From Bad to Worse

More reasons to be concerned and a study of where to focus for stagflation regimes.

Mr. Blonde expected 2022 to be a difficult year for risk taking (outlined here), but it’s gone from bad to worse. Adding a confidence crushing geopolitical event into an environment of slowing cyclical growth and Fed tightening is a toxic set of conditions for risk.

Recent developments only strengthen Mr. Blonde’s conviction in the slowing cyclical growth outlook and even if there is “resolution” in geopolitics there’s a rising risk the damage is already done. Stay defensive and lightly risked.

Bearish Enough?

Using “bearish” sentiment indicators has become popular rationale for being bullish risk assets across social media. Maybe, but sentiment indicators can deliver false positives early in a bearish regime shift and should be considered along side other data rather than on stand alone basis.

For example, Investor’s Intelligence survey last week noted bearish sentiment exceeded bullish sentiment. Is that bullish? Maybe, but it’s discomforting how persistent such readings can be and particularly during the 1970s period of high inflation.

There are times when market participants are not bearish enough.

Bad Breadth

Market breadth and price action remain abysmal. Reminds me of the old Ned Davis advice “don’t fight the fed, don’t fight the tape.” Fed clearly has a tightening bias and the tape is terrible. If you are a short term trade, sure take swings at counter trend bounces, but now is not the time to be taking outsized risk.

The bad breadth and weak momentum is the market’s way of telling us about future weakness. Together they indicate continued negative momentum in earnings revision momentum which is a key fundamental input. When earnings revision momentum is weak/negative you are swimming upstream, it’s not more complicated than that.

Mr. Blonde has already shared his expectation for slowing profit growth this year and rising probability of negative growth in 2023 (here, here, and regularly on his Twitter feed). High, rising oil prices were already a stiff headwind for profit growth and the last 10 days look like the nail in the coffin. What is the credible case for this 40yr relationship to be wrong now?

Selecting for Stagflation

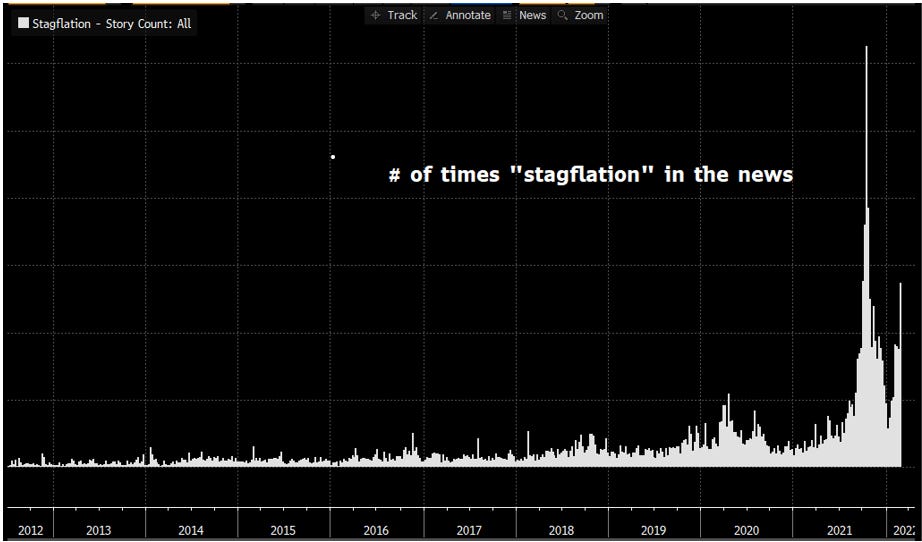

“Stagflation” was on the market’s mind long before the geopolitical spike in commodity prices as shown by a count of Bloomberg news stories using the word. This will reflexively influence investors to seek strategies to protect against such risk, which is among the most challenging regimes for asset markets.

The 1970s are most commonly cited as the stagflation market playbook. Mr. Blonde wouldn’t strongly disagree, but there are important economic differences today with that period. Namely working age population growth, role of labor unions, and debt/GDP all quite different today. Do they matter? No clue that’s for PhD economists to figure out.

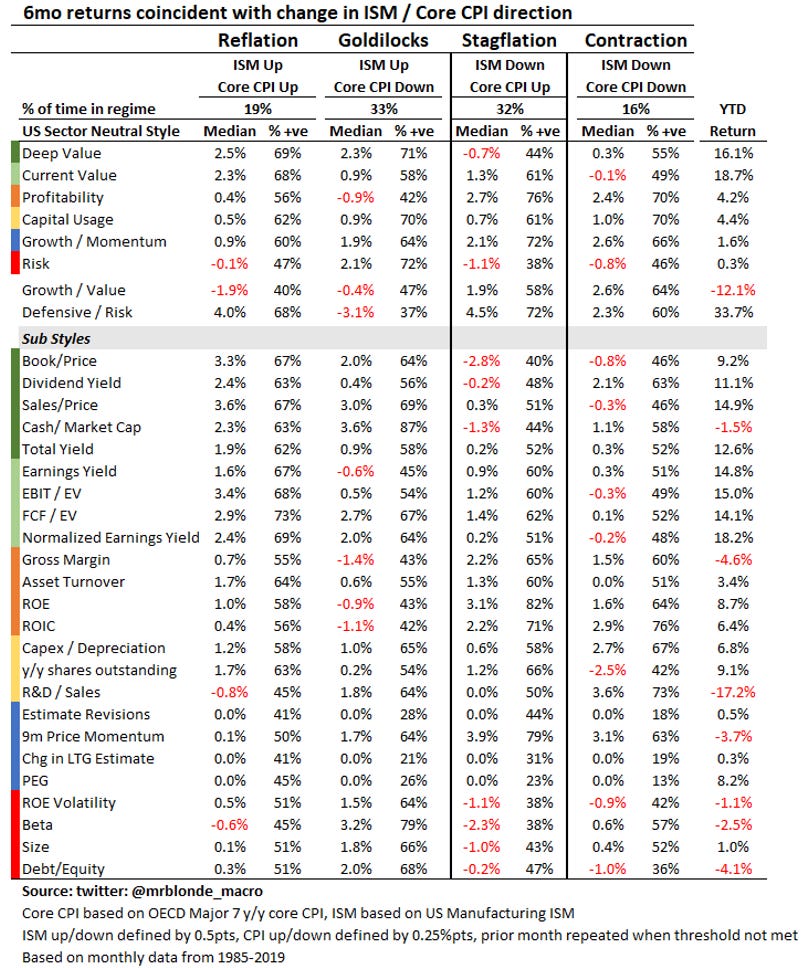

Rather than choose one period of time to define a regime and with hat tip to Morgan Stanley European Equity Strategy team for the idea, Mr. Blonde defined growth & inflation regimes using US Manufacturing PMI and y/y OECD G7 core CPI.

For each regime the prior 6mo change in the variable was considered as rising/falling and market performance measured during the coinciding period. For sectors the data is monthly from 1960, for style factors from 1985. Yes, Mr. Blonde said from 1960…it’s a robust sample size.

This exercise is a roadmap and will not have a 100% hit rate, but its far more robust than choosing one 5yr period in history to make investment decisions.

Sector/Group Takeaways:

First, there are far more cases if ISM down, core CPI up than generally acknowledged with markets in this mode 31% of the time between 1960-2019

Overall market performance is weakest in the stagflation regime with median 6mo S&P 500 % change of just +0.3% and only positive returns 51% of the time.

The best relative performance during “stagflation” periods is found from defensive groups like pharma, health care equipment & services, utilities, food & tobacco, and even software (i.e. defensive tech).

Notable to compare reflation with stagflation to find common performers. Health Care equipment & services, food & tobacco, energy and software tend to outperform in both regimes, while autos and diversified financials struggle in both.

Consumer cyclicals do not like stagflation as evidence by weakness in autos, consumer durables, and retailing. Consumer services (hotels, restaurants, leisure) perform better historically.

Style Factor Takeaways:

A similar amount of time spent in stagflation mode (32% of the time) between 1985-2019

Best sector neutral style factors for stagflation are profitability, growth/momentum and current value, while best to avoid high risk and deep value.

A strategy long defensive factors (profitability, current value, dividend yield) and short risk factors (beta, size, leverage) historically performs quite well. And returns for growth/value improve after trading poorly during “reflation” regime.

Are you gonna bark all day little doggie or you gonna bite?

Ideas, trades, and position updates from Mr. Blonde

Stocks for Stagflation

For stock pickers, the stock list below reflects the types of stocks within each sector that screen favorably for a stagflation regime based on factors that have performed well in the past.

The screen criteria filters for large cap, high profitability, no extreme balance sheet leverage, good growth/momentum with focus on both estimate revisions and price momentum, and reasonable valuations with focus on FCF yield.

The idea here is idea generation. There will absolutely be stocks on this list that have other issues and idiosyncratic drivers that overwhelm whatever macro regime resilience they may have. The hit rate here will not be 100%, but it’s a reasonable starting point for people looking for longs.

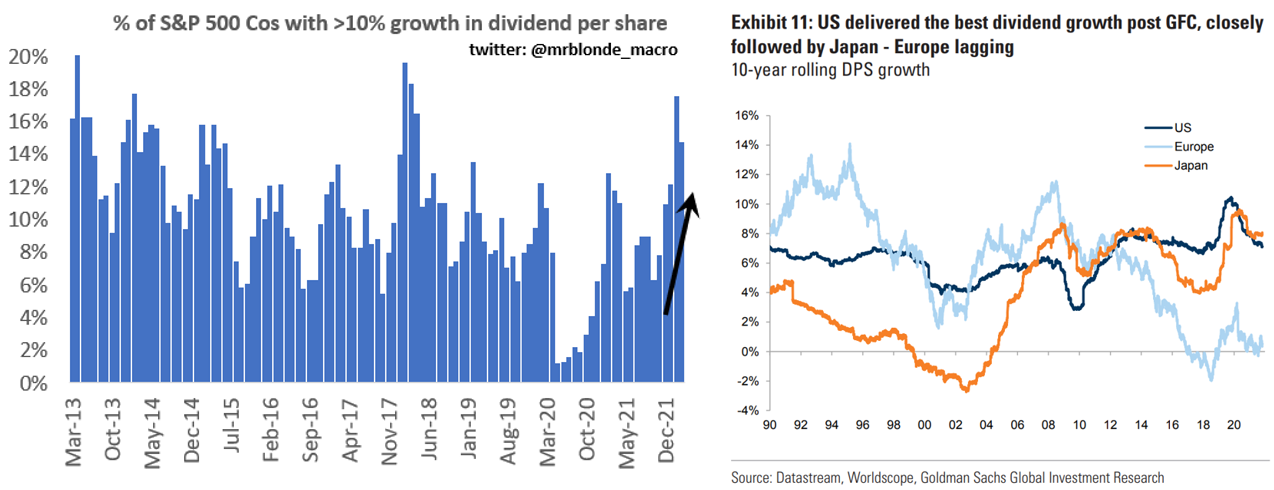

Discount on Dividends

S&P 500 dividend futures is a trade Mr. Blonde recommended, holds and still likes despite the ass kicking it took last week. The US market suffered spillover from significant deleveraging and shift in growth expectations within European dividend futures.

Market technicals are far from good and there is good reason to be cautious on European dividends given recent events, but Mr. Blonde is sticking with his SPX dividend futures position where fundamentals have and should continue to prove more resilient. But given volatile environment, exposure will remain in the very front part of the curve (i.e. 2022-2023) and added a little to 2022 last week.

More context for the view on dividend futures here and here.

Avoid Cyclicals…Still

Consistent with the regime work above and prior posts, Mr. Blonde continues to use cyclical groups on the short side and favor longs in defensive groups. Shorting high beta, high volatility cyclical groups can work even if S&P 500 does not fall much. For Mr. Blonde shorts in SPHB, XRT, and ACWX remain a significant part of the short book.

Recall relative to other indices and non-US markets S&P 500 carries a lot less “net” cyclicality.

Software over Semis

Software over Semis is a pair Mr. Blonde mentioned a few weeks ago (here) and still favors. When market conditions exhibit high levels of volatility and uncertainty its often best to reduce style and sector risks in pair trades to avoid unintended bets.

This pair trade within tech historically works well when cyclical growth momentum is fading and the significant deleveraging and derating of the software sector allows for mean reversion as well. Software, as a group, also exhibits the style characteristics that historically outperform during stagflation regimes (i.e. profitability, growth/momentum, stability, low/no leverage).

Hope you appreciate the content. If you find it insightful please comment and share as the feedback is important to Mr. Blonde. If something is not clear, post a comment with a question, Mr. Blonde doesn’t bite.

Only been reading your comments for a few weeks Mr Blonde, and I'll say these short and direct pieces are better than 99% of the sell side research and Macro musing I read at work. Appreciate the content, even if don't agree with all of it. Impressive.

ETSY

MSFT

L’O

EL

NESN

LISN

Geopolitics. Slowing growth. 2nd & 3rd order consequences from 1st level decisions taken. Unknown unknowns in addition to inflation relative to CB’s bad judgment over past 10-15 yrs.

What could be worse ? Hot war? Not too far away.

Add it all up & most independent thinking investors should have & must today position themselves for another 20% downside or worse.

Meaning if in the best of scenarios, one survives Mosul/Aleppo urban warfare in Kiev factored 2/3x.

Maybe.

Then, looking at the most high quality conservative growth names that will survive this 2022/23 onslaught are the new safe havens.

Ditto - CHF won’t do too badly either but nobody really cares.