As previously suggested, trading against one’s core view is a mental challenge. Mr. Blonde does his best to respect short term trading conditions and avoid pressing shorts or chasing longs at the wrong time. At the moment now does not appear to be the time to press shorts, but instead consider a countertrend bounce.

Sharing these observations is incredibly uncomfortable as markets are on edge and in a weak and weakening environment accidents can happen as observed in UK this week.

But the pre-conditions are in place for a bounce, we just need market narrative to shift to something positive. Could it be the fall in breakevens? Putin’s olive branch? BOE’s recognition of financial stability risks? Another “better than feared” earnings season”? Mr. Blonde doesn’t know, but they are all possibilities and when sentiment is depressed with oversold conditions it typically doesn’t take much.

None of the below changes Mr. Blonde’s core fundamental view and the likely trend in markets. This is a note for traders and tacticians, if not your thing or you don’t want to hear it then no need to read further.

A few charts and market observations that have his attention:

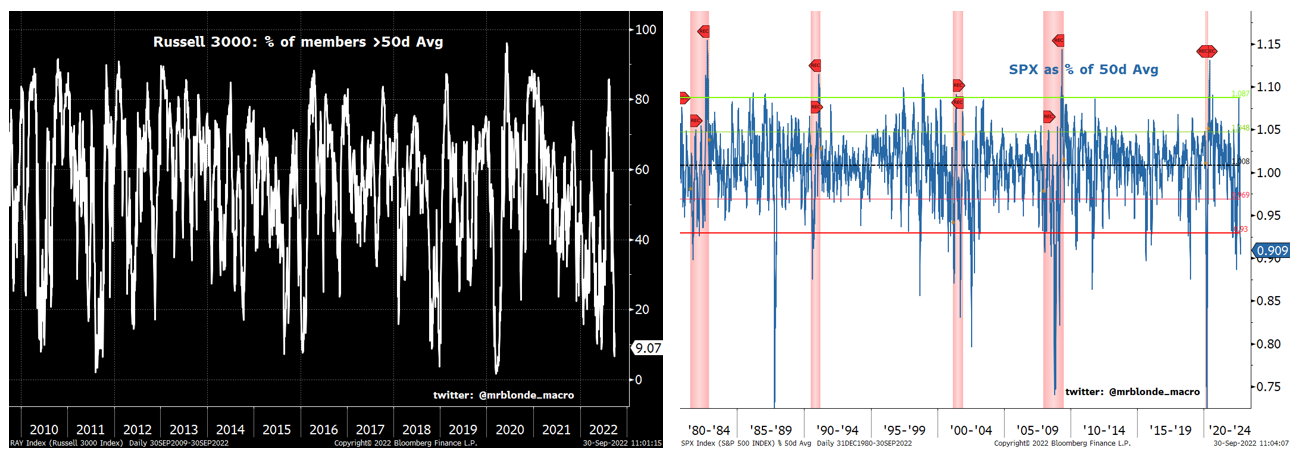

Oversold

First, markets are short term oversold and 100 different charts could be displayed to highlight this. Only 9% of Russell 3000 stocks trade above their 50d moving average — that is low. S&P 500 is trading 10% below its 50d moving average which is more than -2 sigma based on daily data from 1980. Could it go lower, yes its possible, but risk/reward doesn’t favor pressing shorts from this level.

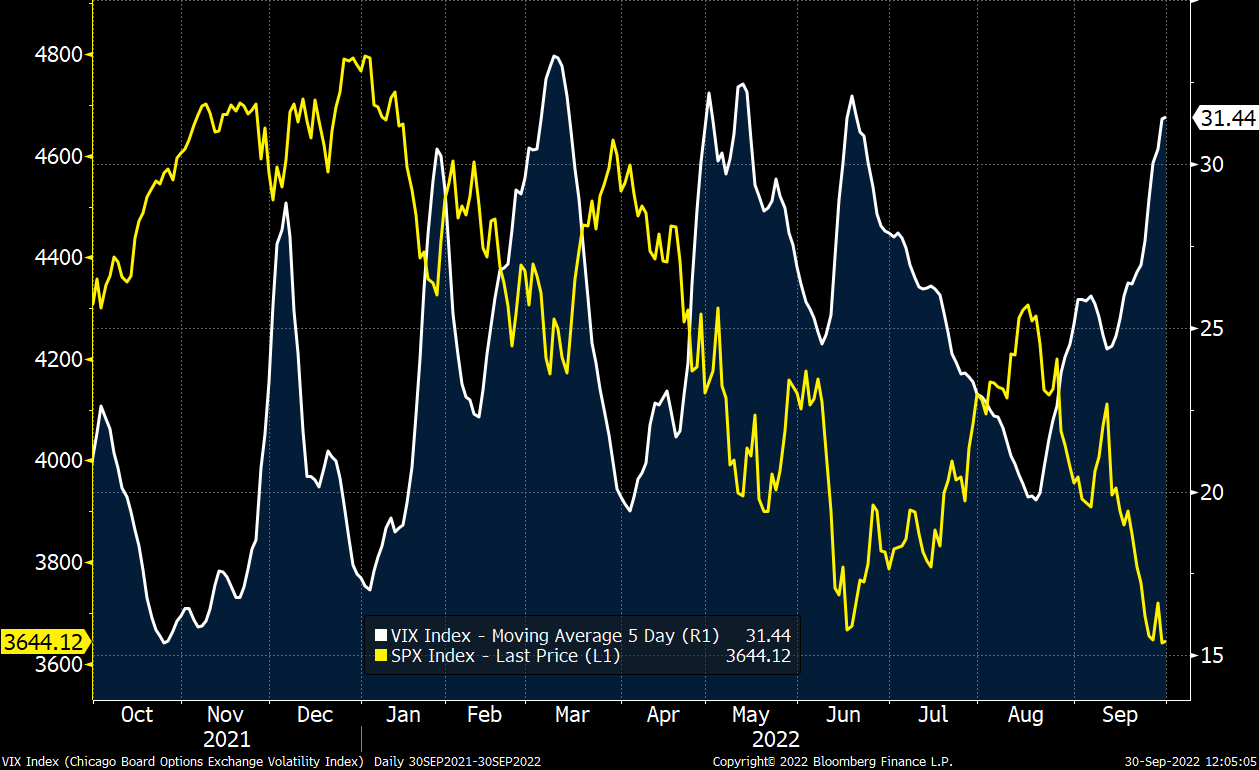

Are you Afraid?

So far this year, 5d average VIX above 30 has been enough to represent a near term low. Maybe it won’t this time, but add this to the other measures of sentiment and positioning that have met criteria for a near term bottom.

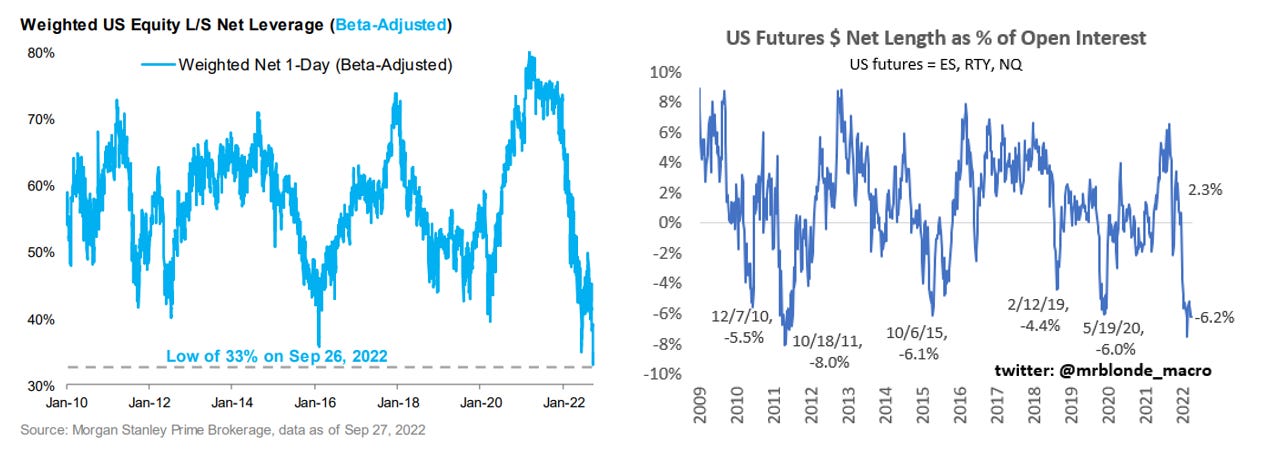

Pain from Positioning?

Second, fast money positioning has compressed significantly. They are still net long and Mr. Blonde isn’t convinced the last decade of net exposure is a great benchmark given macro conditions, but the lowest beta adjusted net exposure in over a decade isn’t nothing. Similarly low/short exposure is seen in CFTC futures positioning.

Equity long/short funds have had a horrific performance year on average. It would be a real gut punch to have a late year countertrend bounce in risk markets as everyone ran for cover. Murphy’s law in action.

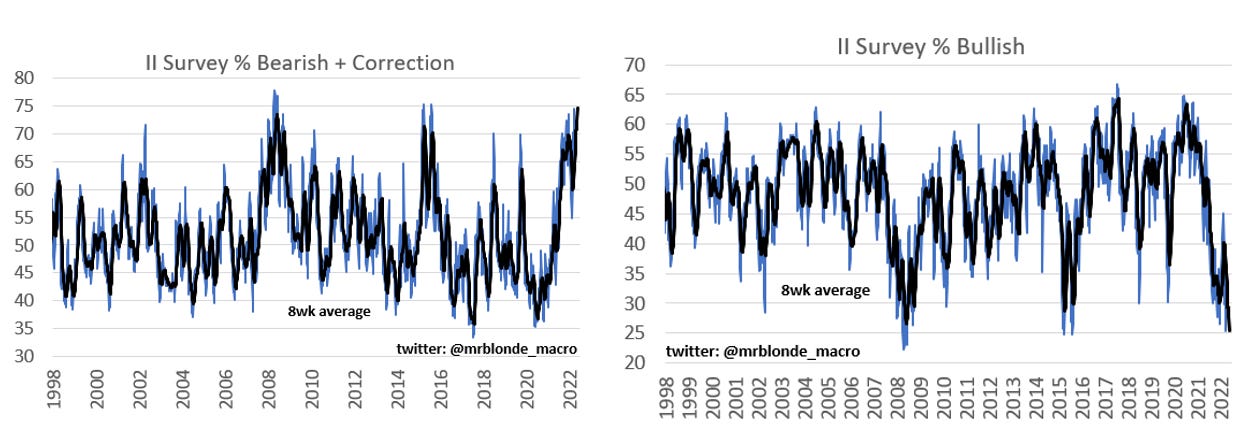

Sentiment Stinks

Sentiment stinks, rightfully so. But when sentiment is this compressed it doesn’t take much good news to positively surprise markets. Mr. Blonde isn’t certain what precisely will deliver that news he just recognizes the market isn’t really expecting it.

Better Seasonals?

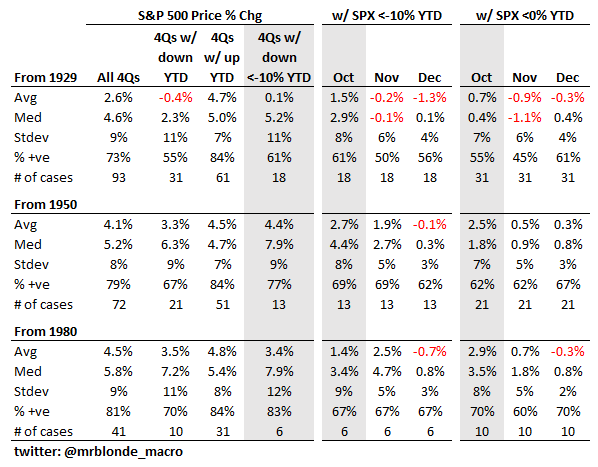

Seasonality into September is bad and was previously noted here. Despite many dismissing it, it works on average. Of course seasonality is not the only consideration, but if you come into a historically good seasonal period with oversold conditions and compressed sentiment it deserves some consideration. Mr. Blonde’s suspicion is alot of tax loss harvesting may have been conducted in Sept…just a guess.

Either way, historical probabilities suggest October is a good month even during bad market years (i.e. SPX < -10% YTD thru Sept). You can dismiss this factor, just know its a possibility and something that’s moving from the liability to asset column.

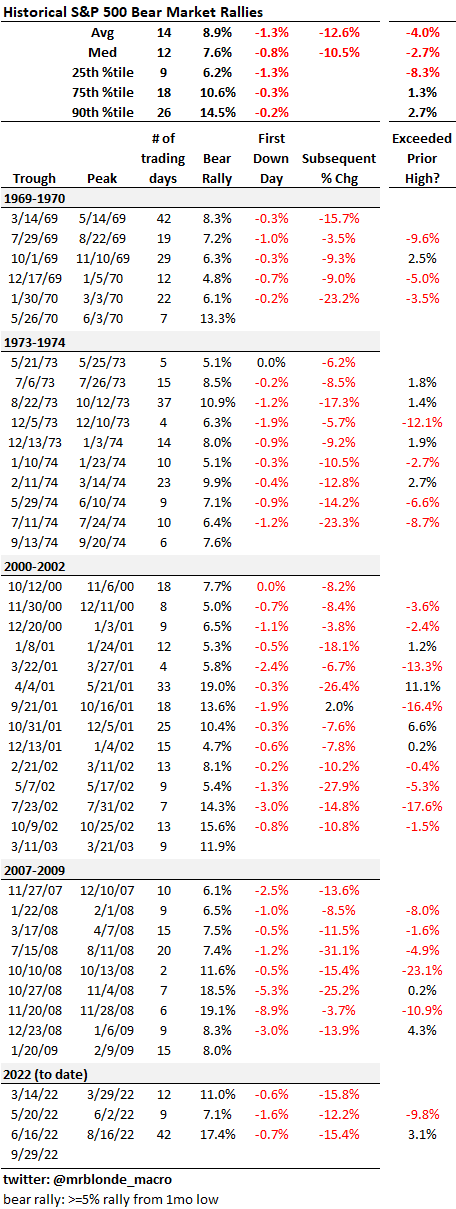

Bear Rallies

Not much to say here other than we appear to have met the minimum criteria for a post bear rally sell off. Mr. Blonde would feel better if SPX was further below the June lows, but enough other signals are evident that its worth mentioning.

Glass half full?

Are we finally getting relief from a key macro risk? US 10yr breakeven inflation is making a new 52wk low. Of course this is related to weakening demand and falling commodity prices (see CRB RIND Index), but its also a necessary pre-condition for central banks to back off. Speaking of backing off, Bank of England stepping into address a financial stability risk is good news. Maybe interesting that Brainard made reference to monitoring financial stability risk today too. Unlike previous policy leaders who said they see none and not to worry.

Bottom line, the pre-conditions are in place for a countertrend bounce in risk. This is an uncomfortable observation for someone who’s core view is negative and sees likelihood of more difficult times ahead. This is not for everyone, but also not a good time to press shorts.

Are you gonna bark all day little doggie or are you gonna bite?

A couple considerations if you want to play it.

Utility Value

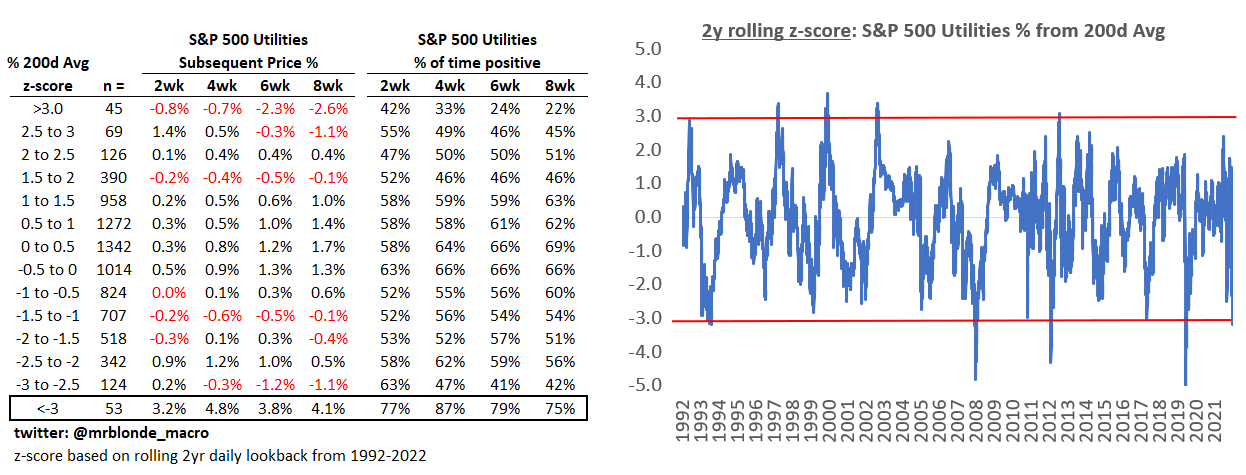

Utilities (XLU) are a classic defensive sector and have performed well this year on both an absolute and relative basis. In the last couple weeks they have been sold aggressively (like some other relative winners) in a wave of capitulatory selling.

Historically, when S&P 500 Utilities trade well below their 200d moving average there is scope for mean reversion in the coming weeks. This strikes Mr. Blonde as a low risk, measured way to have long exposure in the event of a countertrend move.

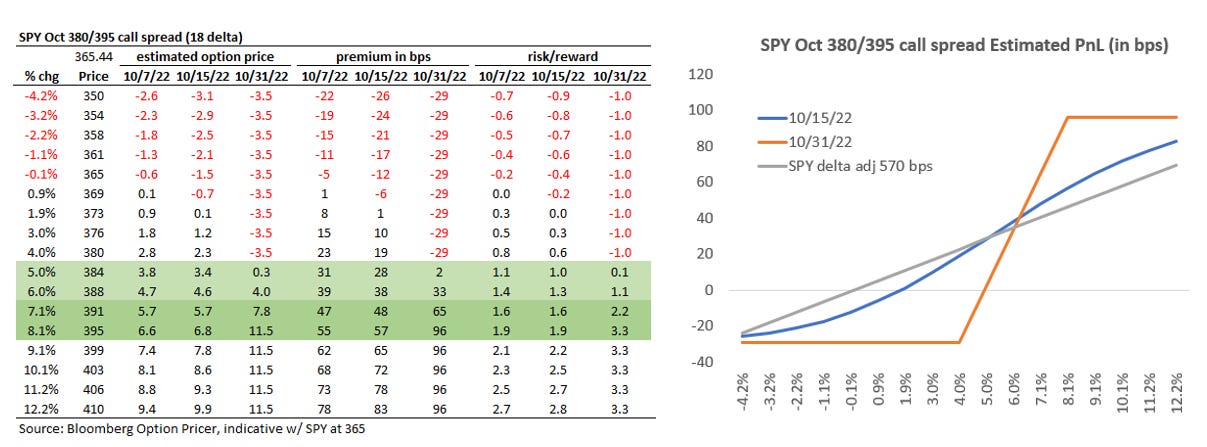

Simple SPY Call Spread

There’s likely a sexier more complicated way to trade a short term bounce, but in an effort to keep it simple here is October month end (10/31) call spread payout profile. SPY 10/31 380/395 call spread offers >3x max payout on premium for a 8% move. Sized in this table at 0.3% of capital at risk in premium is equivalent to a 5.7% delta adjusted long SPY position currently.

Given the points above and a portfolio that is significantly under risked, Mr. Blonde thinks 2-3x payout limited loss structure has value.

That’s all for now. Mr. Blonde just sharing what he sees on the screen and the clear shift in sentiment. Fundamental problems remain and the environment will remain challenging. Countertrend trading isn’t for anyone and it is certainly understandable if you don’t think its worth the risk. Good luck trading your view.

Is the countertrend rally over?

Yes a great article, I feel exactly the same I was hoping SPY got jammed to 352 as they set the low bar for next quarter. then more comfortable with a bounce. Now less sure, also alot of people talking about a bounce, never a good indication. Risk of systemic fk up getting closer! CB's are stuck, if they pivot inflation locked in for a decade imo. They need to break something and hope it isn't GFC esque