and breadth of negative earnings revisions in response to 2Q earnings season would suggest it was not nearly as “good” as many commentators suggest. Taking an axe to profit forecasts in response to a company’s 2Q report is hardly a feel-good story. Growth expectations are falling and Fed tightening expectations are rising – a toxic mix for risk.

From Thrust to Bust

In mid-August, pricing chasing technicians were tripping over each other to tell you about breadth thrusts and 50% retracement of the initial decline. They told us two months and 17% later that June low was the bottom — not really helpful. At precisely that time, overbought markets strongly rejected the falling 200d moving average. Apparently there’s a technical story for everyone.

Mr. Blonde isn’t dismissing the importance of price action or the skill of technicians, but macro conditions are incredibly important in qualifying such price/momentum signals and if growth leading indicators are not improving or you don’t have a genuine change in attitude from central banks then you’re unlikely to have a change in price trend either.

Sometimes a picture is worth 1000 words…

In fact, across markets, S&P 500 (SPX) actually looks the best by a wide margin. Equity markets ex US didn’t even come close to exceeding the local May high and remain distant from a faster falling 200d moving average.

The quality of the move within US markets was equally questionable with a basket of US cyclicals also failing to exceed recent highs or retest 200 day average. For specific examples from specific groups see charts of BKX (banks) or SMH (semis) as important groups failing to lead.

Stay Patient

Bear market rallies are gut wrenching events. The fear of missing out really tickles the weakest part of human brain. We do our best to identify the risk of such evens, like suggested here in mid-June, but chasing markets higher in the face of weakening growth indicators and actively tightening central banks is poor risk management.

Even ‘good’ bad markets typically deliver a few opportunities to buy a bottom. The mid-June event was likely just a warning shot given macro conditions described above. The next couple months are historically the most difficult (here) and now the stage is set for another around of capitulation.

Are you gonna bark all day little doggie or are you gonna bite?

Enough pontificating about markets below are some trades on Mr. Blonde’s radar.

Bad AAPL Seed

Single stock positions/views is not something Mr. Blonde typically spends much time opining on, but in the case of AAPL it has implications for broad markets and could prove to be a good broad market proxy. First, the stock appears to have failed where ‘it should’ if it were going to roll over. For a similar pattern please study the TSLA chart into late March/early April and consider how broad market’s traded Apr-May. Second, the month of September has been a disappointing one for AAPL over the last decade…product launches and all.

AAPL 1mo 25d put implied vol at 33, up from recent low of 25 is on the low end of the range for the last couple of years and low end of the range vs. S&P 500 (SPY). There are worse trades if you think the market is poised for a setback, should it happen it is very likely that AAPL will be an important part of it.

Buy Low for Tight and Slow

Long low beta continues to screen as one of the more attractive opportunities on the screen. This is a style factor that typically performs well when financial conditions are tightening and/or ISM is falling. Both happening together is the toxic combination we have today and supports a defensive position. Put this in the “keep it simple stupid” bucket.

Software > Semis

This pair has been in Mr. Blonde’s book since early January…frustrating to say the least as it continues to flash signs of upturn but refuses to follow through. Sticking with the pair as relative earnings revision breadth turns positive and historically price momentum has followed. As is often the case within markets we see momentum turn positive before you see level move.

That’s all for now. Mr. Blonde is back from the beach and expects to post more often given market conditions. The fundamental review remains the same, but we should expect to start to see some important divergences emerge in the next move lower and as we move into 2023.

If you appreciate this commentary, please like it or leave a comment. If you have a question, please post it in the comment section which allows everyone to benefit from the interaction. Good luck trading your view.

I'm curious how a retail investor (w/options/futures access) might implement the long low beta trade?

thank you for share!