Before reading diving into the charts, please consider listening to the conversation with my friend @MacroAlf last week. The conversation will compliment some of the charts and thoughts below.

We now return to our regularly scheduled program…

This time last year, Mr. Blonde warned the Fed was embarking on a rate hike cycle into a cyclical growth slowdown and the dual tightening of financial conditions would prove to be a significant challenge to risk markets of varying type. This year has been nothing short of difficult and is poised to stay that way for the time being.

The next phase is likely to be about corporate profit expectations. People will dismiss Fedex (FDX) as poor execution or management issue, but that is exactly what happens in weak growth, difficult times — low quality weaknesses are exposed. Expect more into 3Q reporting season.

Goodbye TINA

There have been some good news developments, like more signs of peaking y/y inflation momentum, but this is not the only risk factor facing markets. Central banks tightening into slowing cyclical growth and likely profit recession is a significant headwind for risky assets. The spread between what’s earned in risky assets and what’s earned in 0% volatility liquid cash is approaching 25yr tights. Goodbye TINA.

US 1yr Treasury yields offer ~4% nominal. Seems we are getting paid to wait for better days. Please don’t talk to me about the inflation protection from equities in a year when CPI is +9% and SPX is -13%. It might be a consideration in the long run, but is meaningless concept in the near term.

Even if you are optimistic about growth and the ability of global economy to digest significant financial conditions tightening you no longer need to be 100% invested in risky, less liquid, assets when you get a competitive return from risk free cash. This should not be a controversial view.

Burning at Both Ends

Equity markets face two stiff headwinds. When the central bank is tightening into a cyclical growth slowdown you are raising the cost of capital at the same time profit growth is fading or worse — both forms of tightening financial conditions.

The short hand valuation model Mr. Blonde uses to guide his risk view highlights the headwind. You can choose your own adventure in the table, but in order to get to SPX 4000 you need some pretty lofty expectations given current conditions.

Yield Curve

The recession debate has been a topic for much of 2022, particularly post April. There remains a large cohort that believes in soft landing despite record FCI tightening and surge in energy prices (and other demand destruction inflation). Some will tell you not to worry about yield curve inversion because a recession is still 12mos away. Good luck with that logic.

Also, as we’ve already been taught this year, it is critically important to extend our empirical analysis beyond 2000 or beyond favorable macro periods from 1990. A simple study of yield curve inversions back to 1960 makes clear the need for caution. Is today more like the 1970-80s or 2000s? Macro regimes matter and including as many as possible improves understanding and the empirical probabilities used.

Bottom line, relevant history (i.e. pre-1990) suggests we should be worried about the message from the yield curve NOW.

Seasonals Stink

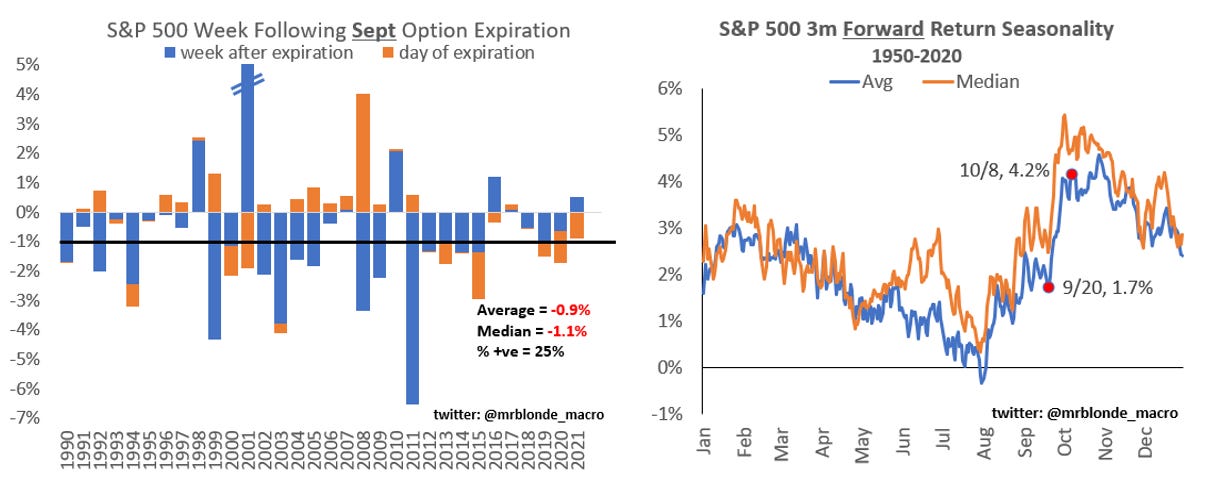

Mr. Blonde is a probabilistic thinker and channeling his inner PTJ seasonality plays a role. We can debate why or how much, but certain times of the year tend to be less favorable than others. You can say “it’s different this time” or you can respect market’s psychological tendencies.

The week following Sept expiration is historically the worst week, on average, of the calendar year. This has largely held true in recent times, but we’ve seen more of the bad performance occur on day of expiration. Forewarned is forearmed.

Beyond short term tactics, seasonality does improve as we move into mid-Oct, but has suggested in previous notes that improvement is largely born from weakness first.

Sentiment Sideshow

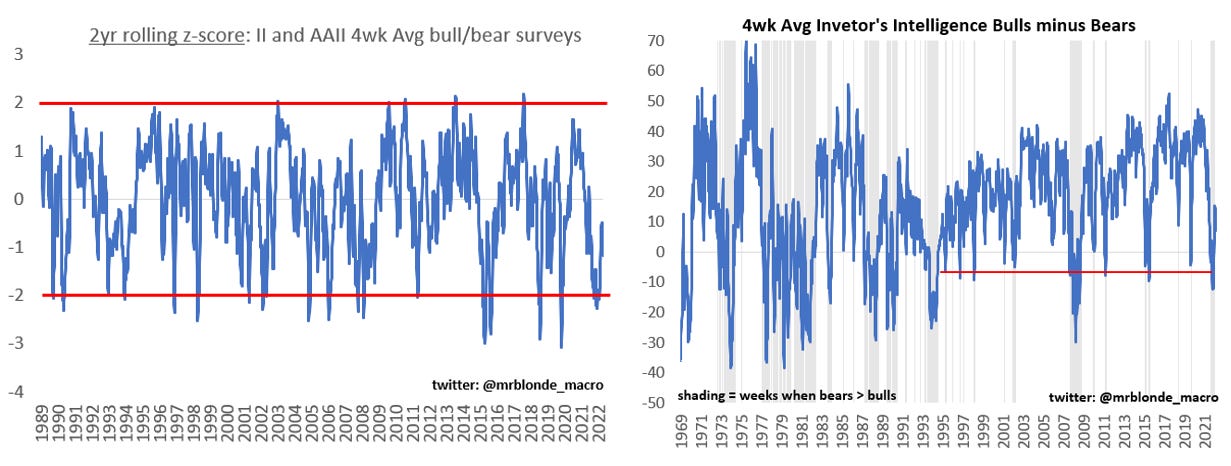

Literally since the first dip in January people have been citing bearish AAII sentiment as a reason to buy stocks. Of course investor psychology matters, but it often is more important in calm bull markets rather than environments with significant macro issues that need resolving. Sentiment also tends to be a conditional factor and requires good news to trigger its relevance as a contrarian indicator.

Mr. Blonde doesn’t see sentiment at a bearish extreme. A rolling 2yr z-score of sentiment surveys is not as depressed as it was in mid-June and its important to consider how long sentiment stayed depressed during difficult macro period in the 70s-80s. Maybe it won’t be the same, but its certainly more relevant to consider that as a possibility than to only use sentiment measures from 1990 (or 2000) to evaluate the range of possibilities.

Finally, when people float charts of 15yr manager surveys to suggest everyone is bearish and underweight equities, it probably makes sense to consider whether an underweight is actually a legitimate consideration given 4% 1yr Treasury yields as discussed above.

Bear Rallies

Recall the bear market rally table shared earlier this year. In mid-August in the midst of “breadth thrust” excitement many suggested the rally was too long and too large to be a bear rally. Who knows. Bear rallies come in various shapes and sizes and there are already many unique aspects of this cycle. It was a big counter-trend rally, but not as if such moves were not part of the past as well. Stay nimble and continue to fade rather than chase rallies.

Are you gonna bark all day little doggie or are you gonna bite?

A few ideas and thoughts with now meaningful change to previously shared views here.

Broad equity markets are 10-12% off of mid-August highs but in many cases are still above mid-June lows. Fundamentals continue to deteriorate and central banks remain handcuffed by realized inflation momentum. There is nothing about the current environment to warrant above an average risk position.

Short Small Season

For market hedges and shorts, Mr. Blonde is turning his attention back to Russell 2000 which has held firm recently but entering a time of year when it tends to underperform. This weak seasonal period coincides with weak market seasonals overall as well as 3Q earnings season which is likely to shed light on the challenging environment faced by corporates, particularly lower margin, higher balance sheet leverage businesses.

Another Round in Housing?

Here’s a repeat idea. Having suggested short homebuilders from early Jan, Mr. Blonde backed off the group following near 30% relative decline into early Apr. The view at the time was the possibility of peaking rates which would serve as macro support to the group. That has not occurred and mortgage rates are making new highs at a time when housing activity is negative.

There certainly doesn’t seem to be a good reason to be long the group given current conditions. Mr. Blonde thinks a small short is warranted into next week’s data which is likely to highlight continued weakness in housing sector and likely at an accelerating rate while the Fed is on a hawkish warpath. Historically you don’t buy cyclical sectors as long as leading indicators are falling.

Cashing in on Dividends

A trade Mr. Blonde has advocated since 4Q21 is to favor S&P dividend futures as a replacement for long equity risk. The view was predicated on the risk of multiple compression even as growth would likely deliver in 2022, albeit at a slowing pace. This trade suffered in late Feb as European dividends were derisked in response to heightened geopolitical risk and the recognition of growth risk, but has largely recovered and has certainly performed better than a long SPY position this year.

But as growth risks mount dividend futures lose their appeal given liquidity profile and risk of mark down.

That’s all for now, hope you appreciate the update and perspective. If you do, please like, share, and/or comment. If you have a question please post it below for the benefit of all followers and readers.

Man. I appreciate a guy who shares actionable information ,doesn’t talk book,or condescend and excels at making some what arcane shit simple. Thank you . This helps. All your interviews do. Smart guy. Humble guy. Look man , if you ever need a tuba player ok nevermind. I am useless

Thanks for that latest update. great insight and ideas