Testing Times

Risk markets are retesting June lows and will test conviction

Markets are retesting, and in several cases breaking June lows. Given recent selling pressure, SPX down 5 of last 6 weeks, and short-term sentiment and positioning that comes with such environments it wouldn’t be surprising if we had a couple up days, but macro conditions do not support a durable up move and several indications suggest new lows are more likely.

No change in fundamental/market view held from the start of the year – Fed is hiking into a cyclical growth slowdown making for unfavorable risk-taking conditions. 2023 growth expectations are too high, but could be reset come 3Q earnings season and the Fed is now telling us they expect and accept recession. More downside needed to reach capitulation and seasonals still weak.

“Don’t fight the Fed, don’t fight the tape.” -Marty Zweig (w/ regular reminders from Ned Davis)

A few charts and observations:

The Retest

While equity indices are retesting June lows, Mr. Blonde would argue macro conditions are worse today than they were then.

The sharp repricing in real yields while breakevens decline historically is a pressure point for risk asset valuations. On this measure, a new low in forward p/e is likely hence a new low in index price.

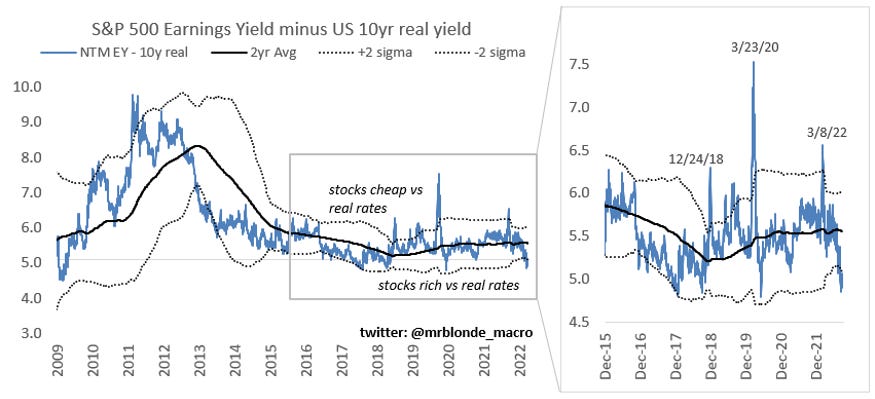

Viewed differently earnings yield vs. 10yr real yield spread sits near 5yr lows and -2 sigma vs. rolling 2yr average. Without a material change in real yields from here its unlikely there will be a durable rally in risk assets. So far, much of he weakness in risk assets is just a repricing of real rates (i.e. valuation adjustment more than EPS adjustment).

Earnings revision momentum is worse today than at the mid-June low. At that time, the bullish view could point to earnings expectations holding up ok, but since then analysts have marked estimates down – particularly during 2Q reporting season. We heard from FDX as well as several chemical companies there’s been a notable shift in activity.

CRB Raw Industrial Materials is one of Mr. Blonde’s preferred measures of real time activity. A basket of obscure commodities that are used to make ‘stuff’ and not widely traded on exchanges. The price shift in these commodities is mostly likely a result of demand changes.

We are experiencing one of the sharpest tightening of financial conditions (FCI) in the last 40yrs…most of which didn’t start tightening until 2Q22. The cumulative and lagged effects of FCI tightening suggest the majority of growth impact is in front of us. Some important signs are already visible specifically housing activity (i.e. new home sales)…not a small part of US economy.

MSCI AC World ex US peaked in early 2021, which was an early sign of what was coming down the pipeline. It has continued to act as a guide for S&P 500 as weak links continue to feel pressure. New lows here join new lows in Eurostoxx, EEM, semis, transports, oil, HYG, etc. Bottom line, new SPX lows look likely.

From seasonal perspective, weakness usually persists into mid-Oct just before 3Q reporting season begins (i.e. JPM reports on 10/14).

Caution More Than Capitulation

S&P 500 is down 5 of the last 6 weeks, -14.2% off of mid-August highs, and retesting the mid-June low. This is a natural spot for a bounce, but one Mr. Blonde expects to be short lived and shallow. In order to get June level capitulation (-3 reading), we need SPX ~3200, +80% of stocks 20% off 52wk highs, and +30% stocks 40% off 52wk highs.

Not Your Father’s Fed

Fed forecasts are not a big part of Mr. Blonde’s framework, but the Fed’s attitude is an important consideration. Perhaps one of the biggest changes from the last 30yrs is the Fed now expects and accepts recession conditions in their forecast. This has important consideration for present and future risk taking. Unlike past periods when growth data shows signs of weakening there will be no life preservers thrown by the Fed…you’re on your own. Add this Fed attitude to what’s already been a ‘fast’ rate hike cycle where the odds of recession are higher. Review this post for past Fed rate hike cycles.

In a past post (here), we outlined the earnings risk that occurs around US recession periods. The chart below plots average S&P 500 performance around NBER declared recessions (only known in hindsight). Many have suggested current economic data makes clear a US recession has not yet started. This is a bearish proclamation given risk doesn’t usually trough until after a recession begins.

Bottom line, the bulk of market correction to date has been in response to rapid shift in cost of capital and correcting peak valuations. Recession risk very much remains and history suggests THE low doesn’t come until after the recession begins.

From Fed Hikes to Growth Cuts

An important, recent development is internal equity price action that suggests even wider credit spreads. This is the natural ‘next phase’ in the cycle when the speed and scope of tightening now starts to inflect some real pain. Weak balance sheet companies were performing ok, actually outperforming, into June/July period despite credit spread widening, but this has changed and should be monitored closely. Its been a while since we’ve heard the word contagion.

Just a brief note in response to recent market volatility. No change in view, stay defensive (whatever that means for your strategy) and use risk rallies to fade rather than chase.

Will follow up later this week with a few ideas to consider in light of difficult market conditions. Good luck trading your view.

Always great material to read. Thank you for the time you put in to create content like this.

Dear Mr. Blonde, thank you for the excellent economic analysis. Currently, the yield of the U.S. 10 Year Treasury 3.97% p.a. In your opinion, is the peak in sight? I expected the strong USD to be anti-inflationary and yields would not rise as much. Thank you!