This commentary remains free for all, but come 10/31 will require a monthly subscription. See here for details and expectations. Hopefully after reviewing content provided over the last year you will find it well worth the price.

Mr. Blonde hoped to take a break from broad market commentary to share a few trade ideas, but recent volatility deserves a comment. The Bear Bounce view was well timed, but the price action late last week raises serious doubt worth evaluating. Bottom line, while it doesn’t feel great there’s still a chance.

Bounce or Breakdown

Last week is characteristic of bear market trading environments. Bulls frustrated, bears frustrated and only the nimblest of traders had much of a chance to feel satisfied. Big stumble late in the week hardly builds confidence, but S&P 500 actually finished with the first weekly gain in four and keeps the bear bounce a possibility.

A few brief broad market observations:

First, a similar pattern took place off the June low where a sharp move up to falling 20d average was initially retraced. Also notable was the behavior around June quarter end which included a sell off on the last day of the quarter, rally in first few days of July, and then a retest of the quarter end low. Its far from perfect, but the similar behavior also suggests its too soon to count out the bear bounce possibility.

Second, the sell off in equities seemed large relative to ‘new’ information provided by the jobs report. In Mr. Blonde’s opinion the report did little to change the path or magnitude of Fed rate hike expectations. For example, no real movement in US 3m10y swaptional vol (yellow) to suggest equities should have repriced by so much. Of course, markets are imperfect over short time frames, so we could learn something different his week, but the equity move seemed large vs. the message from non-equity assets.

Third, credit markets didn’t have nearly as large a reaction. HY CDX for example only retraced 38.2% of its rally while SPX retraced 76.4%.

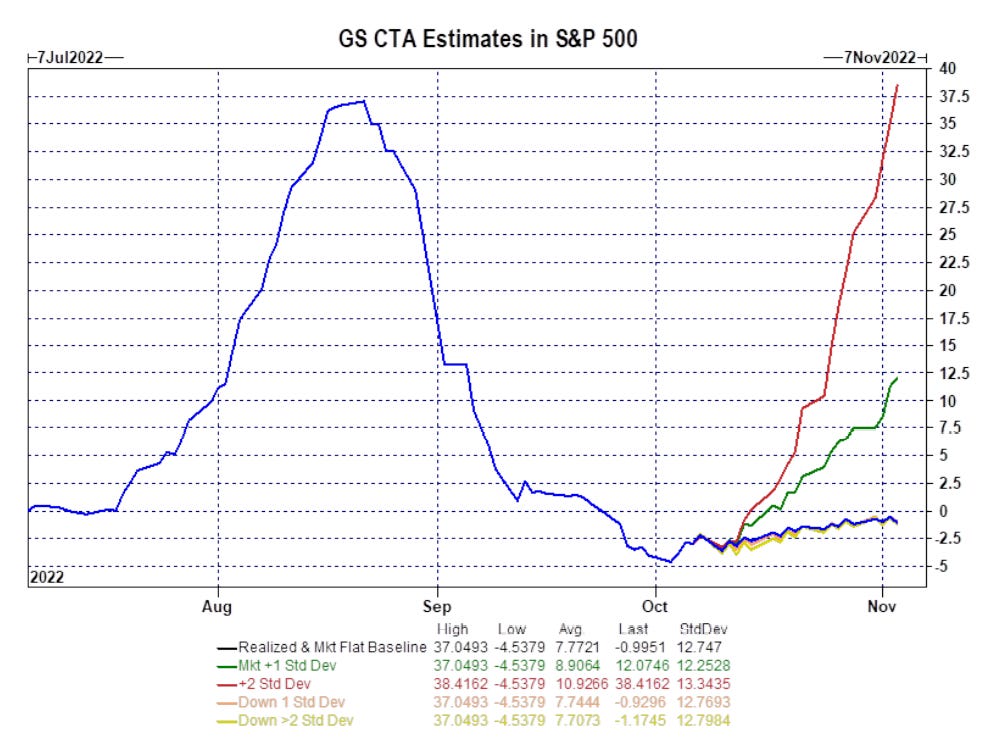

Fourth, estimates suggest CTA equity selling is largely complete and the risk has shifted toward slight buying in a flat tape. This was also a feature—a big one—of the Jul-Aug bear market rally so deserves some attention.

Mr. Blonde won’t pretend to be an expert in this area (there aren’t many), but he does recognize its become an increasingly important flow given non-existent trading liquidity.

Over the next month, GS estimates $38b to buy in a flat tape and $140b to buy in a modestly up tape. Naturally the pro-cyclical nature of such flows can be somewhat self-fulfilling without active selling pressure on the other side. The key takeaway here is previously big seller is now short and more likely to be a big incremental buyer than seller from here.

Fifth, earnings season historically is not the best time to be broadly short equities…even during periods of weak quarters. Also notable is the tendency for negative returns into earnings season to result in positive returns during the season. Directional earnings weakness is no longer much of a debate and the question is one of severity and timing of severity.

Bottom line, Mr. Blonde is holding his month end Oct call spread recommended here and still leans in the direction of a bear market bounce. Without a doubt, Friday’s price action raises an eyebrow but as highlighted above there’s still a chance.

A subsequent note that focuses on relevant and interesting trade ideas for the current environment will follow shortly. Good luck trading your view.

Amazing how this played out. I remember specifically how long October 11-14 felt and that even you were considering that it was the wrong call. Didn't capitalize on it because that's what markets do, they shake out the best of us.

Great thoughts ! Mr B. I have two QQ

1. What are the conditions you would like to see in the macro / USD / Yields for the Equity to bottom or go long equity.

2. As USD is seen as safe haven & most of the sovereign nations or funds buying USD to invest in US assets, what assets they are investing in US with those $$$

TIA