From a tactical trading standpoint, bounce conditions are falling into place. Consistent with 2018 analog that continues to track, some positive divergences as Jan lows retested, hedge fund positioning lighter, and measures of sentiment reaching contrary buy zone. Russia/Ukraine is not unimportant, but it’s a big reason why we are retesting January lows, no?

This doesn’t change Mr. Blonde’s core view of Fed tightening in the face of slowing growth momentum which significantly limits the ability to take directional risk. Just respecting the path of risk and potential for some relief that would likely confuse many at the moment.

2018 Analog

The 2018 analog, first shared in late Jan, now has everyone’s attention, which means it will probably break soon. The pattern suggests some relief before anxiety builds into mid-March FOMC meeting. The Russia/Ukraine story certainly complicates the narrative, but its also a big part of what drove us back down to retest Jan lows.

Trading Tactics

This is not for everyone, risks being ‘too cute’ and even makes Mr. Blonde a little uncomfortable. From tactical trading standpoint, given the 2018 analog, retest of Jan lows with positive divergence on 14d RSI as well as the lower high in front month VIX future and some positioning measures like hedge fund net exposure, Mr. Blonde reduced shorts and bought some short-dated call spreads to play for possibility of bounce into early March.

Small, measured play in the context of bigger picture, less constructive core view. For Mr. Blonde this is more about covering shorts than buying longs.

Sour Sentiment

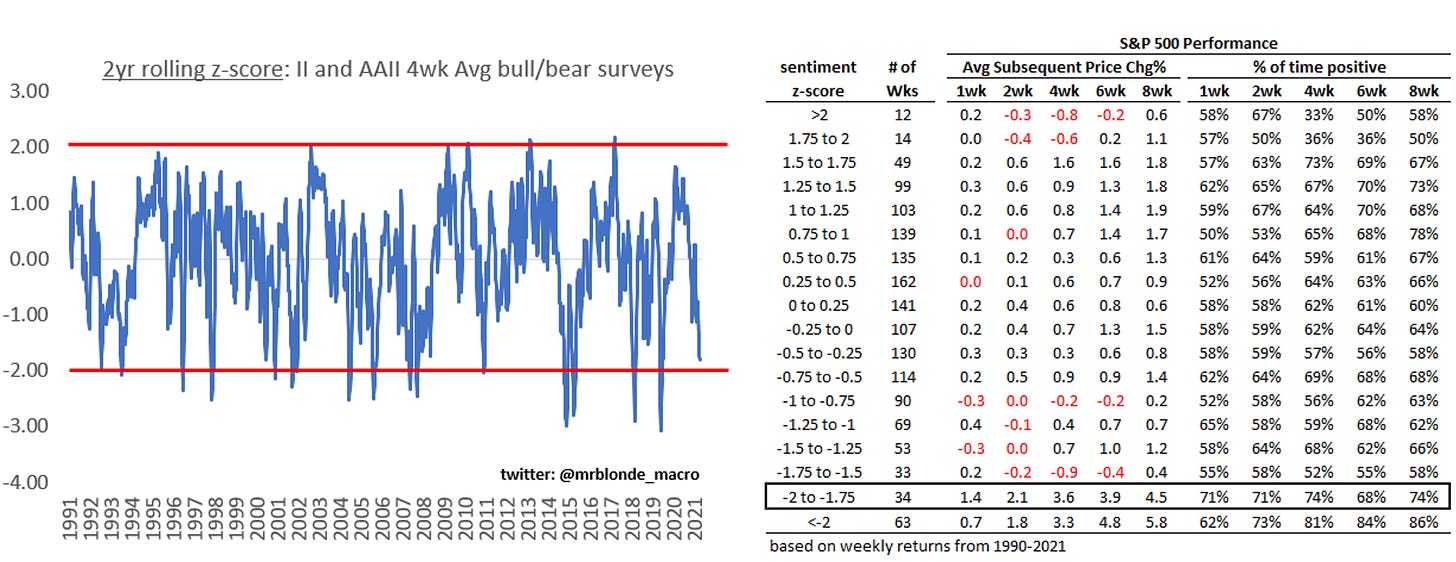

Sentiment is slippery early in a corrective phase because it triggers false positives. It already has been misleading since mid-Dec’21 for those relying on AAII bearish readings. Sentiment readings typically need to reach extremes to deliver subsequent returns that are meaningfully different from average.

Mr. Blonde aggregates AAII and Investor’s Intelligence and normalizes to find that readings <-1.75 start to show some efficacy. -2 would be better, but we can modestly increase net exposure to be positioned for squeeze knowing we won’t catch the precise bottom.

It is quite possible this week given recent events that sentiment readings reach the -2 sigma threshold and coupled with the data points above is more interesting. Also noticeable in the chart below is the deeper declines in sentiment readings in recent years.

Ok, enough of trading tactics. The core view is one that continues to suggest caution and is unattractive for directional risk taking.

Inflation is Kryptonite

Let’s start with historical fact. Every time US y/y inflation has exceeded 5% a recession has been near. The exception is war time periods in the 1940s and the 1951 Korean War. Maybe we will avoid outright recession this time, but is it sensible to expect a growth slowdown given this history? Yes. Is it possible and probable that such a slowdown can ‘feel’ recessionary in some areas? Yes, in Mr. Blonde’s opinion.

Inflation hurts the economy in multiple ways. First, it results in demand destruction as essential goods cost more leaving less spare change to buy discretionary items. Second, it often garners a policy response which raises the cost of capital and further crimps demand. This is not rocket science, Mr. Blonde doesn’t understand why so many want to debate the implications for future growth. US 2y yields have jumped 125bps in the last 6mos which could be considered a ‘shock.’ Maybe it will be ok and digested, but its not without risk.

Stiff Profit Growth Headwinds

Mr. Blonde already outlined the likely cyclical growth slowdown in several recent notes (here, here, here). GDP is not his focus, corporate profits and leading indicators are far more important. In addition to the above observation, consider 2 very simple variables that tend to be critical measures in any profit growth leading indicator: oil prices and credit spreads.

Credit spread widening is a potent form of financial conditions tightening and typically influences both activity and corporate ability to fund projects (at the margin). Similarly, higher oil prices slow activity as more funds are needed to produce the same amount of goods. We can fantasize all the different ways its different this time or we can simply respect 40yrs of historical data…Mr. Blonde prefers the later approach.

Goods as it Gets

It looks increasingly clear we overstimulated demand for what turned out to be a natural disaster rather than a deep, scarring recession that had policy makers crapping their pants. More likely they were trying to distract from their poorly planned shutting down of the economy.

Over a 2yr period there was more real goods consumption than any time in the last 60yrs! This demand is now coming off at the same time inventories are building which puts manufacturing activity at risk. Over ordering, hoarding, over forecasting demand trends are all risks that likely result in too much inventory for the realized growth outcome.

Relevant observation from Absolute Strategy Research noting Global PMI Metal-Users New Orders has fallen below 50 for the first time. Or consider the message coming from y/y CRB Raw Industrial Materials and what it suggests about the future pace of activity. The signs are there for people who want to see them.

Healthy Housing?

Mr. Blonde started shorting homebuilders in early Jan as it was clear what was about to happen to mortgage rates. Almost every day since then people say inventory is low, housing is strong, investors are buying, etc. Some truth to all of that, but it is all known information and doesn’t preclude weakness in the context of an otherwise good trend.

It would be naïve to assume the only driver of home prices is supply. Forever low financing rates have certainly played a role and now moved sharply in the other direction which should at least give housing bulls some pause. Consider the pairwise correlation of home price appreciation across 20 cities. Correlated markets are unhealthy markets and typically reflect a single driver/factor…in this case low financing rates. If housing was “healthy”, wouldn’t we see more differentiation in price movement by region and city?

The sharp rise in mortgage rates is likely to put more pressure on fundamentals and we will see more dispersion, but that means prices will fade and fall in some areas and its likely that activity slows overall. Relax its just a cycle and exactly what we should expect to happen when Fed is tightening policy – don’t fight the fed.

Lower but not Cheaper

Stock prices have fallen in recent weeks but this coincided with widening credit spreads which suggests stocks prices are lower, but not necessarily cheaper. This deserves close attention and is a key input to Mr. Blonde’s equity valuation framework. If credit spreads don’t relax given the tepid profit growth outlook there is little room for equities to be higher. If you are bullish risk, credit looks marginally more attractive to equities given recent moves.

Are you gonna bark all day little doggie or you gonna bite?

Trades and positions Mr. Blonde is focused on.

Defense in Dividends

Mr. Blonde is not all doom and gloom. A large portion of long equity risk rests in S&P 500 dividend futures, specifically the 2023-2025 futures. This has been a recommendation for most of last year with the rationale outlined in more detail here.

If Mr. Blonde is wrong and growth proves more resilient this is a way to capture growth without the likely valuation compression as a result of Fed rate hikes.

Its typical for dividend increases to lag profit growth by a year and we see that recently with a larger % of S&P 500 companies bumping dividend payments by >10%. This supports dividend futures, which remain a form of growth “carry trade” and a way to capitalize on corporate profits.

This is an unexciting carry trade, but one that fits the environment well.

Ugly Contest

What is so exciting about non-US equities? This chart looks terrible and is in a clear downtrend. In what world are non-US equities going up while US equities going down? Hint: none. If you think US equities are a short then there is no reason to not also be short non-US equities. There is no credible scenario where US equities are down in price and broad non-US equities are up. This was a short for Mr. Blonde most of 2021 and still is.

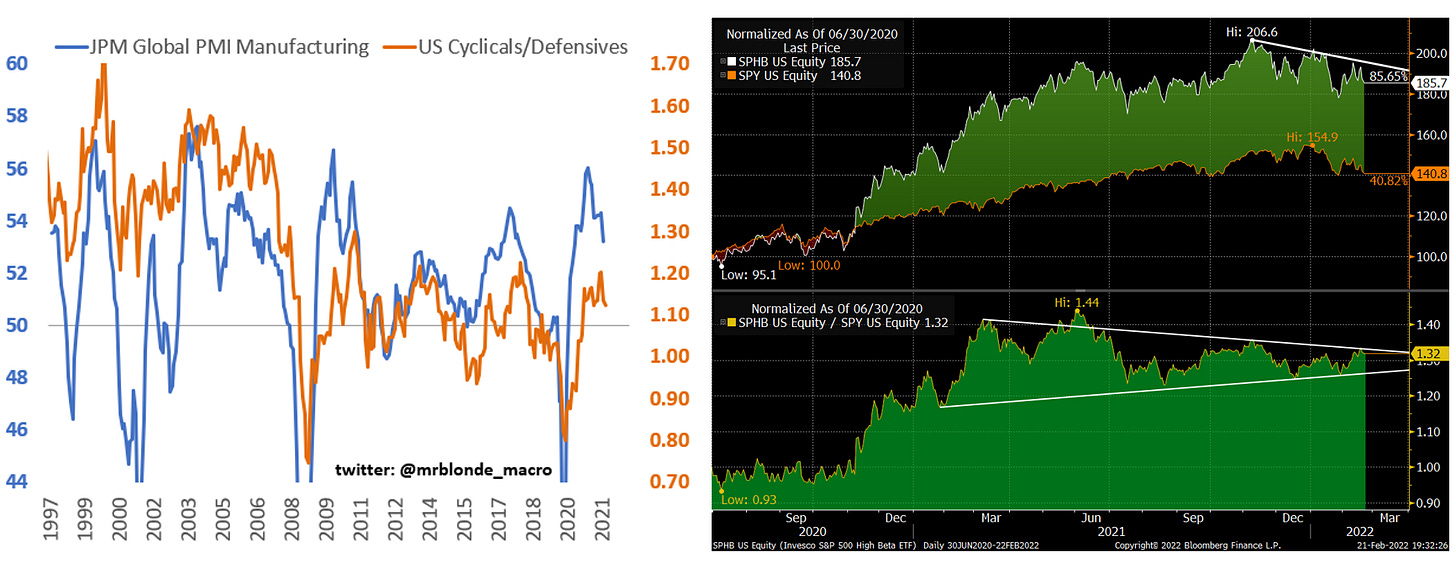

Avoid Cyclicals

Last year was ARKK and XRT, this year high beta cyclicals make up a significant portion of Mr. Blonde’s short book. Both absolute and relative trends look weak and with the likely down trajectory of global PMIs we should expect cyclical market segments to lag. Also, as outlined in “Don’t Fight the Fed” cyclical groups tend to underperform soon after the first Fed tightening.

Good luck trading. Mr. Blonde will follow up later this week with a few long stock screens to keep on the radar in preparation for another leg lower that presents a more durable buying opportunity.

Great article.

These are so good. Thanks mate