Choose Your Fighter

Stock and bond vigilantes are in an epic cage match...stocks usually force submission

Mr. Blonde hopes you appreciate the content. The framework here is data driven through a study of past events to probabilistically think about the path of least resistance for markets. There is always an element of judgement, but hopefully the presented data gives context and rationale for the judgement made.

Profit growth momentum continues to lose momentum as the Fed gets more hawkish. This remains a bad combination for risk markets. Index equity prices are lower, but indices are not cheaper after adjusting for cost of capital (i.e. higher rates). Mr. Blonde does not yet find it attractive to increase portfolio risk.

This short note is largely an update of existing view. Mr. Blonde updates some indicators and outlines the case for adding long duration as the next phase of the cycle shifts focus to growth disappointment.

Review of View

For the last 8-9mos, Mr. Blonde’s base case market view has been Fed hiking into cyclical growth slowdown and would result in challenging equity market conditions and would favor defensive position or short high beta, cyclical parts of the market with particular focus on consumer cyclicals.

There is alot Mr. Blonde doesn’t get right but since Aug’21 S&P 500 has fallen 5-6% while other market segments are far worse. This has not been an environment for buying dips, don’t let the bulls hide behind SPX.

Choose Your Fighter

In the last post, From Fed Hikes to Growth Cuts, Mr. Blonde outlined the likelihood the market narrative would shift from Fed tightening to rising probability of recession as a result of swift hikes.

The ‘guts of the stock market’ are very clearly focused on growth risks as Fed hikes exacerbate already slowing growth momentum. The message from rate sensitive cyclicals like homebuilders, banks, consumer durables, autos could not be clearer.

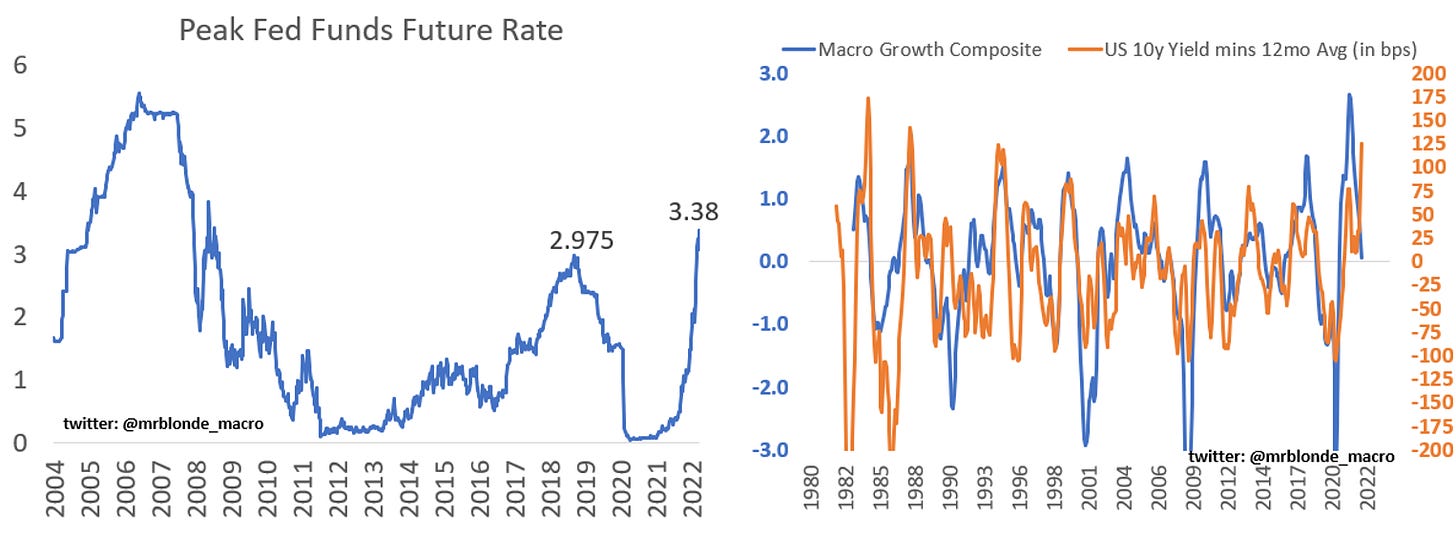

Such divergence between 10yr Treasury yields and US cyclicals/defensives is rare. The left chart below is the spread of z-score of each market’s deviation from 12mo trend. Sounds like a mouthful, but basically reflects the magnitude of cyclical growth disagreement between equity and bond markets. Mr. Blonde studied all past periods when the spread first breached -2.5 and evaluated recession likelihood and subsequent performance.

Choose your fighter, but to Mr. Blonde’s eye stock vigilantes usually win the fight and recently he started adding long duration to his portfolio for the first time since late 2018.

Fading Growth Momentum

There will be more to say about 1Q earnings season after next week when ~50% of S&P 500 market cap reports, including mega tech. Talking heads will say companies beating 1Q EPS, but so far the pattern of fading surprise and revision momentum which often precedes negative growth is proving to be more important.

Notable recently is the lack of upward revisions to 2022 index EPS excluding the energy sector. Narrow markets are unhealthy markets.

Mr. Blonde’s indicators continue to point to falling global manufacturing PMI which historically is a key variable in determining profit surprises, particularly for cyclical groups. The PMI indicator includes macro variables with varying lead times like China credit impulse, US$ momentum, new orders/inventories ratio, CRB raw industrial commodities, money supply momentum, etc. Bottom line, negative growth momentum increases the probability of negative profit surprises.

Inflation Elation

Is anyone not talking about inflation right now? Many market participants are convinced of 1970s style replay of high, persistent inflation with no end in sight. Maybe that ends up being the multi-year outcome, but even during the 1970s inflation momentum was sensitive to growth momentum with a lag.

As inflation momentum rose from 3% to 6% the market narrative shifted from transitory to persistent. So as inflation momentum falls from 6.5% back toward 3-4%, what do people think is going to happen to the narrative? If there is one thing economists are good at its extrapolating the recent past into the future.

This perspective says nothing about how inflation will evolve over the next 3-5yrs, but the combination of aggressive Fed hikes into slowing cyclical growth momentum and at a time when US politics looks poised for gridlock as Dems get runover in mid-term elections would suggest a narrative shift in 2H22.

Running to Stand Still

The fade in inflation momentum might end up being a market positive, but its more likely that fading growth dominates the narrative first. And for equity markets, given valuation, growth is becoming increasingly important to justify valuation.

Recently equity risk premium has compressed while credit risk has expanded. There are certainly compositional differences between these universes, but that’s always been the case and such a divergence is unusual.

The risk premium divergence is important and acts as an important drag on SPX index price. Mr. Blonde’s valuation framework uses US BBB credit yield to discount EPS and determine fair value assuming no future growth. This framework has proven to be a good gauge for the last 20yrs.

Consensus EPS for 2022 and 2023 is $235 and $250, respectively. Mr. Blonde has already outlined his opinion that consensus estimates will prove too optimistic, but the sensitivity table below allows you to consider your own forecast with US BBB credit yield at 4.5%.

Equity market valuations are a concern, but maybe more concerning is how extended profits are relative to trend. 25% above trend is material and a risk.

Reversion to trend can occur one of two ways: extended period of below average growth that results in convergence between trend and sport EPS or a recession that results in a sharper setback in profits and quicker reversion to trend. The latter is looking more likely and already consistent with Mr. Blonde’s profit growth outlook outlined here and here.

Are you gonna bark all day little doggie or are you gonna bite?

Ideas, trades, and position updates from Mr. Blonde. Not a lot new here, mainly an update of existing ideas that still have legs.

Some Bond for Blonde

The only new position recently for Mr. Blonde is the beginning of long duration via TLT call spreads. The view here is pretty simple that market already assumes a lot of rate hikes and a terminal rate that exceeds 2018 level, sentiment is bearish on duration, Treasuries are oversold, the growth environment is weakening and Mr. Blonde’s expectation is the narrative can shift quite a bit as the year progresses in favor of long duration.

It won’t be easy, but to quote an old boss, “If it were easy we’d all have a G6.”

Tighter FCI Favors Lower Beta

The Fed has made reasonably clear they desire tighter financial conditions to squash inflation and if that results in growth weakness than so be it. Tighter financial conditions is equivalent to risk off and one of the cleaner expressions within equity markets is to favor low beta vs. high beta stocks on a sector neutral basis.

AGFiQ Market Neutral Anti-Beta ETF (BTAL) is a direct expression, but long USMV/short IWM or long XLP/short IWM would also work. This is an opinion and recommendation from Mr. Blonde that dates back to Nov’21.

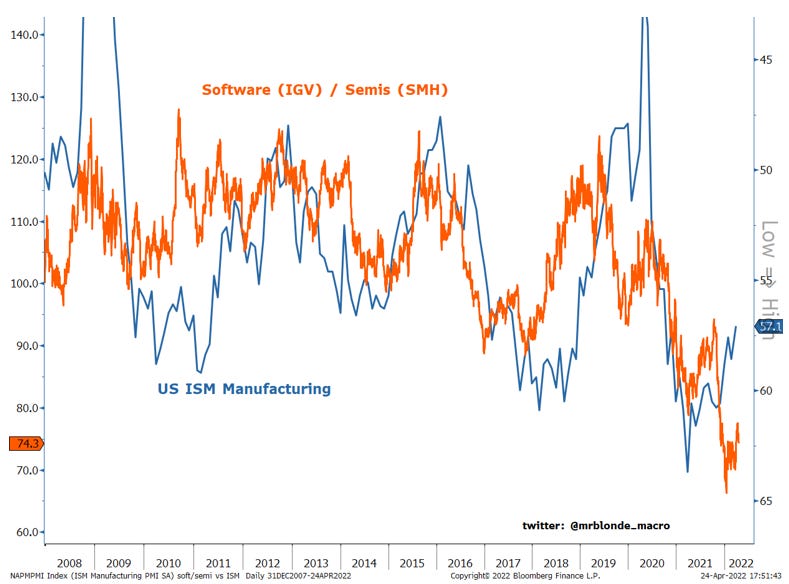

Software over Semis Still

Software over Semis is a pair Mr. Blonde mentioned a few weeks ago (here, here) and still favors. When market conditions exhibit high levels of volatility and uncertainty its often best to reduce style and sector risks in pair trades to avoid unintended bets.

This pair trade within tech historically works well when cyclical growth momentum is fading and the significant deleveraging and derating of the software sector allows for mean reversion as well. Software, as a group, also exhibits the style characteristics that historically outperform during stagflation regimes (i.e. profitability, growth/momentum, stability, low/no leverage).

Software valuations have largely retraced the post-COVID expansion and while far from dirt cheap, the group offers growth that’s likely to be more durable than semis. Thematically software represents new economy capex as companies focus on labor productivity, not new but unlikely to go away either.

good luck trading, its tough out there.

Mr G has been around the block for so many yrs it’s funny. Today, his Family team supports all his many mistakes. 😂

That said, he no longer wastes time w/ IB sell side research.

Having the gift of triage Mr G has come across Mr. Blonde on TWITTER who’s research & thought process, when applied in practice to portfolios ( in our case global) can be incremental ONLY, when followed carefully.

PS! We ( I) don’t know him.

Whether adding long duration to the portfolio idea or, falling manufacturing PMI view or the nuanced view on inflation as relates to the RED political wave about to take place end of this year in the US, valuations are about to take a front seat in this epic real time financial movie!

CAPITULATION?

Not by a long shot.

S&P 3570 would be a FABULOUS 5yr opportunity as much as it might test nerves for for all of those around & holding 1st class quality growth names during this process.

No one knows, time, date & bottoming out.

Who said - what hurts can only make you stronger if only you survive …. Indeed THRIVE 🙏

Excellent feedback Mr Blonde 🎯👊👍

B: Reading your work has been time well spent. It would be helpful to have the spread at the bottom of some of the charts to put the historical differences in context a little easier. I read this on an iPad Pro and it’s difficult to make out the historical context when making comparisons (particularly when the pic has two charts on it). Just a thought...