Stocks were up last week in what felt like a continuation from the mid-June low and position squaring into earnings season. Many suggest positive stock prices are a reflection of earnings season as they selectively choose headlines to fit their view. Its too soon to say anything definitive about earnings season, but it’s a touch softer than average when evaluated across a number of metrics. A lot to digest this week though with ~50% of S&P 500 market cap reporting and the Fed likely delivering another 75bps rate hike in the face of recession like PMI prints.

A few, early, earnings season charts:

It’s common for the early part of earnings season to be equity friendly with first week returns typically the best and fading as the season progresses.

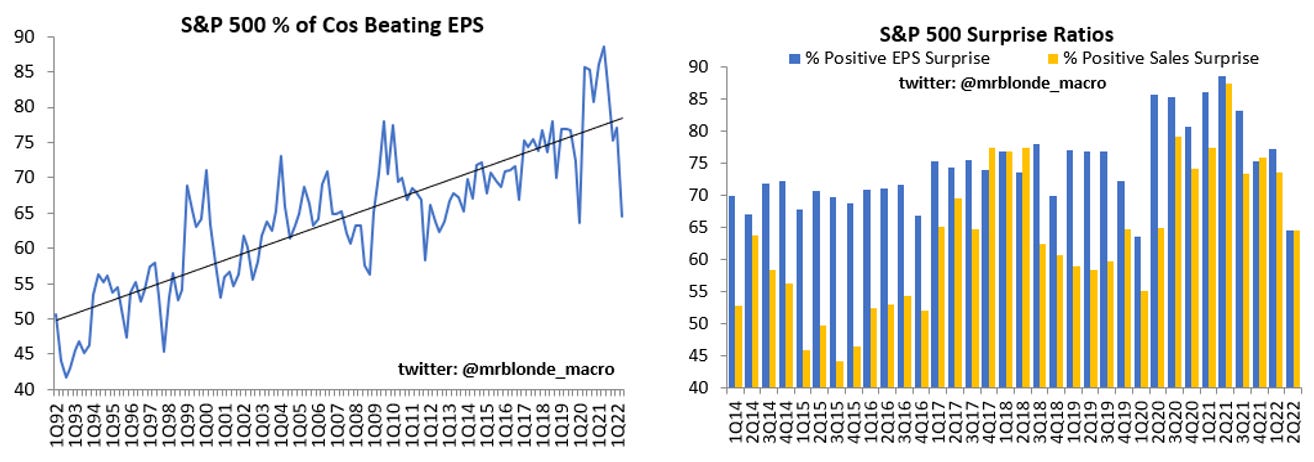

Mr. Blonde can’t think of a more meaningless statistic from CNBC talking head than “% of companies beating EPS” as if beating by 1c on $3 estimate even means anything. The chart history makes clear beating EPS isn’t what it used to be if everyone is doing it. It is now more notable when >70% of companies don’t beat lowered EPS. There is a bit more variance in harder to manipulate sales surprise, which is also running well below recent quarter trends.

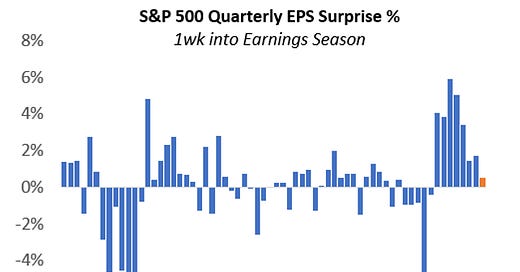

A study of EPS surprise % (actual vs. estimate beat %) shows the smallest magnitude beat for first week of earnings season since mid-2020. Fading earnings momentum is an early sign of weakness.

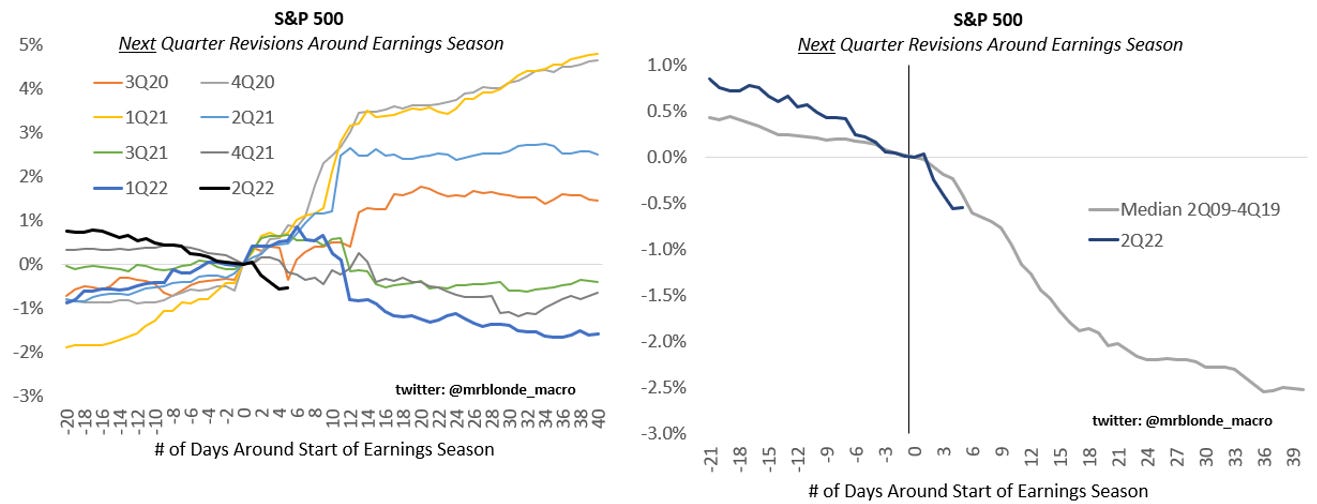

One of the best ways to judge the quality of earnings season is evaluate how estimates in subsequent periods change as analysts digest the message from management. Its not uncommon for negative revisions to the subsequent quarter during earnings season, but slope of negative revisions for next quarter has steepened.

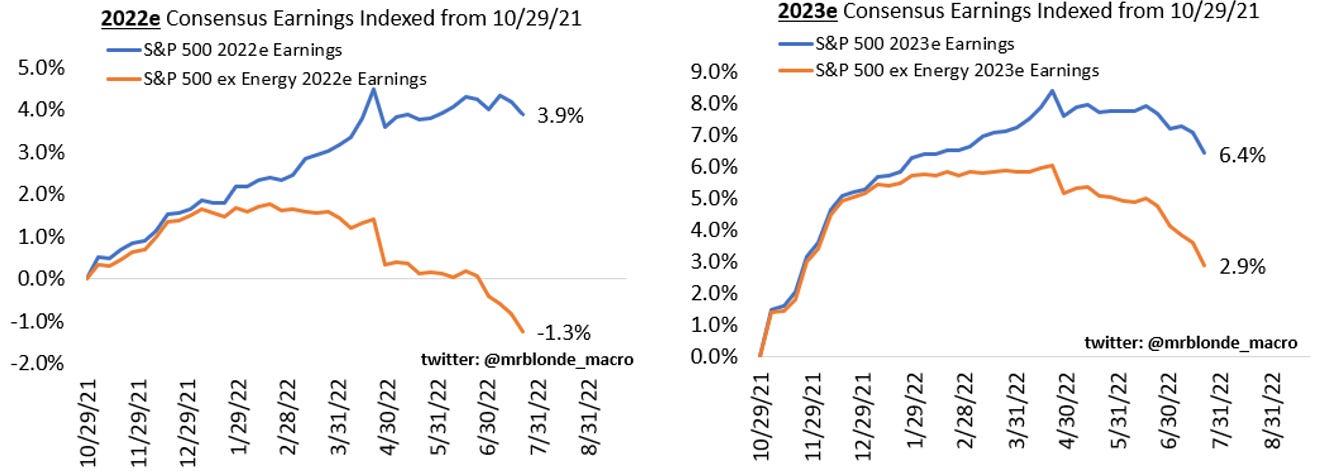

Negative revisions are not isolated to the next quarter with both 2022 and 2023 estimates coming down, especially when excluding the energy sector. However, even energy is likely to be a drag now with oil prices more than 20% off of highs.

During earnings season its useful to monitor 1mo revision trends which encompass the period around and during reporting season. See below, but it’s a sea of red.

Perhaps one of the most comprehensive ways to judge earnings season is by broadly studying stock price reaction to reports after dispersion adjusting results. Big misses (i.e. >-2 sigma) have been hit harder than big beats are rewarded. This is not uncommon but the gap has widened in recent quarters and continues in 2Q22 so far.

The above stats will change after this week given the number and size of companies reporting. Mr. Blonde’s bias for disappointing results remains and recent data trends are now clearly confirming a weak profit outlook he flagged in 4Q21. Unfortunately it will get worse before it gets better.

In addition to the pressure coming from tighter financial conditions and rising business costs, its important to consider how far above trend EPS is coming into 2022. The backdrop is unlike profit growth slowdowns from 2010-2018 which were far less extended. The higher the rise, the harder the fall is a risk as many companies are over earned. The extension of NTM (next 12mo) EPS above trend also makes it difficult to be confident in valuation based on this figure.

Bottom line, future estimates are untrustworthy at best during periods of significant negative revisions. And as mentioned here in the past falling NTM EPS is a rare event and results in stiff headwind for equities to overcome.

The stats above are for the US, which remains the most important and profitable region in the world by a country mile. Rest of world, particularly Europe and EM, have failed to generate any meaningful earnings growth in over a decade and its unlikely to change in current backdrop. The PMI cycle hurts global profit growth, but historically impacts cyclical geographies with greater force. So remember when they tell you to buy non-US because its “cheap”…you get what you pay for.

That’s all for now. Still on track for stiff fundamental headwinds that significantly limit equity upside and serve to significantly limit scope and duration of equity rallies.

Great work. Thank you. Feels like the fed rhetoric Wednesday will be a summer sentiment driver.

Reported earnings and "Estimates" can both become quite a farce. Particularly when reporting companies cease providing their own guidance and leave unplugged analysts who fear being wrong in public. Sales $s, as you note, may be the least manipulatable. Excellent piece, thank you for sharing!