From Fed Hikes to Growth Cuts

More signs we are entering the next phase of cycle, stay defensive

Mr. Blonde would like to shake hands with the person that predicted +75bps in 2yr yields and 7% rally in SPX led by growth/tech stocks over the last 20 days. Anticipating that result was key because tech groups were responsible for +60% of the rally in SPX and a reminder its hard to be bullish SPX if you aren’t also positive on tech and growth stocks…especially if banks are sucking wind.

Its not Mr. Blonde’s style to blindly buy yesterday’s price momentum. Of course, price action matters, but it’s equally important to have a view on the macro regime and what you expect from markets in 3-6mos time…otherwise you just end up buying high and selling low (or like many I guess you just only buy and never sell).

In previous notes Mr. Blonde suggested it would be a difficult market for both bulls and bears and a nimble trading mentality was preferred. He should have listened to himself more a few weeks ago and added exposure. Live and learn.

But now SPX rallied 10% off lows, trades at 20x forward p/e and Fed dialed up its hawkish rhetoric and plans. Change is in the air and the market is shifting focus from Fed hikes to growth cuts. Some updated thoughts followed by trades to consider.

Got Growth?

The Macro Growth Composite continues to decelerate and will likely slip into negative territory this year.

The importance of having a cyclical growth framework when facing markets was shared in Growing but Slowing note last year. The bottom line is markets, and importantly market internals, are very sensitive to the trajectory of growth, so having an opinion here helps to define longs and shorts (or areas to avoid if you don’t short…which really is a shame).

Of course, inflation also matters, but historically inflation follows growth. Even during the often-cited 1970s period when growth slowed the momentum in inflation was not far behind. Mr. Blonde’s indicator for inflation momentum showed signs of peaking recently which would be consistent with decelerating y/y inflation into late 2022 and 2023.

Bottom line, it appears markets are entertaining the idea of Fed rate hikes impacting growth which will negatively impact inflation and leave the macro backdrop in a healthier growth/inflation mix. Mr. Blonde certainly agrees rate hikes will impact growth, but less certain the path will be as smooth as markets currently seem to be assuming.

Don’t Fight the Fed…Still

The shift in mentality should not be that surprising, it is common during Fed tightening cycles to experience this evolution. In Don’t Fight the Fed back in December Mr. Blonde offered various market observations around Fed tightening cycles and showed the consistency of increased market volatility and cyclical stock underperformance as the Fed tightens.

Recall this summary table of industry group performance around tightening cycles and now think about what we’ve seen recently in banks, homebuilders, autos and other consumer cyclicals. Don’t fight the Fed and reduce exposure (or short) these groups.

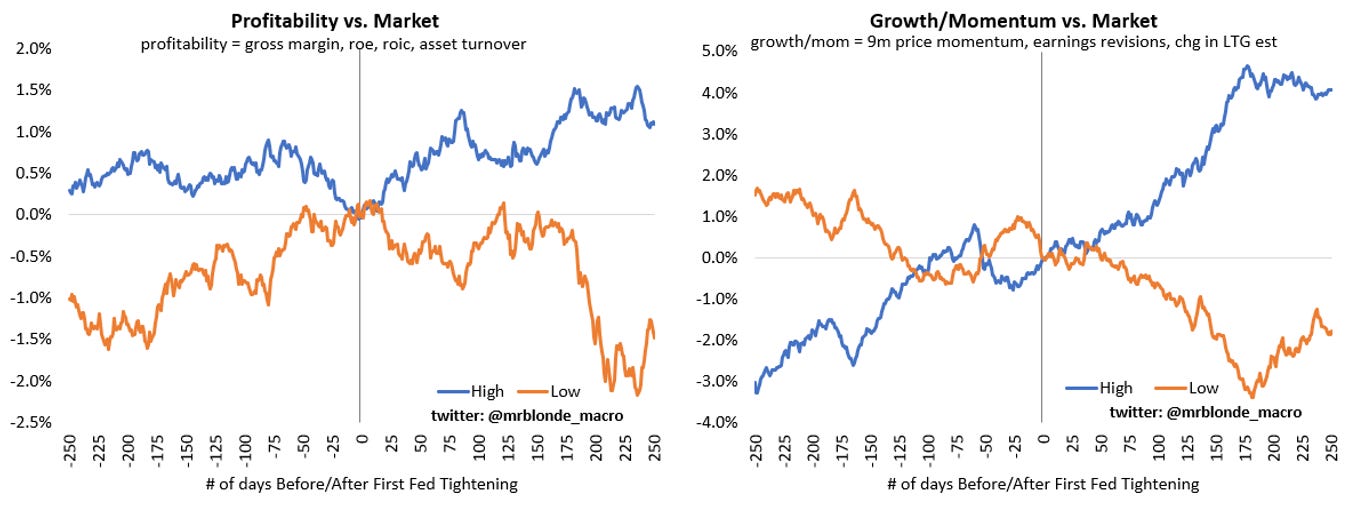

Perhaps more interesting is how style factor preferences change around the start of tightening. One of the more interesting developments in the last month is the re-emergence of Nasdaq outperformance over lower quality, cyclical indices like Russell 2000.

Such a shift is probably not what most are prepared for at this stage given recent performance of deep value, beta, and low(er) quality style factors. As market focus shifts from why the Fed is hiking to the impact of those hikes investor preference shifts towards stocks with profitability, stability and ability to deliver with reduced sensitivity to the cyclical economy. More in the aforementioned note.

Yielding to the Curve

The other big recent event is the first inversion of the 2s10s yield curve. Mr. Blonde doesn’t really care what economists think about the yield curve or its recession predicting prowess. He only cares about what an inverted curve means for market performance in subsequent periods.

This cycle is primarily about inflation, not the Fed electing to slowly normalize policy rates back to some imaginary neutral level. The Fed is forced to defend its inflation credibility and not about taking a victory lap on the level of unemployment rate. Therefore market implications can deviate quite a bit from what many suggest by only studying the last 3-4 rate cycles.

Market takeaway from past 13 yield curve inversions:

periods pre-1985 (inflation driven) were much worse for markets than periods post-1985 (great moderation)

in almost all periods, cyclical growth momentum slowed as evidence by falling ISM Manufacturing

irrespective of medium term equity market performance, credit spreads are almost always wider in the 6mos following yield curve inversion

performance of cyclicals/defensives is mixed, but leans toward favoring defensive groups especially if inflation is the driver of curve inversion (pre-1985)

front end yields pre-1985 often continued to move higher even after inversion and result in even deeper inversion

Mr. Blonde is a little torn on how to trade the above table. Certainly, there are not many traders today that also traded pre-1985, so difficult for them to relate. The knee jerk reaction for many is likely to be the post-1985 market conditions and assumptions. If inflation momentum fades enough that may be the right call for next 6-9mos, but if inflation proves stickier then it will leave many in shock and awe. Base case is to expect markets to trade weaker than the post-1985 episodes given macroeconomic conditions (slowing growth, tighter policy).

Are you gonna bark all day little doggie or are you gonna bite?

Ideas, trades, and position updates from Mr. Blonde

Big Picture

This year, given the points made above, the bias is to fade rallies in broad markets. US markets (S&P 500) are clearly in a much stronger position than non-US (MSCI AC World ex UX) and that will likely continue.

It takes quite a bit to send S&P 500 lower and keep it lower, but as growth slows and cash offers a competitive return it will put downward pressure on valuations and require EPS growth to do the heavy lifting, which Mr. Blonde has already highlighted as a challenge here.

Perhaps more interesting is the changing character within the market in the last month which will be more important for alpha generation in a sideways, difficult, choppy index tape.

Overall, trade focus remains short high beta cyclicals and long defensive growth, high quality parts of the market. For most of the last 3-6mos focus has been on shorts and short alpha given the anticipated environment and opportunity set, but will dedicate time in next couple notes on long risk.

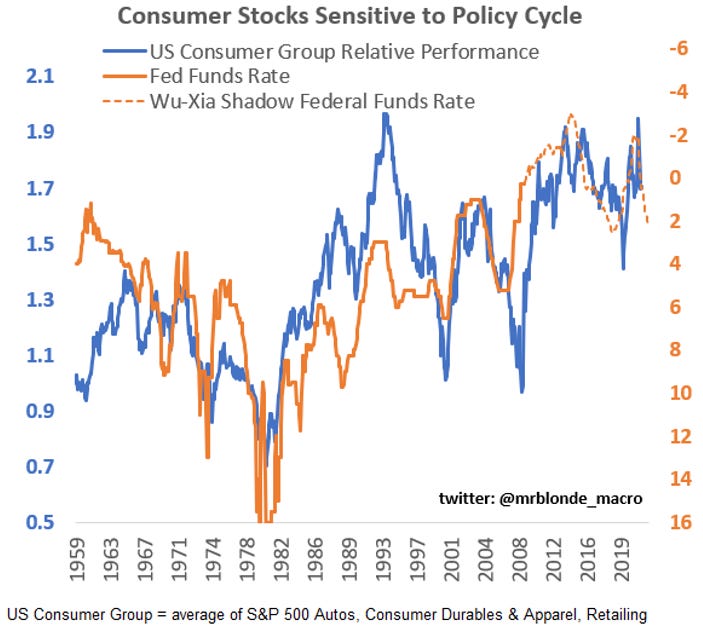

Consumer Cleansing

Mr. Blonde has had a negative view on consumer cyclicals for most of the last year. Throughout that period, he’s been told about strength of US household balance sheet, “excess savings” and how great the environment is for the consumer. Tell it to the judge. In the last 6mos, S&P 500 equal-weight consumer discretionary sector has lagged S&P 500 by ~9.5% and XRT (S&P specialty retail) has lagged by 21%.

Specialty retail (XRT) and homebuilders & construction (ITB) have been my horses in this race and expect both to remain difficult longs as long as the focus is on Fed rate hikes. The combination of higher cost of capital (mortgage rates) and higher food & energy bills are stiff headwinds to discretionary purchasing power.

Housing bulls, of which there are many, continue to site low inventory but equally important to consider how the change in affordability will ripple through the sector. Inventory seems low today, but might not seem so low in 6-9mos when there are far fewer buyers.

Stay short homebuilders and housing construction (ITB, XHB, etc) until mortgage rates stop rising.

Back up the Truck

Hat tip to twitter: @NancyRLazar1 and her excellent, data-driven work on the cycle. Like Mr. Blonde she sees risk of overproduction leading to being over-inventoried at a time when consumer demand for goods is fading. There is no shortage of “stuff” to buy as Nancy’s chart on real retail inventories ex autos makes clear. The risk is far fewer consumers show up to buy and companies are left with excess inventory.

The story late last week from Craig Fuller (@FreightAlley) at Freightwaves corroborates this view and makes pretty clear the risk of cyclical setback: https://www.freightwaves.com/news/just-three-years-after-2019s-trucking-bloodbath-another-one-is-on-the-way

Short truck stocks. Excess inventory will result in fewer orders and less pricing power for trucking sector and dry van rates will fall. The stocks trade with momentum in van rates which have already rolled over with the group near multi-year highs. Transport bulls will be today’s housing bulls in a couple months ;)

Buy Some Bonds

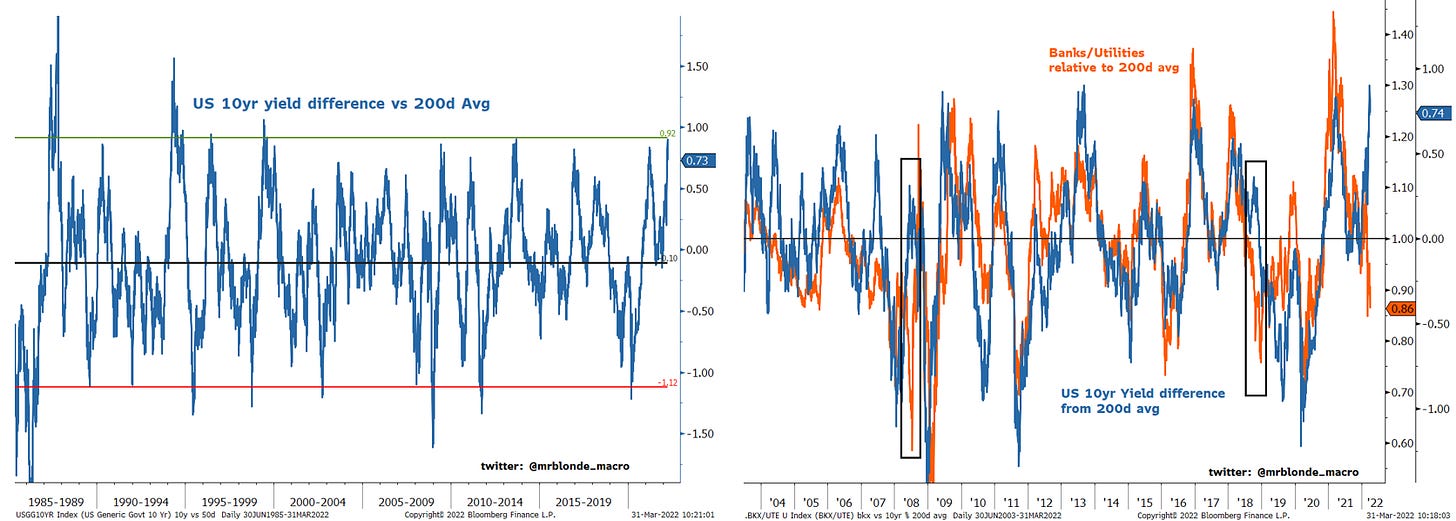

It’s been a few years since Mr. Blonde was long rates, but he started to add long duration exposure. Maybe it only proves to be a trade, but it’s a space that feels unloved at the moment and has reached overbought conditions.

First, notice the divergence between 10yr yield momentum and the Macro Growth Composite in the chart above. Mr. Blonde wants to fade that.

Also important is the message from the “guts of the stock market” that the pace and magnitude of expected Fed rate hikes has met, if not crossed, its limit. Please see the significant divergence from banks/utilities vs. level of 10yr yield as an example – it’s a rare event and it’s not bullish.

Seasonally, bond yields have strong tendency to peak in the March-April time period. Consider last year when arguably the backdrop was extremely favorable for rising yields: growth accelerating, inflation accelerating and the Fed on the verge of turning hawkish. Yet, rates peaked in mid-March and fell 50-65bps. This year, the backdrop is less favorable with growth decelerating (and recession talk increasing), inflation momentum peaking, and the Fed is already max hawkish. By the way…for all the hate on bonds, 30yr yields only 10-15bps above year ago highs.

Mr. Blonde has added Sept TLT call spreads to his portfolio for limited loss exposure to the view that bond yields end up lower and surprise most pundits. He also finds him tactically trading bonds from the long side now…a meaningful change for him.

That’s all for now, thanks for reading. Please comment, like, share if you appreciate the work. Sorry for long space between posts its been a busy period for Mr. Blonde who loves sharing his thoughts but needs to prioritize money making aspects of life first. Look forward to posting more frequently.

Am too old to trade or, more accurately stated, I’ve burnt both hands & feet chasing momentum & timing value over the years.

Long term cycles since I’ve been at this ( mid 80s) always include growth or lack thereof and inflation ( either too hot or too cold). And, you hammered it by using the adage of don’t fit the Fed. It’s a losers game that I can sing a long song about.😏

It dawned on me about 10yrs ago, after losing my shirt & a few other pieces of wardrobe in the 2000 crash that, focusing on high quality growth names that have been around for that past 50-60-70 yrs ( including World War II ) are a pretty good way to sleep & make money over time. Payouts included. You’ll probably laugh when I say Nestle, Lindt u Sprungli here in CH, Estée Lauder, L’Oreal here in EU land, tech names in the US like Microsoft, Google, Apple et cetera and, others just to mention a few still combine double digit compound growth and sport defensive characteristics that just can’t be overlooked.

I like the stuff you do. And read it carefully. Thank you for your Twitter space.

Well written, straight to the points comment as per usual Mr. Blonde. Thank you. I agree with most of the colour, but would also add that I believe shorts should include materials sectors, specifically base metals because of the inventory builds and overall street consensus to the long side as a knee jerk to the current Ukraine situation and longer term look to EV's. Suppose many can't handle the volatility or mark down to portfolios there though. Those shorts pay for the long's in high quality growth in niche areas, like Optical cables. Really hard to see any other sectors that would allow decent sleep over the next 3 months.