Repressed and Impressed

Equity valuation thoughts and a trade to avoid valuation compression risk

Markets bounced harder than Mr. Blonde expected in October, particularly the recent short squeeze in low quality, high beta exacerbated by hedge fund gross exposure position reduction and another speculative frenzy among retail apes.

Negative real rates continue to financially repress investors that require positive return on assets. Investors are faced with difficult decisions in an “everything is expensive” market which has been an important support for equities. At least equities offer the chance at positive real return.

Equity valuation is rich, but not more expensive than credit as long as profit growth is positive. But with inflation pressuring central banks and tight credit spreads the risk to equity valuations are rising at a time when profit growth slowing. Mr. Blonde likes SPX dividend futures as a way to be long fundamental growth (with inflation protection) while avoiding rate driven valuation compression.

Repressed and Impressed

The big picture view is little changed: US equities are the best house in a bad neighborhood. Central bank induced financial repression at this scale is a live experiment and we are the lab monkeys (or “apes”). There is a lot not to like about it, but complaining won’t make us any money.

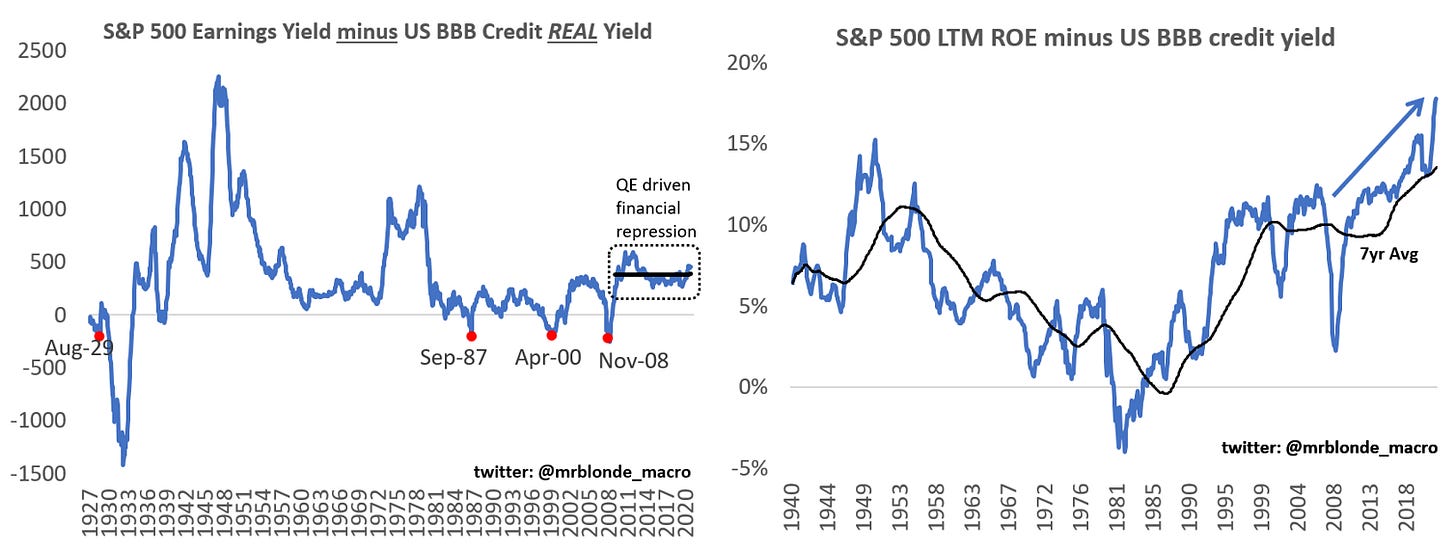

There is a lot of misplaced equity bubble talk…the bubble is further up the capital structure and equity valuation is just being pulled along. The valuation pull is happening during a period of robust profit growth, particularly in the US. In fact, when evaluating return on equity vs. return on debt the widening gap tells an impressive story and has valuation implications (think ROIC-WACC spread).

Bottom line, if central banks are able to suppress rates and corporate continue to growth than stock prices will rise. It’s just corporate finance math and not that complicated, but it does favor sectors and companies where confidence in profitability is stable and higher (i.e. US, high quality growth compounders, etc).

Connecting the Dots

Mr. Blonde’s SPX valuation framework highlights the interaction and explains well why SPX is 4700. By capitalizing NTM EPS by the cost of capital (US BBB yield + dividend yield) we can approximate SPX “fair value.” See the chart for how this model tracked in the last decade – a good guide.

Current consensus EPS is ~220 and US cash BBB yield is 2.5% with 5yr average dividend yield of ~2% we approximate cost of capital at 4.5%. At face value, it suggests SPX 5000, though SPX has traded ~8% below this fair value on average over the last decade.

Point being, SPX price is not as ludicrous as some would have you believe. It also highlights how important the level of rates has become for equity markets. The idea that US 10yr can trade to 4% without it being a problem for equities is nonsense without robust earnings growth at the same time. For context, if rates +100bps (assuming spreads unchanged) we need 15% earnings growth just to keep stocks flat.

Good Enough Growth?

As the above framework outlines there are two primary drivers for equity market returns: cost of capital (rates) and earnings growth. Both would appear to be moving in slightly less favorable direction over the next 6-12mos.

Earnings growth is likely to decelerate over next 12mos both organically and exacerbated by tax policy.

The strongest market moves come from surprises and empirically the strongest positive earnings surprises come during environments of high/rising manufacturing PMI. Despite recent price action in markets there is growing evidence that PMIs peaked and will fall most of next year. Everyone cheering the easing of supply chains, but perhaps a flood of inventory won’t be welcomed by markets even if it makes for good GDP math. Last time I checked we don’t trade GDP futures.

Giving Mr. Blonde confidence is his leading indicator of US earnings growth. The multi-factor macro model of future profit growth is out of sample from 2006 and has a strong track record an identifying profit growth turning points.

The outlook confirms the “growing but slowing” outlook, but important to keep in mind a few factors not captured that can negatively impact the outlook. First, there is not direct input for fiscal impulse and next year brings a big negative shift. Second, there is no input for tax policy and, while statutory tax rate seems unlikely to rise, effective tax rates likely will. Third, China remains a key source of global growth and can be a source of growth weakness into 1H22.

Bottom line, S&P 500 growth forecasts in 2022 seem reasonable with downside bias, but not currently enough evidence at this stage to suggest downside is material.

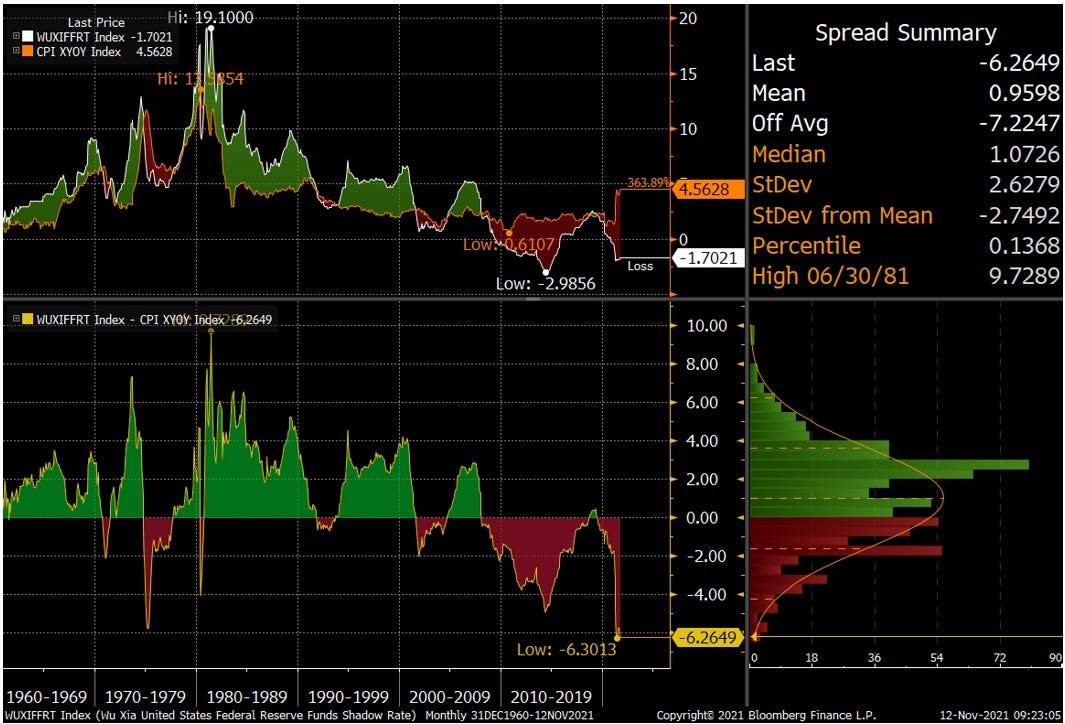

Rate Driven Re-rating

So, in the near-term equity markets are more likely to be influenced by the cost of capital channel (i.e. P/E). Should rates stay low and real rates deep in negative territory? It’s hard to imagine rates can become more favorable with level of 5y5y real rates resting firmly below 0% and real shadow fed funds rate below -5%. Even if y/y core CPI reverts to target the amount of monetary accommodation will remain near 50yr levels of easiness.

How rates progress in 2022 will be a key market debate. It’s not a stretch to assume valuation compression as Fed tapers QE and timing of rate hikes nears. Not to mention rate hikes happening in other parts of the world. During the 2014 tapering period, the shadow fed funds rate increased 275bps before the first nominal rate hike and put downward pressure on market valuation.

Mr. Blonde thinks 22x forward p/e (4.5% earnings yield) should act as a firm valuation ceiling in a backdrop of decelerating profit growth, sticky inflation trends and less comfortable monetary policy environment. But as always, valuation is in the eyes of the beholder leaving a wide range of opinions.

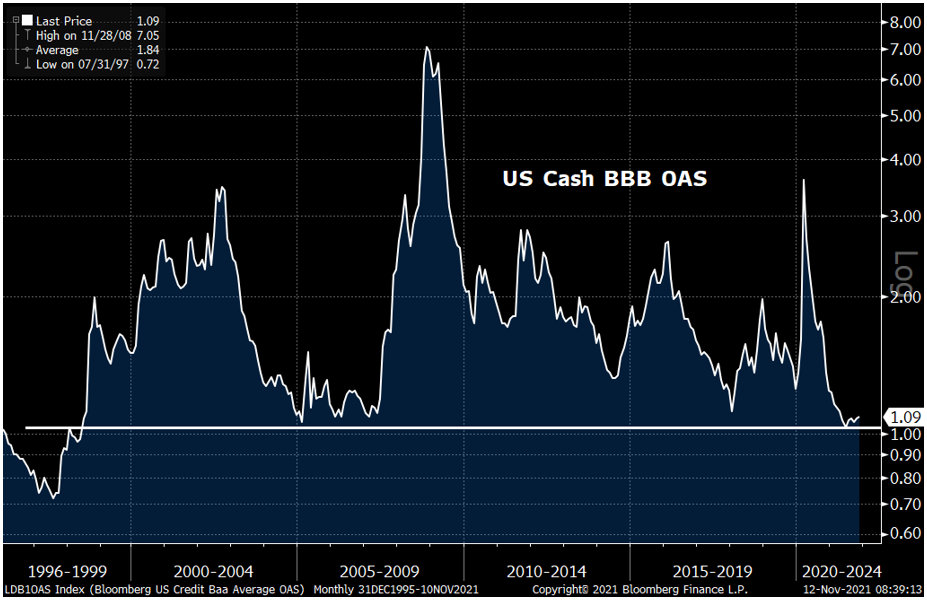

Complicating matters is US BBB corporate credit spreads at 20yr tights at the same time policy rates are 0% and yield curves are flat. This is a massive tailwind for equity valuations, particularly among its most profitable components (i.e. think ROIC-WACC spread). But with spreads at tights, there is no room for spread compression when rates need to rise. Everything is duration in the everything bubble.

Are you gonna bark all day little doggie or you gonna bite?

S&P 500 dividend futures represent an attractive way to be long equities in a lower beta instrument that does not carry the risk of policy rate driven valuation compression and historically has performed better than inflation.

This trade is not for everyone, will require a futures account and has some trading liquidity constraints for institutional accounts. That said, Mr. Blonde sees it as a great alternative to vanilla equity exposure and it represents a meaningful portion of his equity risk.

The thesis is unchanged from early this year and remains attractively priced: robust earnings growth, but risk of multiple compression as Fed policy normalizes in response to inflation and economic recovery. Over the last year SPX dividend futures for 2022-2025 all performed well delivering >20% returns before considering leverage and with less volatility.

The outlook for the next 6-12mos is actually quite similar. In a market where “everything is expensive” SPX dividend futures are one area cheap relative to current and expected fundamentals.

Consider chart(s) below courtesy of GS, but implied 10yr dividend growth for S&P 500 is ~+2% vs. realized US dividend growth of 6-8% annualized over the last decade.

Mr. Blonde won’t cover Europe dividend futures in this note, but this chart highlights why they are a poor instrument. Europe doesn’t grow earnings (or dividends) like the US. Also note the stability of dividend growth historically.

Further supporting the position in the current environment is its inflation protection attributes. Over rolling 5yr periods historically, S&P 500 dividend growth exceeded headline US CPI growth nearly 70% of the time. Alternatively, you can judge by decade to see dividend growth exceeds CPI growth in 8 of the last 10 decades. It lagged in the 1970s, but did better than index prices and delivered >3x the return of S&P 500 index.

Here is what Mr. Blonde expects from this trade. These forecasts are precisely wrong, but directionally correct and there appears to be enough upside to leave margin of error. The expected returns from dividend futures exceed what Mr. Blonde expects S&P 500 index to deliver over the next couple years as valuations normalize.

The primary risk to the dividend future trade is technical in nature. As a result of global structured note issuance, there is a meaningful technical supply of dividends in the market. To hedge, dealers need to sell dividends, depressing implied dividend levels – and that hedging need grows as equities fall. No good trade is without risk, in this case the depressed price of dividend futures compensate for taking that risk in Mr. Blonde’s opinion.

There is also the risk of double dip style recession challenging the ability of corporates to pay dividends. Added confidence comes from the low dividend payout ratio of S&P 500 and significant cash position of corporates.

Finally, the contribution to dividends can differ meaningfully from contribution to S&P 500 market cap. While Tech remains the largest contributor to index dividends paid, it is substantially less than its market cap weight. Bottom line, long SPX dividend futures is a way to be long corporate fundamentals and short (or unexposed) to sentiment (i.e. valuation).

Excellent post as always, Thanks. As fed steps in normalizing its policy with inflation coming and pressures from pretty much everywhere mounting, do you have a ballpark figure for 10yr at year end or maybe next year?

Great minds think alike - i love the the dividend futures idea and have a position. In a true inflationary scenario the out years are quite cheap. Further, the threat of a stock buyback tax from DC could shift some shareholder payouts into dividends.